Okay, I understand. Here's an article based on the prompt, focusing on providing comprehensive advice and avoiding formulaic structures, written in English and exceeding 800 words:

Making Money Fast & Easy: The Elusive Dream, and Pathways to Consider

The siren song of rapid wealth accumulation has resonated throughout history. The promise of making money "fast and easy" is undeniably alluring, a tempting escape from the drudgery of long hours and incremental gains. However, it’s crucial to approach this notion with a healthy dose of skepticism and a clear understanding of the realities of wealth creation. While "fast and easy" might be an oversimplification, exploring opportunities for expedited financial growth within a reasonable risk framework is a worthwhile endeavor.

The cornerstone of any financial strategy, regardless of its timeline, rests on a fundamental principle: understanding risk. Opportunities that promise extraordinary returns invariably carry significant risks. Therefore, the first step is to honestly assess your risk tolerance. Are you comfortable potentially losing a substantial portion of your investment in pursuit of higher gains? Or do you prioritize capital preservation above all else? Your answer to this question will heavily influence the types of ventures you should consider.

Let's debunk the "easy" part first. Genuine, sustainable wealth creation almost always demands effort, knowledge, and a degree of resilience. While passive income streams exist, establishing them often requires an initial investment of time and/or capital. Thinking of starting a blog and monetizing it with ads? You need consistent high-quality content creation, search engine optimization, and audience engagement. Considering dropshipping? You'll need to conduct market research, build a website, manage customer service, and navigate the complexities of supply chain logistics. Even seemingly simple avenues like affiliate marketing require strategic content creation and audience targeting. The key is to identify avenues that align with your skillset and interests, making the work feel less burdensome.

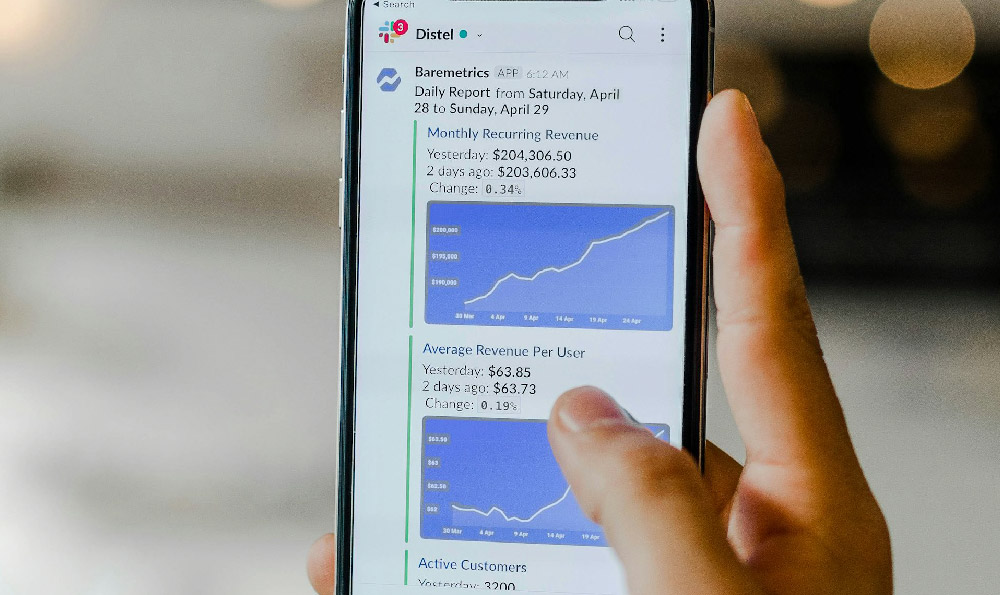

Now, regarding the "fast" element, some avenues genuinely offer the potential for quicker returns compared to traditional investment strategies. High-growth stocks, particularly those in emerging industries like renewable energy, biotechnology, or artificial intelligence, can experience rapid price appreciation. However, these stocks are notoriously volatile and require thorough due diligence. Understanding the company's financials, its competitive landscape, and the overall industry trends is paramount. Blindly following hype or relying on internet rumors is a recipe for disaster. Consider diversifying your portfolio to mitigate the risk associated with individual high-growth stocks.

Another route often touted for rapid wealth creation is real estate. While the process of buying, renovating, and flipping properties can be lucrative, it requires a significant upfront investment, specialized knowledge of the local market, and a willingness to manage construction projects and navigate legal hurdles. Real estate investment trusts (REITs) offer a more passive approach, allowing you to invest in real estate without directly owning properties. However, REITs also come with their own set of risks, including interest rate sensitivity and market fluctuations.

The world of cryptocurrency presents both immense opportunity and significant risk. Bitcoin and other cryptocurrencies have demonstrated the potential for exponential growth, but they are also subject to extreme volatility. Investing in cryptocurrency requires a deep understanding of blockchain technology, market dynamics, and regulatory developments. Furthermore, the cryptocurrency space is rife with scams and fraudulent schemes, so it’s crucial to exercise extreme caution and only invest what you can afford to lose. Exploring decentralized finance (DeFi) platforms can offer opportunities for earning interest on your crypto holdings, but again, these platforms come with inherent risks that demand careful evaluation.

Beyond the traditional investment routes, consider leveraging your existing skills and knowledge to create new income streams. Freelancing, consulting, or offering online courses can be a relatively fast way to generate income if you possess in-demand skills. Platforms like Upwork, Fiverr, and Coursera provide avenues for connecting with potential clients or students. Similarly, creating and selling digital products, such as ebooks, online courses, or templates, can be a source of passive income once the initial effort is invested. The key here is identifying a need in the market and offering a valuable solution.

It's also vital to be wary of schemes that promise guaranteed returns or "get-rich-quick" opportunities. Pyramid schemes, Ponzi schemes, and other fraudulent investments are designed to exploit people's desire for easy money. If an opportunity sounds too good to be true, it almost certainly is. Always conduct thorough research, consult with a qualified financial advisor, and never invest in something you don't fully understand.

Ultimately, the pursuit of making money fast requires a blend of calculated risk-taking, diligent research, and a realistic understanding of market dynamics. There is no magic formula or guaranteed path to instant wealth. Focus on developing valuable skills, building a diversified portfolio, and consistently seeking opportunities for growth. While the dream of "fast and easy" might be elusive, strategic planning and disciplined execution can certainly accelerate your journey toward financial freedom. The real key is to define what "fast" means to you, and align your strategies accordingly, always prioritizing ethical practices and informed decision-making.