Okay, I understand. Here's an article exploring the investment potential of Palladium, written in a comprehensive style and meeting your length and structure requirements:

Palladium, a silvery-white metal belonging to the platinum group, has captured the attention of investors in recent years. Its primary use lies in catalytic converters, crucial components in automobiles that reduce harmful emissions. This dependency on the automotive industry has made palladium's price highly sensitive to global car sales, emission standards, and technological shifts. So, the question remains: is allocating capital to palladium a sound investment decision?

To answer this, a multifaceted analysis is required. The demand side of the equation is significantly influenced by governmental regulations. Stricter emission standards worldwide, particularly in major automotive markets like China and Europe, have historically fueled demand for palladium. These regulations mandate the use of catalytic converters, and palladium is particularly effective in controlling emissions from gasoline engines, which are still prevalent in many parts of the world. The shift towards electric vehicles (EVs) undoubtedly presents a long-term challenge to palladium demand. However, the transition to a fully electric fleet is a gradual process, with hybrid vehicles, which also use catalytic converters, serving as a bridge. Moreover, the internal combustion engine (ICE) is not disappearing overnight, especially in developing nations with less developed charging infrastructure and lower consumer affordability for EVs. The pace of EV adoption, therefore, becomes a critical factor in assessing palladium's future prospects.

Supply-side dynamics also play a significant role in palladium's price fluctuations. The metal is primarily mined in Russia and South Africa, making its supply vulnerable to geopolitical risks and disruptions in mining operations. Labor disputes, political instability, and environmental concerns in these regions can all impact palladium production, leading to price spikes. This concentration of supply in a few geographical locations creates a potential vulnerability for investors. Furthermore, the extraction of palladium is often a byproduct of mining other metals like platinum and nickel, which means that the supply of palladium is not always directly correlated with its own demand. The economics of mining the primary metals influence how much palladium ultimately enters the market.

Investment options for palladium exposure vary. Investors can opt for physical palladium, such as bars or coins, providing direct ownership of the metal. However, storing and insuring physical palladium incurs costs. Exchange-Traded Funds (ETFs) that track the price of palladium offer a more convenient and liquid way to invest. These ETFs typically hold physical palladium, providing investors with indirect exposure to the metal's price movements. Mining companies that produce palladium also offer a pathway for investment, though these companies' performance is influenced by factors beyond just palladium prices, such as operational efficiency, management decisions, and exploration success. Futures contracts provide another avenue for speculative investment, allowing traders to bet on the future price of palladium. However, futures trading is inherently risky and requires a deep understanding of market dynamics and risk management strategies. Each investment method presents different levels of risk, liquidity, and management requirements, which need to be carefully evaluated against one's investment goals and risk tolerance.

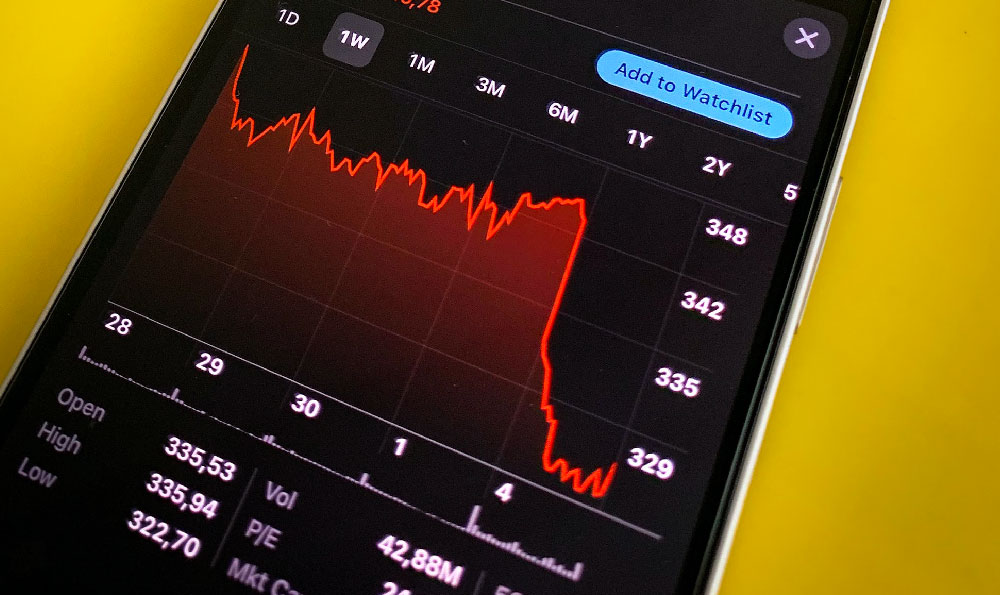

The risks associated with palladium investment are considerable. As mentioned earlier, the automotive industry's transition to electric vehicles poses a significant long-term threat to palladium demand. Technological advancements in catalytic converter design could also reduce the amount of palladium required per vehicle. Furthermore, the price of palladium is known for its volatility, driven by fluctuating supply and demand dynamics, geopolitical events, and speculative trading. This volatility can lead to significant gains but also substantial losses. Market sentiment, driven by news and economic data, can also exacerbate price swings. A global recession could dampen car sales, reducing demand for palladium and negatively impacting its price. Before allocating funds, potential investors should conduct thorough due diligence, assess their risk tolerance, and consider the long-term outlook for the automotive industry and the global economy.

Despite the risks, palladium presents potential opportunities for investors. The scarcity of the metal, coupled with its essential role in emission control, could support prices in the short to medium term, particularly if emission standards continue to tighten. Any unexpected disruptions in supply could also trigger price rallies. Furthermore, research into new applications for palladium, such as in electronics and fuel cells, could create new sources of demand. Investors must carefully weigh these opportunities against the risks, considering their investment horizon and overall portfolio diversification. Diversification is a crucial element in mitigating risk, and allocating a significant portion of one's portfolio to a single commodity like palladium can be inherently risky. A well-diversified portfolio across different asset classes can help to cushion the impact of any single investment's performance.

In conclusion, whether palladium is a smart investment choice depends on individual circumstances, risk tolerance, and investment goals. A comprehensive understanding of the factors driving palladium's supply and demand, the risks associated with investing in the metal, and the available investment options is essential before making any decisions. Careful research, due diligence, and a well-defined investment strategy are crucial for navigating the complexities of the palladium market and maximizing the potential for returns while managing risk. Investors should regularly review their palladium positions in light of changing market conditions and adjust their strategies accordingly.