Okay, I understand. Here's an article exploring the question of whether investing is a quick path to money, and how someone might approach attempting to achieve rapid financial gains through investing, keeping in mind the inherent risks and realities:

Is investing a get-rich-quick scheme? The allure of rapid wealth creation through shrewd investments has captivated individuals for generations. The promise of transforming modest capital into substantial fortunes within a short timeframe is undeniably enticing. However, the reality of achieving such rapid financial success through investing is far more nuanced and often fraught with challenges. While investing can indeed be a powerful engine for wealth accumulation, it is rarely a quick and easy path to riches.

The notion of rapid wealth creation through investment often conjures images of overnight millionaires who picked the right stock, cryptocurrency, or real estate deal at the perfect time. These success stories, while captivating, represent the exception rather than the rule. The vast majority of successful investors build their wealth gradually over time through disciplined saving, strategic asset allocation, and a long-term investment horizon.

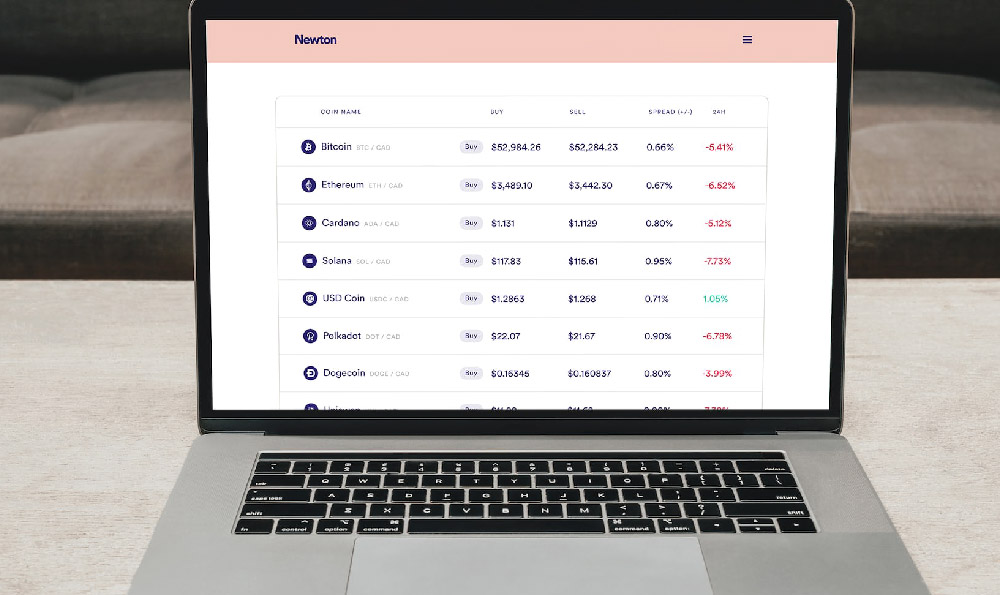

One of the primary reasons why quick riches through investing are uncommon is the inherent risk involved. Investments that offer the potential for high returns typically come with a corresponding level of risk. High-growth stocks, speculative assets like meme coins, and leveraged trading strategies can generate significant profits, but they also carry a substantial risk of loss. Investors who chase quick gains without carefully considering the risk factors involved are often exposed to the potential for significant financial setbacks. The market is filled with examples of people who made fortunes, and lost everything just as quickly.

Furthermore, market timing, the practice of attempting to predict short-term market movements in order to buy low and sell high, is notoriously difficult, even for experienced professionals. Successfully timing the market requires a combination of skill, knowledge, and luck. Attempting to time the market often leads to poor investment decisions, such as buying high during periods of euphoria and selling low during market downturns. This behavior can erode long-term returns and hinder the accumulation of wealth.

While the notion of investing as a quick path to money may be largely unrealistic, there are strategies and approaches that can potentially accelerate the wealth-building process, although they inevitably involve higher levels of risk and require a deep understanding of the markets and investment instruments.

One such approach is to focus on investments with high growth potential. This might involve investing in emerging industries, disruptive technologies, or small-cap companies with strong growth prospects. Identifying and investing in companies or sectors poised for rapid growth can potentially generate substantial returns in a relatively short period. However, it's crucial to conduct thorough due diligence and understand the risks associated with these types of investments. Investing in growth stocks and new industries requires a significant amount of research, and the ability to stay ahead of news and industry trends.

Another avenue for potentially accelerating wealth accumulation is through real estate investing, specifically strategies like house flipping or value-add real estate projects. These strategies involve acquiring properties that are undervalued or in need of renovation, improving them, and then selling them for a profit. Successful real estate investors can generate significant returns in a relatively short timeframe. However, real estate investing requires substantial capital, expertise in property management, and a tolerance for risk. Moreover, the real estate market is inherently illiquid, meaning that it can take time to buy and sell properties. Real estate also carries the risk of market downturns, and expensive repairs.

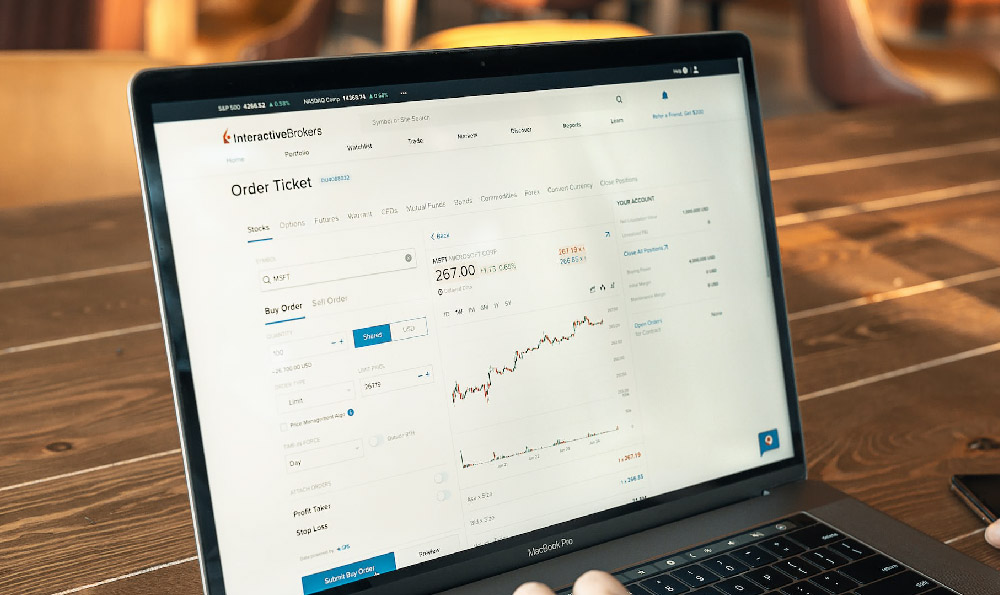

Another strategy, although exceptionally risky, is active trading, particularly in volatile markets. Day trading, swing trading, and options trading can offer the potential for high returns, but they also require significant time, skill, and discipline. Active traders need to be able to analyze market trends, identify trading opportunities, and manage their risk effectively. The vast majority of active traders lose money, as market conditions are hard to predict, and success can be influenced by many factors outside of the trader's control. It's important to remember that active trading is a full-time job, and requires extensive study and practice.

For those with a high tolerance for risk and a desire to potentially accelerate wealth accumulation, entrepreneurial ventures can offer another avenue for rapid financial gains. Starting a successful business can generate significant wealth in a relatively short period, but it also requires hard work, dedication, and a willingness to take calculated risks. Entrepreneurship is perhaps one of the riskiest investments one can make, as there is no guarantee of success.

It's essential to acknowledge that pursuing a rapid path to wealth through investing can be highly stressful and demanding. The pressure to generate high returns can lead to impulsive decisions, emotional trading, and a neglect of other important aspects of life. A balanced approach to investing, which prioritizes long-term financial security and well-being, is often the most sustainable and fulfilling path to wealth accumulation.

Ultimately, the most prudent approach to investing involves setting realistic expectations, diversifying your portfolio, managing risk effectively, and maintaining a long-term perspective. While the promise of quick riches may be alluring, the reality is that building wealth through investing is typically a gradual process that requires patience, discipline, and a commitment to continuous learning. Instead of chasing fleeting opportunities, it's often more rewarding to focus on building a solid financial foundation and achieving sustainable long-term growth. The market rewards those who are patient, and penalizes those who try to get rich quickly.