The modern financial landscape is increasingly intertwined with the flexibility of work-life balance, particularly as more individuals explore part-time employment to gain financial freedom or supplement their income. While the idea of reducing working hours may seem aspirational, it carries distinct implications for how people allocate time to other pursuits, including investment strategies. Understanding the nuances of part-time work hour limits—both legal and practical—can serve as a foundation for crafting a sustainable approach to wealth management, especially in the volatile realm of cryptocurrency. By analyzing the interplay between work constraints and investment opportunities, we can identify methods to maximize returns without compromising personal well-being, while also mitigating the risks associated with market fluctuations.

Part-time work hour limits are often defined by regulatory frameworks, such as the Fair Labor Standards Act (FLSA) in the United States, which stipulates that non-exempt employees working more than 40 hours per week are entitled to overtime pay. However, the reality of part-time roles is more complex, as they vary in structure and compensation models. For instance, some remote positions offer flexible hours without strict time constraints, while others may require a fixed schedule, such as 20 hours per week, with no additional benefits for exceeding those limits. This variability necessitates a tailored strategy for individuals who wish to integrate investment activities into their time management. A critical observation is that time spent on investment research, portfolio optimization, or market analysis is not always measurable in hours logged, but rather in the depth of understanding and decision-making quality. Therefore, the boundaries of part-time work hour limits must be reevaluated in the context of how effectively one can allocate time to intentional financial planning.

For those considering part-time work as a conduit to investment growth, the first step is to recognize that time is an irreplaceable resource. Cryptocurrency markets operate 24/7, which can create pressure to monitor and react to price changes in real time. Yet, the most successful investors often adopt a strategic, less reactive approach by analyzing long-term trends and fundamental data. This shift in mindset allows individuals to work within predefined hour limits while maintaining a competitive edge in the market. For example, a part-time worker who dedicates two hours per week to studying market dynamics, researching projects, and adjusting their portfolio can achieve significant results over time. The key lies in prioritizing quality over quantity, ensuring each hour invested in financial activities is leveraged for maximum impact.

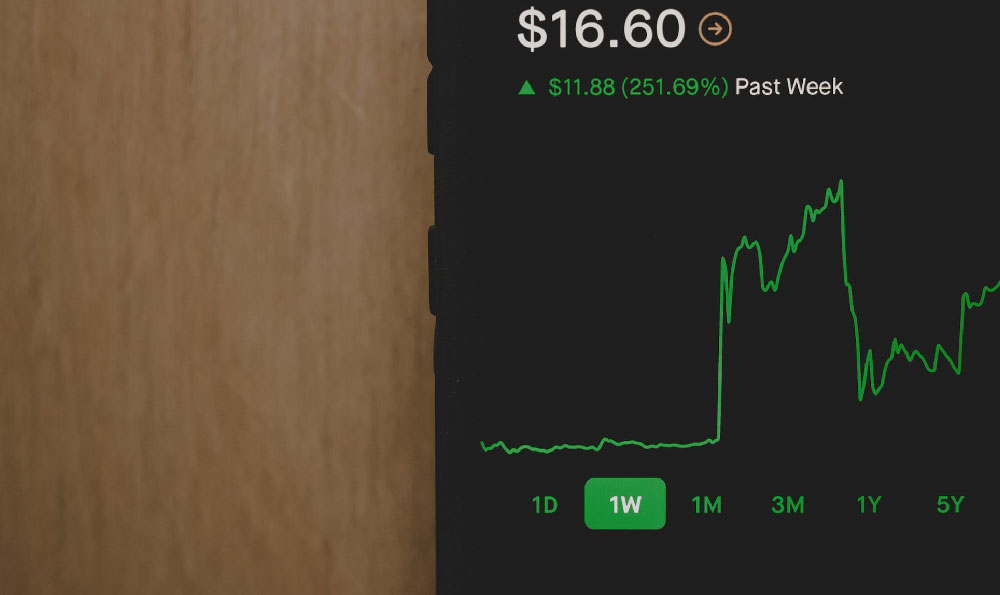

Another aspect to consider is the economic feasibility of combining part-time work with investment pursuits. While part-time income can provide a financial cushion, it is essential to align investment goals with this income level. For instance, someone earning a modest part-time salary may need to adopt a more conservative approach, such as dollar-cost averaging or investing in stablecoins, to reduce the risk of overexposure. Conversely, a part-time worker with a higher income or access to capital might explore more aggressive strategies, like diversified crypto portfolios or staking opportunities. The critical factor is to avoid overcommitting to work or investment activities, as both can lead to burnout or poor financial decisions. A balanced approach involves setting clear boundaries and using time management tools to track progress. For example, allocating specific days or hours for research and investment can prevent time conflicts with work obligations.

Moreover, the legal and logistical constraints of part-time work hour limits can influence investment choices. In some jurisdictions, agencies or employers may impose restrictions on the number of hours an employee can work, particularly for those with multiple job roles. For instance, a worker with a primary job and a part-time gig may face limits on total weekly hours, which can complicate dividend reinvestment or trading activities. This scenario underscores the importance of transparency and clarity in work schedules to ensure that time spent on investment does not inadvertently breach contractual agreements. Investors should also be mindful of jurisdiction-specific rules, such as tax implications for part-time income or restrictions on trading during work hours. By staying informed, individuals can navigate these challenges while optimizing their financial strategies.

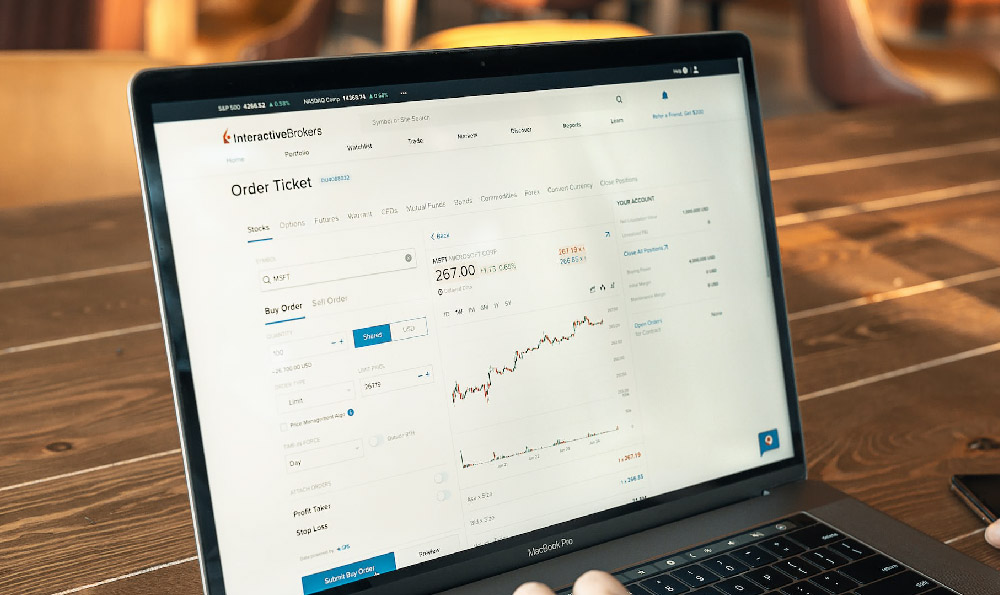

The intersection of part-time work and investment also raises the question of whether limited time can be compensated through efficiency. In the cryptocurrency ecosystem, where information overload is common, efficiency in research and decision-making is paramount. Tools like technical indicators, market sentiment analysis, and algorithmic trading can help investors extract actionable insights within constrained timeframes. For example, the use of automated trading platforms allows for relentless monitoring of market conditions without requiring constant manual intervention. Similarly, fundamental analysis tools can simplify the evaluation of projects, reducing the time needed to assess long-term value. By adopting these technologies, individuals can effectively mitigate the limitations of part-time work hours while maintaining a competitive edge.

However, the challenge extends beyond time allocation to the broader implications of balancing work and investment. A common pitfall is underestimating the time required for diversification, risk management, and continuous learning. In the crypto market, where volatility is inherent, investors must dedicate time to understand market risks, such as rug pulls or regulatory changes, and devise strategies to navigate them. For instance, a part-time worker who allocates three hours per week to portfolio risk assessment and diversification can build resilience against market shocks. Additionally, staying updated on blockchain developments, technological trends, and macroeconomic factors is crucial, as these elements can significantly impact investment outcomes.

In conclusion, part-time work hour limits are not an insurmountable barrier to achieving financial growth, but rather a framework that requires strategic adaptation. By combining legal awareness, economic planning, and technological efficiency, individuals can optimize their time to engage in meaningful investment activities. The crux of this approach lies in creating a sustainable balance, where the time spent on work and investment complements rather than competes with the other. Ultimately, the goal is to transform limited hours into opportunities for financial empowerment, ensuring that investments are not only profitable but also aligned with long-term personal and professional aspirations. This balance, however, demands discipline, foresight, and a commitment to continuous learning—qualities that are fundamental to mastering the complexities of the crypto market.