Here's an article based on your request.

Navigating the world of finance as a nurse can be challenging, but with the right strategies and a proactive approach, maximizing your income and building a secure financial future is entirely achievable. It's about more than just the hourly wage; it’s about strategically leveraging your skills, experience, and available opportunities to create a robust financial portfolio.

One avenue to consider is career advancement and specialization within the nursing field itself. The demand for nurses is consistently high, but certain specialties, such as critical care, operating room, or neonatal intensive care, often command higher salaries due to the specialized knowledge and skills required. Pursuing certifications in these areas not only enhances your expertise but also makes you a more valuable asset to potential employers, thereby increasing your earning potential. Further academic pursuits, such as obtaining a Master of Science in Nursing (MSN) degree, can open doors to advanced practice roles like nurse practitioner or clinical nurse specialist, which typically offer significantly higher compensation packages. This commitment to continued education is an investment in your future earning power.

Beyond traditional employment, exploring alternative work arrangements can also prove lucrative. Travel nursing, for example, offers the opportunity to work in various locations across the country or even internationally, often with premium pay and benefits to compensate for the temporary nature of the assignments. While the lifestyle may require flexibility and adaptability, the financial rewards can be substantial. Per diem nursing, which involves working on an as-needed basis for hospitals or healthcare facilities, provides greater control over your schedule and the ability to pick up extra shifts, thereby boosting your income. Another option is telehealth nursing, where you provide remote patient care through phone calls or video conferencing. This arrangement offers convenience and flexibility, allowing you to work from home while still utilizing your nursing skills.

The world of finance is vast, and strategic investment is a cornerstone of long-term financial success. While caution and thorough research are paramount, exploring avenues such as stocks, bonds, and real estate can significantly grow your wealth over time. It's crucial to diversify your investment portfolio to mitigate risk, spreading your capital across different asset classes to avoid being overly exposed to any single market fluctuation. Understanding your risk tolerance is key. Are you comfortable with the possibility of short-term losses in exchange for potentially higher returns, or do you prefer a more conservative approach with steady, albeit slower, growth? Consulting with a qualified financial advisor can provide personalized guidance tailored to your individual financial goals and risk profile.

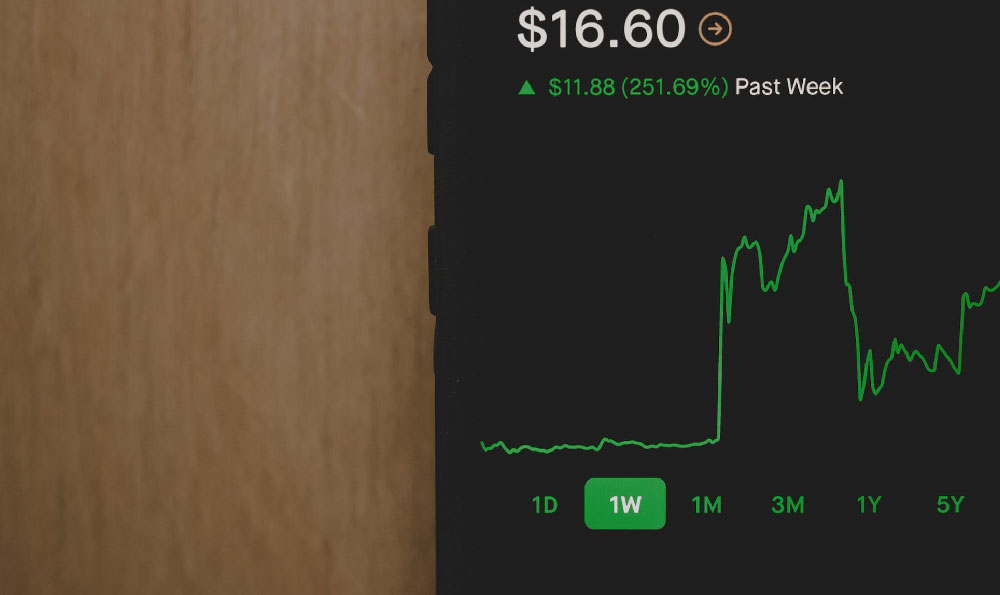

Venturing into the realm of cryptocurrency can be tempting, given its potential for rapid gains, but it's imperative to approach this market with extreme caution and a well-informed perspective. Cryptocurrency is notoriously volatile, meaning prices can fluctuate dramatically in short periods. Before investing any capital, dedicate significant time to researching different cryptocurrencies, understanding their underlying technology, and assessing their potential long-term value. Never invest more than you can afford to lose, and be prepared for the possibility of significant losses. Consider starting with a small amount and gradually increasing your investment as you gain more experience and knowledge. Be wary of scams and "get-rich-quick" schemes, which are prevalent in the cryptocurrency space. Stick to reputable exchanges and platforms, and always prioritize security measures to protect your digital assets.

Furthermore, effective budgeting and expense management are fundamental to maximizing your disposable income and freeing up capital for investment. Track your income and expenses meticulously to identify areas where you can cut back on unnecessary spending. Create a realistic budget that aligns with your financial goals, prioritizing essential expenses while allocating funds for savings and investments. Automate your savings and investment contributions to ensure consistency and avoid the temptation to spend the money elsewhere. Pay off high-interest debt, such as credit card debt, as quickly as possible, as the interest payments can significantly drain your financial resources. Negotiate lower interest rates on existing loans or explore options for debt consolidation to reduce your overall debt burden.

Beyond traditional financial instruments, consider exploring income-generating side hustles that leverage your nursing skills or personal interests. Offering private health consultations, teaching CPR or first aid courses, or providing care management services to elderly individuals are just a few examples of how you can generate additional income outside of your primary nursing job. Online tutoring or freelance writing related to health and wellness topics can also provide a flexible and convenient way to supplement your income.

Finally, remember that financial planning is an ongoing process, not a one-time event. Regularly review your financial goals, investment portfolio, and spending habits to ensure that you are on track to achieve your desired outcomes. Adjust your strategies as needed to adapt to changing market conditions and life circumstances. Stay informed about developments in the financial world and seek professional guidance when necessary. By combining a proactive approach to career advancement, strategic investment planning, and diligent financial management, nurses can effectively maximize their income, build a secure financial future, and achieve their long-term financial goals. Patience, discipline, and continuous learning are key to success in the world of personal finance.