Okay, here's an article addressing the challenges and opportunities for generating income during maternity leave, aiming for a comprehensive and insightful piece exceeding 800 words, written in English and without explicit headings or numbered lists.

Navigating the financial landscape during maternity leave can feel like traversing a minefield. The joy of welcoming a new child is often interwoven with anxieties about reduced income, mounting expenses, and the long-term impact on one's career. The transition from a steady paycheck to a significantly diminished or nonexistent one can be jarring, forcing many new mothers to re-evaluate their priorities and explore alternative income streams. It's not just about maintaining the household budget; it's about preserving a sense of financial independence and security during a pivotal life stage.

The immediate challenge is often bridging the gap between pre-leave earnings and the actual benefits received. Maternity leave policies vary wildly across countries and even within companies, leaving many women with a fraction of their former salary, or worse, unpaid leave. Government programs, while helpful, often fall short of replacing a full income. This disparity necessitates proactive planning and a willingness to explore diverse avenues for supplemental income.

One popular approach is leveraging existing skills and experience through freelance work. The digital age offers a plethora of opportunities for remote work, from writing and editing to graphic design and virtual assistance. Platforms like Upwork, Fiverr, and Freelancer connect individuals with businesses seeking specific skills on a project basis. The key here is identifying marketable skills, crafting a compelling profile, and dedicating focused time to pitching and delivering high-quality work. While managing a newborn and freelance projects can be demanding, the flexibility allows for fitting work around the baby's schedule. It's important to set realistic expectations and communicate clearly with clients about availability and deadlines.

Beyond traditional freelancing, consider monetizing passions and hobbies. If you're a skilled knitter, baker, or photographer, online platforms like Etsy or Shopify provide avenues for selling handmade goods or digital products. Building an online store requires effort in marketing and customer service, but it can evolve into a sustainable business over time. Similarly, if you possess expertise in a particular area, consider creating and selling online courses or workshops. Platforms like Teachable or Udemy offer the infrastructure and marketing tools to reach a wider audience. The advantage of these approaches is the potential for passive income, where you create a product or service once and continue to earn revenue from it over time.

Another avenue to explore is direct sales or network marketing. Companies like Avon, Mary Kay, and various health and wellness brands offer opportunities to sell products directly to consumers, often through online or in-person parties. While success in direct sales requires strong networking skills and a commitment to building relationships, it can provide a flexible income stream and the potential for long-term growth. However, it's crucial to carefully research the company and its products before investing time and money, ensuring that it aligns with your values and that the business model is sustainable.

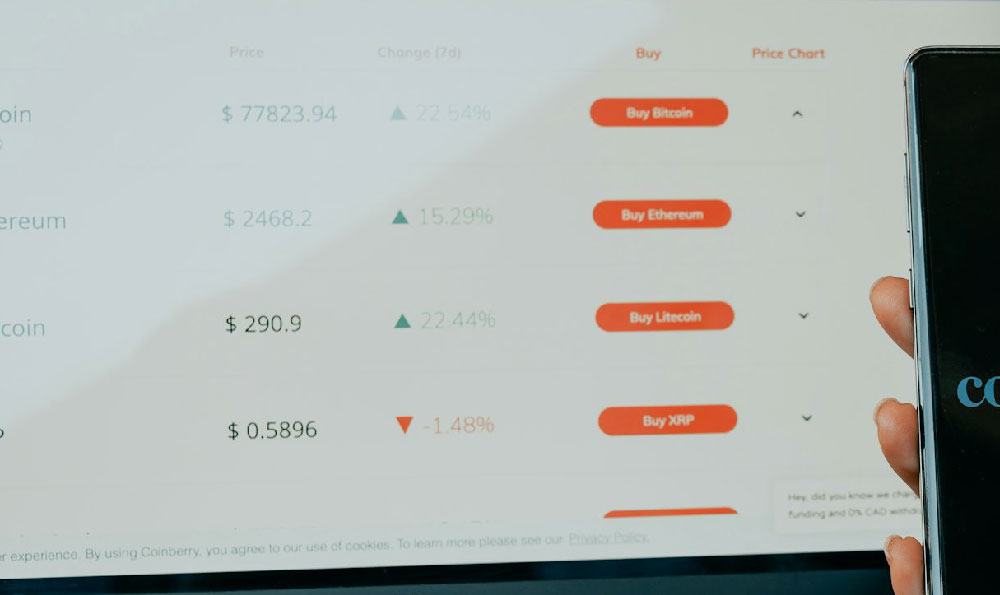

Investing, while not a source of immediate income, is crucial for long-term financial security. Even small, regular contributions to a retirement account or investment portfolio can make a significant difference over time. Consider consulting with a financial advisor to develop a personalized investment strategy that aligns with your risk tolerance and financial goals. Explore tax-advantaged investment options, such as Roth IRAs or 401(k)s, to maximize returns and minimize tax liabilities. Remember that investing involves risk, and it's important to diversify your portfolio and avoid putting all your eggs in one basket.

Looking beyond short-term income generation, maternity leave can also be an opportunity to invest in yourself and acquire new skills. Online courses, workshops, and certifications can enhance your resume and make you more competitive in the job market upon your return. Consider learning a new language, mastering a software program, or obtaining a professional certification in your field. These investments can pay off in the long run by increasing your earning potential and expanding your career opportunities.

Furthermore, explore potential government assistance programs and tax credits that may be available to new parents. These programs can provide financial relief and help offset the costs associated with raising a child. Research eligibility requirements and application procedures to ensure that you're taking advantage of all available resources.

The emotional and psychological aspects of maternity leave should not be overlooked. Feeling financially stressed can negatively impact your well-being and your ability to bond with your baby. Prioritize self-care and seek support from your partner, family, and friends. Joining online communities or support groups for new mothers can provide a sense of connection and shared experience.

Ultimately, navigating the financial challenges of maternity leave requires a multifaceted approach. It involves proactive planning, creative problem-solving, and a willingness to explore diverse income streams. It also requires a realistic assessment of your skills, resources, and time constraints. By combining short-term income generation strategies with long-term financial planning, you can not only weather the financial storm but also emerge stronger and more resilient on the other side. The key is to remain adaptable, resourceful, and focused on your goals, both financial and personal. This period, while demanding, can also be a time of significant growth, innovation, and self-discovery. Embrace the challenge, explore your options, and create a financial plan that empowers you to thrive during this transformative chapter of your life.