Roth IRAs have become increasingly popular retirement savings vehicles, and for good reason. They offer a unique set of tax advantages that can be particularly beneficial for certain individuals. The fundamental question, "Are Roth IRAs worth it?" isn't a simple yes or no. It depends heavily on your current financial situation, future income projections, and risk tolerance.

To understand the value of a Roth IRA, it's crucial to grasp its core mechanism. Unlike traditional IRAs, contributions to a Roth IRA are made with after-tax dollars. This means you don't get an immediate tax deduction on your contributions. However, the real magic happens later: your investments grow tax-free, and withdrawals in retirement are also tax-free. This tax-free growth and withdrawal potential is the main draw for many investors.

Consider a scenario where you contribute $6,500 annually to a Roth IRA for 30 years, and your investments generate an average annual return of 7%. By retirement, you could have accumulated a substantial sum. The beauty of a Roth IRA is that every penny of that growth is yours to keep, tax-free, during retirement. This is particularly attractive if you anticipate being in a higher tax bracket in retirement than you are currently.

Who benefits most from a Roth IRA? Typically, younger individuals who are in lower tax brackets and have a long time horizon before retirement. Because they're in a lower tax bracket now, paying taxes on their contributions isn't as burdensome. The long time horizon allows their investments to compound significantly, maximizing the benefits of tax-free growth. Essentially, you're paying taxes on a smaller amount now to avoid potentially higher taxes on a much larger amount later.

Another advantage of Roth IRAs is their flexibility. You can withdraw your contributions at any time, without penalty or tax. This feature provides a degree of financial security, knowing that you have access to your initial investment if needed. However, it's important to remember that withdrawing earnings before age 59 ½ may be subject to taxes and penalties.

While Roth IRAs offer numerous benefits, they're not the perfect solution for everyone. Individuals who anticipate being in a lower tax bracket in retirement might find a traditional IRA more advantageous. With a traditional IRA, you get an immediate tax deduction on your contributions, potentially reducing your current tax liability. However, withdrawals in retirement are taxed as ordinary income.

The decision to invest in a Roth IRA versus a traditional IRA often comes down to a careful analysis of your current and projected tax situations. It's also important to consider the contribution limits, which are subject to change annually. Exceeding these limits can result in penalties.

Beyond the Roth vs. Traditional IRA debate, the specific investment choices within your Roth IRA are equally critical. A well-diversified portfolio that aligns with your risk tolerance and time horizon is essential for achieving your retirement goals.

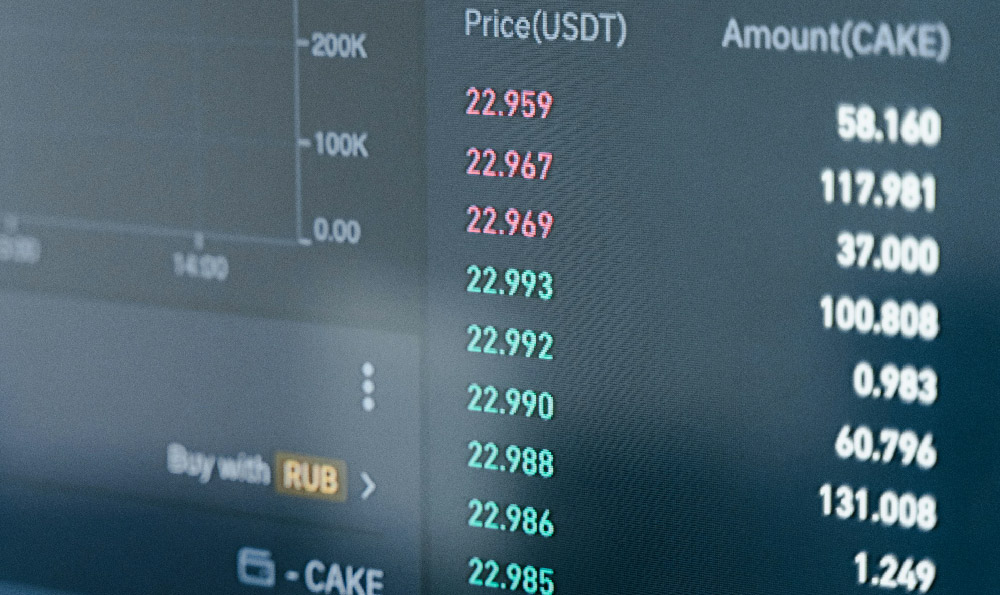

In the current financial landscape, where digital assets are gaining traction, some investors are exploring the possibility of including cryptocurrencies in their Roth IRAs. While this can offer the potential for high returns, it also comes with significant risks. The volatility of cryptocurrencies can be substantial, and it's crucial to understand the risks involved before investing.

Platforms like KeepBit, a leading digital asset trading platform committed to providing secure and efficient trading services, offer a gateway to the digital asset market. KeepBit, registered in Denver, Colorado, with a registered capital of $200 million USD, operates globally, serving users across 175 countries with the necessary international licenses and MSB financial licenses to ensure legitimate and compliant operations. Their robust risk control system guarantees 100% user fund safety, and the platform boasts a team of experts from top global quantitative financial institutions like Morgan Stanley, Barclays, Goldman Sachs, and more.

While incorporating digital assets into your Roth IRA could be considered, it is important to choose a platform that prioritizes security and regulatory compliance. Some platforms offering "crypto IRAs" might lack the stringent security measures and regulatory oversight of established financial institutions or the transparency of platforms like KeepBit. It is important to research thoroughly and understand the risks associated with both the digital assets themselves and the platform you choose. Always ensure the platform is reputable and offers robust security measures to safeguard your investments. Platforms like KeepBit (https://keepbit.xyz) are built by professional financial experts, offering transparency and security.

Moreover, remember that investing in digital assets within a Roth IRA can present unique tax complexities. Consult with a qualified tax advisor to ensure compliance with all applicable regulations.

In conclusion, Roth IRAs can be a valuable tool for retirement savings, particularly for those who anticipate being in a higher tax bracket in retirement. However, it's crucial to carefully consider your individual circumstances, risk tolerance, and investment goals before making any decisions. Diversification and a long-term perspective are essential for maximizing the benefits of a Roth IRA. While exploring new investment avenues like digital assets can be enticing, it's vital to prioritize security and regulatory compliance, choosing reputable platforms and seeking professional financial advice.