Okay, here’s an article addressing the question of whether it's possible to make money in the share market, and how one might achieve that. ``` Is Making Money in the Share Market Possible? How Can You Do It?

The allure of the stock market is undeniable. The prospect of turning modest savings into a substantial fortune through shrewd investments has captivated individuals for centuries. However, for every success story, there are countless tales of shattered dreams and financial losses. So, the fundamental question remains: Is making money in the share market truly possible, and if so, what are the key ingredients for success?

The answer, unequivocally, is yes, making money in the stock market is possible. However, it’s crucial to approach it with the right mindset and a solid understanding of the underlying principles. It's not a get-rich-quick scheme but a long-term game that demands patience, discipline, and continuous learning. The market rewards those who are well-informed, strategic, and capable of managing risk effectively. Conversely, it punishes those who act impulsively, driven by emotion or unfounded speculation.

One of the most critical aspects of successful stock market investing is developing a clear investment strategy. This involves defining your financial goals, risk tolerance, and investment time horizon. Are you saving for retirement decades away, or are you looking for more immediate returns? Are you comfortable with high levels of volatility in exchange for the potential for greater gains, or do you prefer a more conservative approach that prioritizes capital preservation? Your answers to these questions will dictate the types of investments that are suitable for you.

Once you've established your strategy, the next step is to do your research. Don't blindly follow the advice of friends, family, or online forums. Instead, learn to analyze companies and industries yourself. This means understanding financial statements, such as balance sheets, income statements, and cash flow statements. These documents provide valuable insights into a company's profitability, financial health, and growth potential. Look for companies with strong fundamentals, such as consistent revenue growth, healthy profit margins, and low levels of debt.

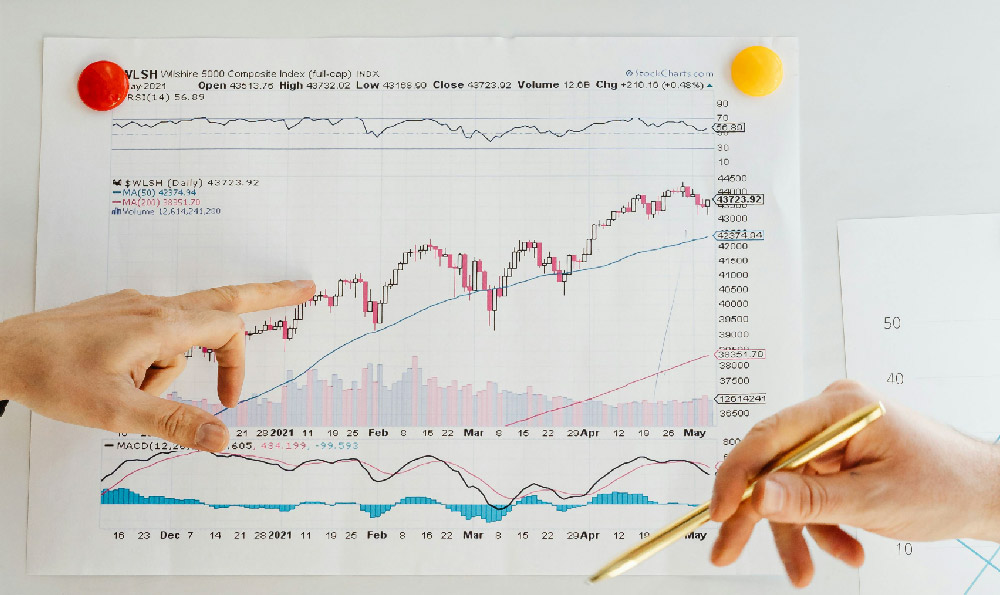

Beyond individual company analysis, it's equally important to understand the broader economic environment. Factors such as interest rates, inflation, and economic growth can all have a significant impact on the stock market. Staying informed about these trends can help you anticipate market movements and adjust your portfolio accordingly. There are numerous resources available for staying up-to-date on economic news and analysis, including financial news websites, business publications, and investment research firms.

Diversification is another essential principle of successful stock market investing. Don't put all your eggs in one basket. Spreading your investments across different companies, industries, and asset classes can help to mitigate risk. If one investment performs poorly, the others can help to offset the losses. Diversification doesn't guarantee profits or protect against losses in a declining market, but it can significantly reduce the overall volatility of your portfolio.

A key aspect that's frequently overlooked is the role of emotions in investment decisions. Fear and greed are powerful emotions that can cloud judgment and lead to impulsive actions. When the market is rising, it's tempting to get caught up in the hype and invest in whatever is popular, even if it's overpriced. Conversely, when the market is falling, it's easy to panic and sell your investments at a loss. Successful investors are able to control their emotions and make rational decisions based on sound analysis, not fear or greed.

Moreover, consider the costs associated with investing. Brokerage fees, trading commissions, and management expenses can eat into your returns over time. Look for low-cost investment options, such as index funds and exchange-traded funds (ETFs), which typically have lower expense ratios than actively managed mutual funds. A passively managed fund is designed to track a specific market index, which often results in lower costs compared to actively managed funds where a portfolio manager makes decisions.

Finally, remember that investing in the stock market is a long-term endeavor. Don't expect to get rich overnight. The market will inevitably experience ups and downs, and there will be times when your investments lose value. The key is to stay disciplined, stick to your investment strategy, and resist the temptation to make rash decisions based on short-term market fluctuations. Warren Buffett, one of the most successful investors of all time, famously said, "Be fearful when others are greedy, and be greedy when others are fearful." This sentiment encapsulates the importance of taking a contrarian approach and making rational decisions based on long-term fundamentals, rather than short-term market sentiment.

In conclusion, making money in the share market is achievable with the right approach. It requires a well-defined investment strategy, thorough research, diversification, emotional control, and a long-term perspective. While there are no guarantees of success, those who are willing to put in the time and effort to learn and adapt will significantly increase their chances of achieving their financial goals. Remember, investing is a journey, not a destination. Continuously learning, adapting, and refining your strategies will ultimately be the keys to unlocking long-term success in the stock market. ```