Okay, here's an article exploring the Martingale strategy within the context of a hypothetical platform called "CoinPro." I'll focus on the strategy's mechanics, potential pitfalls, and ethical considerations, while avoiding a rigid, numbered structure and the overuse of introductory phrases. I will also refrain from making any implications that CoinPro is a real platform and approach this prompt as an example strategy.

Here's the article:

The allure of quick riches is a siren song, and in the volatile world of cryptocurrency and online betting, strategies promising guaranteed wins are particularly tempting. The Martingale strategy, an old betting system, is often touted as one such method. Imagine employing this on a platform, for argument's sake, called "CoinPro," which offers trading in various crypto derivatives or even simulated high-stakes coin flips. Does it work? And what are the real implications?

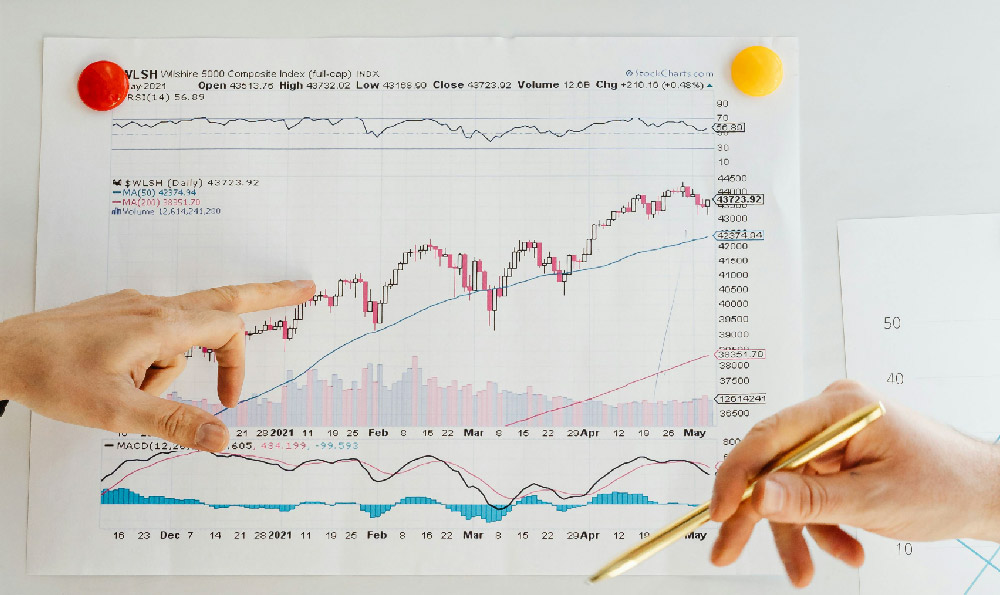

The basic principle behind the Martingale strategy is deceptively simple: after each loss, you double your bet. The theory is that eventually, you will win, and when you do, you'll recover all your previous losses plus a profit equal to your initial bet. It originates from 18th-century France, commonly applied to games of chance like roulette where the odds are close to 50/50. Applied to CoinPro, perhaps in the context of trading Bitcoin futures with high leverage or a simulated coin toss within the platform, the strategy would involve doubling your investment amount after each unsuccessful trade, aiming to recoup losses when a winning trade finally materializes.

However, the apparent simplicity masks a fundamental flaw. The Martingale strategy relies on two crucial, and often unrealistic, assumptions: unlimited capital and the absence of betting limits. In the real world, neither of these conditions holds true. Even with a seemingly modest initial bet on CoinPro, a string of consecutive losses can quickly escalate your investment to a point where you exceed your available funds. Imagine starting with a $10 bet. After five consecutive losses, you'd need to wager $320 on the next trade just to break even. After ten losses, that figure jumps to $5,120. Most individuals, and even many institutions, simply don't have the deep pockets required to sustain such a sequence.

Furthermore, CoinPro, like many similar platforms, likely imposes maximum bet sizes. These limits are often in place to protect the platform from excessive risk and to prevent market manipulation. If you reach the betting limit before securing a win, you're effectively locked out of the strategy and left with accumulated losses. Even if the platform doesn’t restrict the bet amounts, the volatile nature of the crypto market could lead to losses that exceed the platform’s capacity, which would leave you without compensation.

Beyond the practical limitations, the Martingale strategy carries significant psychological risks. The pressure to recoup losses can lead to impulsive decision-making, causing you to deviate from your initial plan and potentially amplify your losses even further. The relentless doubling down can create a sense of desperation, overriding rational judgment and leading to reckless trading behavior. The fear of missing out on a “guaranteed” win can also cloud your perception of risk, making you more likely to ignore warning signs and continue betting even when the odds are clearly stacked against you.

Consider the implications of leverage. While CoinPro might offer high leverage to amplify potential profits, it also magnifies potential losses. Employing the Martingale strategy with high leverage is akin to pouring gasoline on a fire. A small initial loss can quickly snowball into a catastrophic financial disaster. The pressure to double down intensifies, and the margin calls become increasingly frequent, potentially wiping out your entire account in a matter of hours.

Moreover, the perception of a “guaranteed” win is a dangerous illusion. While the probability of a long losing streak decreases as the number of trials increases, it never reaches zero. The inherent randomness of the market, coupled with the finite resources of the investor, makes the Martingale strategy inherently unsustainable in the long run. It's a high-risk, high-reward approach that is far more likely to lead to ruin than to riches.

Ethically, promoting or using the Martingale strategy can be problematic. Platforms like the hypothetical CoinPro have a responsibility to educate their users about the risks involved in different trading strategies. Encouraging or even subtly suggesting the use of the Martingale, especially to inexperienced traders, borders on predatory behavior. The strategy preys on the human desire for quick profits and exploits the lack of understanding of probability and risk management. Users who blindly follow this advice are likely to suffer significant financial losses, which can have devastating consequences for their lives.

The promise of easy money is a powerful motivator, but in the world of investing, there are no shortcuts to success. The Martingale strategy is a prime example of a flawed system that offers a false sense of security. While it might yield short-term gains in some cases, its inherent limitations and psychological pitfalls make it a dangerous and unsustainable approach. Instead of chasing the illusion of guaranteed profits, focus on developing a solid understanding of risk management, diversification, and long-term investing principles. A more rational approach would prioritize preserving capital and making informed decisions based on thorough research and analysis. Always remember the mantra: if it sounds too good to be true, it probably is. This holds especially true for so-called "guaranteed" strategies within the complex and often unpredictable realm of cryptocurrency.