DAO Maker Investment: How and Where?

DAO Maker has carved a niche for itself in the cryptocurrency and blockchain space as a platform dedicated to launching and growing promising projects. Investing in DAO Maker itself, or projects launched through its platform, presents unique opportunities and risks that potential investors should carefully evaluate. This analysis will explore the various avenues for investment related to DAO Maker, shedding light on the "how" and "where" aspects of participating in this ecosystem.

Investing directly in DAO Maker typically means acquiring its native token, $DAO. This token serves multiple purposes within the DAO Maker ecosystem. Primarily, it governs the DAO, allowing holders to participate in crucial decisions regarding the platform's development, operations, and treasury management. The $DAO token also grants access to certain tiers and benefits within the DAO Maker Launchpad, enabling users to participate in token sales of projects incubated on the platform. Furthermore, $DAO can be staked to earn rewards, providing a passive income stream for holders who contribute to the network's security and stability. The token's utility within the ecosystem makes it a crucial element to consider when evaluating the overall investment opportunity.

The primary avenue for acquiring $DAO is through cryptocurrency exchanges. Leading exchanges like Binance, KuCoin, and Gate.io often list $DAO, offering convenient access for a global audience. Before purchasing, it's essential to conduct thorough research on the exchange itself, ensuring it has a solid reputation, robust security measures, and adequate liquidity. Price comparisons across different exchanges are also recommended to secure the most favorable purchase price.

Once acquired, securing your $DAO is of paramount importance. Hardware wallets like Ledger or Trezor are considered the gold standard for cryptocurrency storage, as they keep your private keys offline, significantly reducing the risk of hacking or theft. Software wallets, such as MetaMask or Trust Wallet, offer a more convenient option but require greater caution in terms of security practices. Regardless of the chosen storage method, enabling two-factor authentication (2FA) and employing strong, unique passwords are crucial steps to safeguard your investment.

Beyond directly purchasing $DAO, participating in the DAO Maker Launchpad offers another way to invest in the broader ecosystem. The Launchpad functions as an incubator and launch platform for blockchain startups. By holding and staking $DAO tokens, users can gain access to token sales of these emerging projects. Access is often tiered, with higher staking amounts granting access to larger allocations and potentially earlier participation rounds.

Investing in projects launching through the DAO Maker Launchpad comes with both potential rewards and significant risks. The allure lies in the possibility of identifying and investing in promising projects early on, potentially capturing substantial gains as these projects mature and gain traction. However, it's crucial to recognize that many early-stage blockchain projects fail to achieve their goals. The due diligence process becomes absolutely critical.

Thorough due diligence involves deeply researching the project's whitepaper, team, technology, market potential, and tokenomics. A clear understanding of the project's goals, the problem it aims to solve, and its competitive landscape is essential. Evaluating the team's experience and track record is also crucial, as a strong and capable team is more likely to navigate the challenges of building a successful blockchain project. Analyzing the tokenomics helps determine the potential long-term value of the project's token and its sustainability. Engaging with the project's community, asking questions, and assessing the overall sentiment can also provide valuable insights.

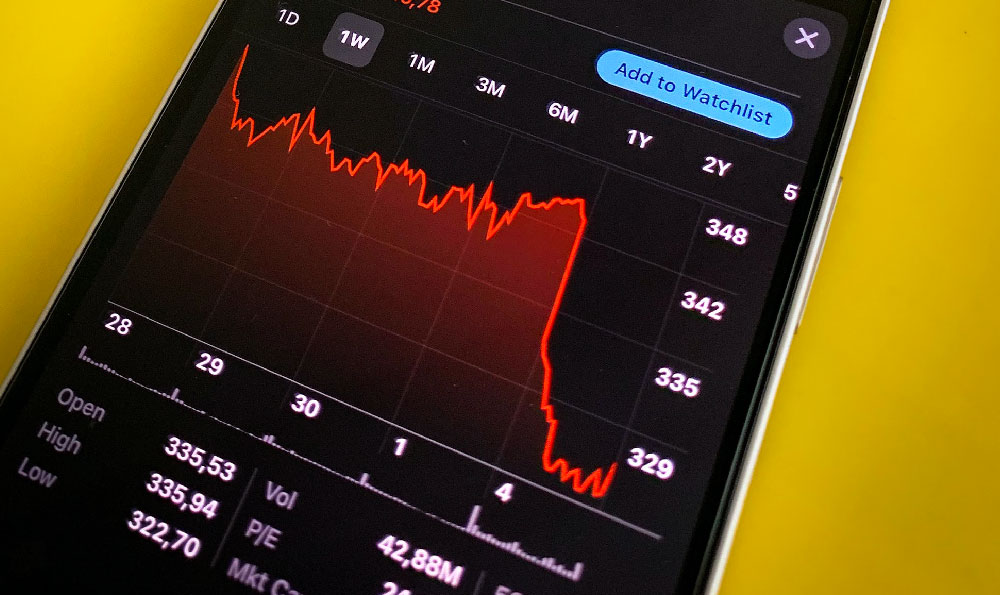

The risks associated with investing in early-stage blockchain projects are substantial. Market volatility, regulatory uncertainties, technological hurdles, and competition can all significantly impact a project's success. Liquidity can also be a concern, especially for smaller projects with limited trading volume. Diversification is therefore a crucial risk management strategy. Spreading investments across multiple projects can mitigate the impact of any single project's failure.

Another aspect to consider is the allocation size. While the potential for high returns may be tempting, it's wise to allocate only a small percentage of your overall investment portfolio to these high-risk ventures. This approach helps protect your capital and ensures that you can withstand potential losses without significantly impacting your financial stability.

Furthermore, keeping abreast of the evolving regulatory landscape is crucial. Regulations surrounding cryptocurrencies and blockchain projects are still developing, and changes in regulations can have a significant impact on the viability of these projects. Staying informed about the latest regulatory developments and consulting with legal or financial professionals can help you make informed investment decisions and navigate the regulatory complexities.

In conclusion, investing in DAO Maker and its Launchpad projects presents a unique opportunity to participate in the growth of the blockchain ecosystem. Whether you choose to invest directly in $DAO or participate in token sales of incubated projects, a thorough understanding of the platform, the associated risks, and the importance of due diligence is paramount. By adopting a strategic approach, diversifying your investments, and staying informed about the evolving market dynamics, you can increase your chances of success and potentially reap the rewards of investing in this innovative space. Remember, responsible investing involves a balanced approach that considers both potential gains and potential losses.