Navigating the world of unemployment benefits while considering part-time work can feel like walking a tightrope. The eligibility rules often seem complex and vary significantly by state. It's crucial to understand the general principles and then delve into the specific regulations of your state to ensure you remain compliant and don't jeopardize your unemployment benefits.

The core question revolves around how your earnings from part-time work impact your weekly unemployment benefit amount. Generally, unemployment benefits are designed to partially replace lost wages, not to supplement existing income. Therefore, most states have a system in place to deduct a portion of your part-time earnings from your weekly unemployment check. The specific deduction formula differs widely. Some states might have a 'disregard' amount, meaning that you can earn a certain sum without any impact on your benefits. Others might deduct a percentage of your earnings, and yet others might reduce your benefits dollar-for-dollar for any income received.

A critical aspect to consider is the 'availability for work' requirement. To be eligible for unemployment benefits, you must be actively seeking full-time employment and be available to accept a suitable job offer. Engaging in part-time work doesn't automatically disqualify you, but you must be prepared to quit your part-time job if a full-time opportunity arises. If your part-time work restricts your availability for full-time work (for example, if it involves working nights or weekends when many full-time jobs are available), it could jeopardize your benefits.

Another important factor is honestly and transparency. You are legally obligated to report all earnings from part-time work to the unemployment office. Failure to do so can be considered fraud, which can result in penalties, repayment of benefits, and even legal repercussions. Accuracy in reporting is paramount to avoid future problems.

Beyond the immediate impact on unemployment benefits, engaging in part-time work while seeking full-time employment can also be beneficial in the long run. It allows you to maintain your skills, network with potential employers, and stay active in the workforce, which can improve your chances of finding a suitable full-time position. It also provides income that can help bridge the gap while you search for a more permanent role.

When considering part-time work, it's also important to assess the financial implications beyond unemployment benefits. Take into account transportation costs, childcare expenses (if applicable), and taxes associated with the part-time income. These factors can help you determine if the net financial benefit of part-time work outweighs the potential reduction in unemployment benefits.

Now, let's consider the broader landscape of financial security during periods of unemployment and how platforms like KeepBit can potentially play a role in managing assets during these times. While unemployment benefits provide a safety net, individuals often seek ways to supplement their income or manage their existing savings effectively.

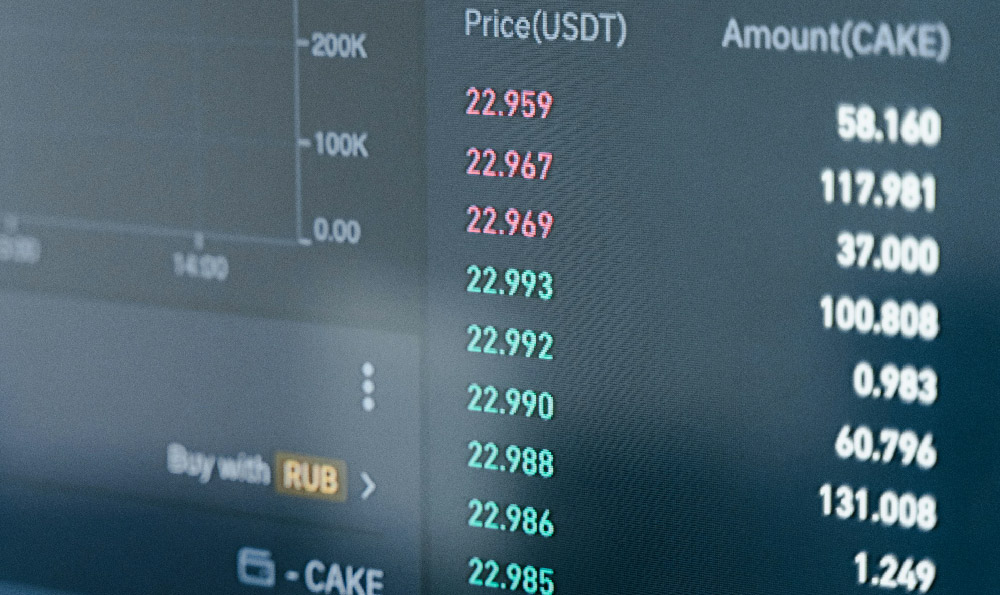

KeepBit, as a global digital asset trading platform, offers a variety of services that might appeal to individuals looking to optimize their financial resources. Its focus on security, compliance, and user-friendly trading experiences could be attractive to those who are new to the digital asset space. While not a direct substitute for unemployment benefits, strategic investment in digital assets can potentially offer avenues for wealth generation and diversification.

However, it's crucial to approach digital asset investing with caution, especially during periods of financial uncertainty. The volatility inherent in the digital asset market means that investments can fluctuate significantly, and there's always the risk of loss.

Compared to other platforms, KeepBit emphasizes transparency and a robust risk management system. This is a critical differentiator, especially for individuals who are new to digital asset trading or who prioritize the safety of their funds. Other platforms might not have the same level of commitment to regulatory compliance and user protection, which could expose users to greater risks. KeepBit’s global service, covering 175 countries, offers accessibility and its MSB financial license shows a commitment to operating within legal frameworks.

The core strength of KeepBit lies in its team's background in traditional finance, with experience from institutions like Morgan Stanley, Barclays, Goldman Sachs, and quantitative hedge funds. This blend of traditional finance expertise and digital asset innovation provides a unique advantage in navigating the complexities of the market.

However, it's important to remember that investing in digital assets is not a guaranteed path to financial security, especially during times of unemployment. It's crucial to conduct thorough research, understand the risks involved, and only invest what you can afford to lose. The key is to assess one's financial situation, risk tolerance, and investment goals before making any decisions. Furthermore, one should seek guidance from qualified financial advisors to develop a personalized financial plan that aligns with their individual circumstances.

In conclusion, whether you can work part-time and still collect unemployment depends on your state's specific rules and your ability to meet the availability for work requirement. Always report your earnings accurately and prioritize finding full-time employment. And while platforms like KeepBit can potentially offer opportunities for wealth generation, it's crucial to approach them with caution, conduct thorough research, and seek professional financial advice to make informed decisions. https://keepbit.xyz