How to Make Money Online: Proven Tips and Strategies for Earnings

The digital age has revolutionized the way individuals approach financial growth, offering a vast array of opportunities beyond traditional banking. Whether through cryptocurrency trading, online freelancing, or investment in digital assets, the path to profitability requires a blend of strategic thinking, market awareness, and prudent risk management. For those seeking to leverage these opportunities, the key lies in understanding the underlying mechanisms, adapting to evolving trends, and maintaining a disciplined mindset. This article delves into the nuances of online earning strategies, focusing on the potential of virtual currencies and broader financial tools, while emphasizing the importance of long-term planning and safeguarding one’s capital.

Virtual currencies, such as Bitcoin, Ethereum, and emerging altcoins, have emerged as a lucrative avenue for online investors. Their decentralized nature and global accessibility make them unique compared to conventional assets. However, their volatility also demands a deeper understanding of market dynamics. One proven approach is to conduct thorough research on the technological foundations of the coin, including its blockchain infrastructure, use cases, and competitive landscape. Coins backed by robust protocols and active development teams often exhibit greater resilience, even in turbulent markets. For instance, innovations in scalability, security, or energy efficiency can drive long-term value, while weak fundamentals may result in abrupt price corrections.

In addition to technical analysis, monitoring macroeconomic factors is essential. Inflation, interest rates, and geopolitical events often influence cryptocurrency markets indirectly. During periods of economic uncertainty, investors may turn to digital assets as a hedge against fiat currency devaluation. Conversely, regulatory crackdowns or central bank interventions can trigger short-term dips. A smart investor recognizes these patterns and adjusts their portfolio accordingly, rather than reacting impulsively. For example, during the 2022 Bitcoin halving event, the market’s response was influenced by both supply constraints and broader economic sentiment, demonstrating the need for context-aware decision-making.

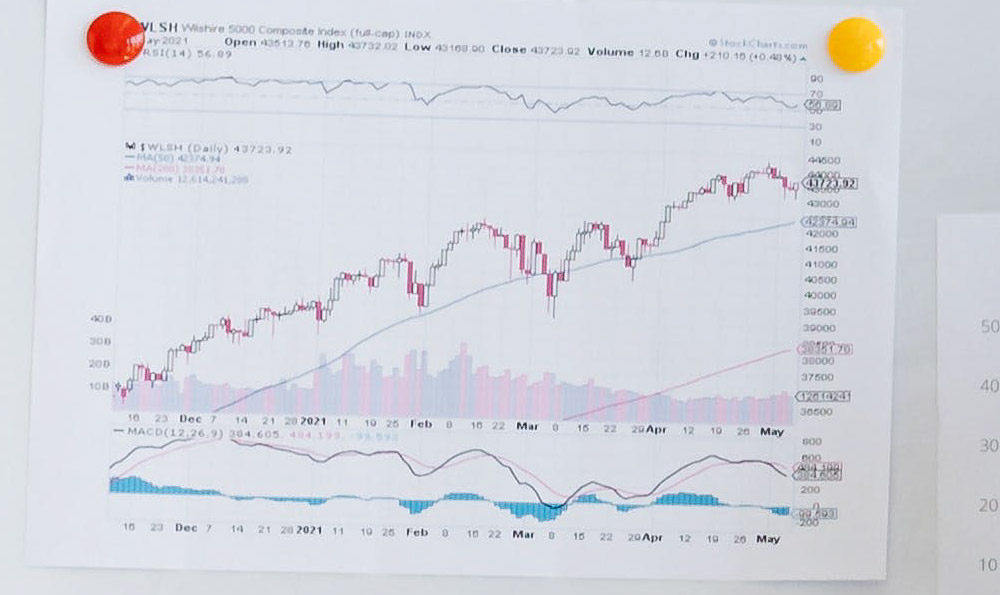

Another critical element is leveraging technical indicators to identify trends. Tools like moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) provide insights into price momentum and market sentiment. A seasoned trader understands how to combine these indicators to predict potential turning points. For instance, a bullish crossover in the MACD often signals a short-term uptrend, while an overbought RSI reading may indicate a need to rebalance positions. It is important to note that no single indicator is foolproof, and their effectiveness depends on market conditions and timeframes. A diversified approach that incorporates multiple indicators can offer a more comprehensive view of market behavior.

Risk management remains a cornerstone of sustainable online earnings. While high returns are enticing, unchecked exposure to volatility can lead to significant losses. A proven strategy involves setting clear risk parameters, such as determining the maximum percentage of capital that can be allocated to a single trade or investment. Diversification across different asset classes, markets, and geographies can mitigate the impact of adverse events. For example, holding both Bitcoin and stablecoins allows investors to balance high-risk potential with liquidity and stability. Furthermore, establishing stop-loss orders and taking profits at predetermined points can prevent emotional decisions and protect against sudden market reversals.

The rise of decentralized finance (DeFi) and yield farming has introduced new avenues for online income. These platforms enable users to earn interest by providing liquidity to decentralized protocols, often offering higher returns than traditional savings accounts. However, the inherent risks of smart contract vulnerabilities and network congestion require vigilance. Investors should carefully evaluate the projects they engage with, checking for transparency, security audits, and community engagement. Platforms with established track records and additional safeguards—such as custody solutions or insurance mechanisms—often present a more favorable risk-reward profile.

A frequently overlooked aspect of online earning is the importance of continuous education. The crypto market is highly dynamic, with new technologies, regulations, and trends emerging regularly. Staying updated through credible sources, such as academic journals, industry reports, and well-researched analyses, can provide a competitive edge. Joining online communities, attending webinars, and learning from experienced traders can also enhance one’s understanding. For example, mastering the fundamentals of blockchain technology or understanding the mechanics of market manipulation can help investors make more informed decisions.

Beyond virtual currencies, other online income strategies include niche-based digital businesses, passive income models, and algorithmic trading. For instance, creating and monetizing content through platforms like YouTube or TikTok can generate revenue through ads, sponsorships, or memberships. Similarly, investing in dividend-paying stocks or peer-to-peer lending platforms offers alternative avenues for financial growth. However, success in these areas depends on persistence, adaptability, and a willingness to refine strategies based on performance metrics.

In conclusion, generating online earnings requires a holistic approach that balances opportunity with caution. Virtual currencies, when analyzed through the lens of technology, macroeconomics, and technical indicators, can present a dynamic yet risky investment landscape. Effective risk management, continuous learning, and diversification across multiple income streams are essential for long-term profitability. The most successful investors are those who approach the market with a clear strategy, remain adaptable to change, and prioritize sustainable growth over short-term gains. By adopting these proven principles, individuals can navigate the complexities of online earning and build a resilient financial foundation.