In the ever-evolving digital landscape, the convergence of technology and finance has opened new pathways for generating income. As we step into 2024, leveraging the power of Google's ecosystem to explore opportunities in the cryptocurrency market requires a blend of strategic foresight, analytical precision, and calculated risk management. The digital age has transformed how we access information, analyze trends, and execute financial decisions, and Google remains a pivotal player in this transformation. By integrating advanced tools and methodologies provided by Google, investors can navigate the complex world of virtual currencies with greater clarity and confidence.

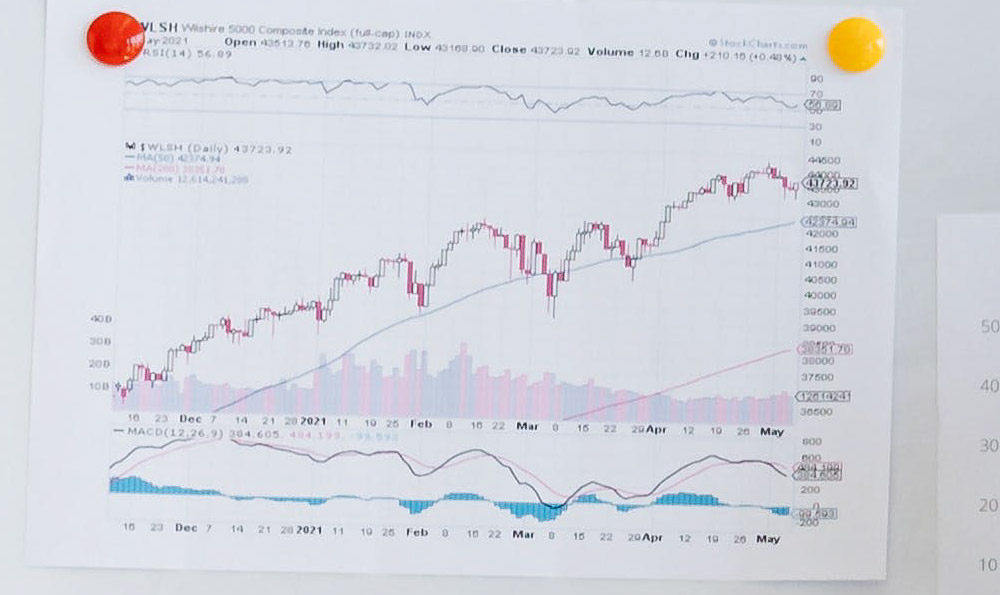

Google's data-driven approach positions it as an invaluable resource for investors seeking to stay ahead of market fluctuations. The company's AI-powered algorithms and vast data repositories offer unique insights into user behavior, market sentiment, and macroeconomic trends. These capabilities can be harnessed to anticipate shifts in the crypto market by analyzing search patterns through Google Trends, identifying emerging technologies, and monitoring regulatory developments that may impact the sector. Investors who combine this data with fundamental analysis of blockchain projects and technical indicators such as moving averages or RSI can create a more robust framework for decision-making. It is crucial to recognize that while data can guide, it should never replace due diligence in evaluating the long-term viability of any investment.

The integration of Google's technological infrastructure with cryptocurrency ventures presents additional avenues for generating returns. Google Cloud, for instance, provides scalable solutions for decentralized applications and blockchain development, enabling startups to deploy innovative projects that could disrupt traditional financial systems. Investors interested in these sectors can monitor Google's partnerships with blockchain firms or track the adoption of its services by crypto companies, which may signal future growth potential. Furthermore, Google's investment in AI and machine learning can be applied to automate trading strategies, optimizing the execution of buy and sell orders in real time. This synergy between technology and finance underscores the importance of staying informed about advancements that could shape the industry in the coming years.

As the cryptocurrency market matures, the challenge of risk management becomes increasingly complex. Google's security protocols and encryption technologies provide a foundation for safeguarding digital assets, but investors must also employ best practices to protect themselves from vulnerabilities. One effective strategy is to use cold storage wallets, which store private keys offline and are less susceptible to hacking. Additionally, diversifying investments across multiple cryptocurrencies and platforms can mitigate the risks associated with market volatility. Investors should also be cautious of phishing attempts and fraudulent platforms, as these threats have become more sophisticated in the digital era. By combining Google's security features with personal due diligence, it is possible to create a layered defense against potential risks.

The role of user behavior in shaping the crypto market cannot be overstated. Google's tools provide a window into how users interact with financial concepts, revealing patterns that can inform investment choices. For example, an increase in search queries related to "how to invest in crypto" or "Google 2024 cryptocurrency trends" may indicate growing interest in the sector, potentially affecting demand and pricing dynamics. Investors who stay attuned to these signals can make more informed decisions, aligning their strategies with market sentiment. However, it is essential to differentiate between correlation and causation, as increased search activity does not always translate to market movement. A nuanced understanding of these relationships allows for more accurate predictions and better risk assessment.

Understanding the broader economic context is another critical component of successful investing in the digital age. Google's data tools enable users to track macroeconomic indicators, such as inflation rates, interest changes, and geopolitical events, which can influence the cryptocurrency market. For instance, an economic downturn may lead to increased demand for safe-haven assets, including Bitcoin, while regulatory changes could impact the legality and accessibility of crypto trading. By analyzing these factors through Google's platforms, investors can anticipate market reactions and adjust their portfolios accordingly. This proactive approach aligns with the principles of long-term investing, emphasizing the importance of adaptability and strategic positioning.

The integration of Google's services with crypto investing also highlights the evolving nature of financial innovation. As the metaverse and decentralized finance (DeFi) continue to gain traction, Google's tools can help investors identify emerging opportunities in these domains. For example, tracking the adoption of NFTs or the growth of DeFi platforms can provide insights into potential high-yield investments. However, the same tools can also expose investors to risks associated with speculative assets or unproven technologies. Balancing the pursuit of innovation with a conservative approach to risk management is key to sustaining long-term profitability.

In the context of 2024, the competition in the crypto market is intensifying, and investors must differentiate themselves through unique strategies. Google's vast resources and advanced analytics can be leveraged to uncover overlooked opportunities, such as niche blockchain projects or emerging altcoins. By analyzing user engagement data, market sentiment, and technical metrics, investors can identify projects with strong fundamentals and growth potential. This approach not only enhances the likelihood of success but also aligns with the principles of value investing, focusing on intrinsic worth rather than short-term speculation.

Ultimately, the ability to generate income through Google and crypto investing requires a comprehensive understanding of both realms. While Google's tools offer valuable insights, the success of any investment ultimately depends on careful planning, continuous learning, and adaptive strategies. As the digital landscape continues to evolve, investors who remain informed and proactive will be best positioned to capitalize on opportunities while mitigating risks. The future of finance is inseparable from technology, and those who master this intersection will shape the next era of wealth creation.