Roaring Kitty, whose real name is Keith Gill, achieved initial profitability and garnered significant attention for his prescient and highly profitable investment in GameStop (GME). Understanding his initial investment strategy and the factors that contributed to his early success requires a deep dive into his research, analysis, and conviction.

Gill's journey began long before the GameStop frenzy that captivated the world in early 2021. He wasn't just jumping on a bandwagon; he was meticulously analyzing financial statements and fundamental data. His initial investment strategy was rooted in identifying undervalued companies with strong potential for a turnaround or significant long-term growth, a value investing approach similar to that of Benjamin Graham or Warren Buffett.

He wasn't simply looking for stocks that were "cheap" in the sense of having a low price; he was looking for companies whose stock prices were significantly below their intrinsic value. This intrinsic value, he believed, could be determined through rigorous analysis of their balance sheets, cash flows, and management teams. He looked for companies with a solid foundation, even if they were facing temporary challenges or were overlooked by the broader market.

GameStop, at the time, perfectly fit this profile. The company was facing significant headwinds due to the rise of digital game downloads, which threatened its traditional brick-and-mortar retail model. Many analysts and investors had written off GameStop, predicting its inevitable decline and, in some cases, even bankruptcy. This negative sentiment drove the stock price down, creating what Gill perceived as a massive undervaluation.

Gill's research went beyond simply looking at GameStop's current challenges. He saw potential for the company to adapt and thrive in the changing landscape. He recognized the value of GameStop's loyal customer base, its established brand recognition, and its network of retail locations. He believed that with the right management and strategy, GameStop could successfully transition to a more digital-focused business model or even pivot to new markets.

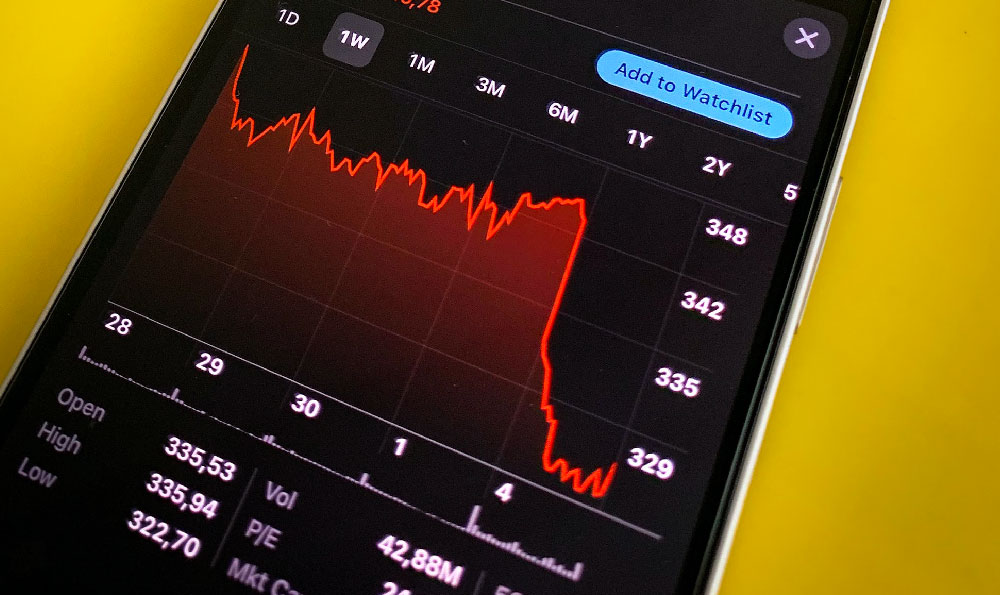

One of the key aspects of his investment strategy was his focus on the options market. While he initially invested in GameStop shares, he later began purchasing call options. A call option gives the holder the right, but not the obligation, to purchase a specified number of shares of a stock at a predetermined price (the strike price) before a specific date (the expiration date).

Gill's decision to purchase call options was a calculated risk that amplified his potential returns. If the stock price rose above the strike price, the options would become increasingly valuable, allowing him to profit significantly. Conversely, if the stock price remained below the strike price, the options would expire worthless, resulting in a loss of the premium paid for the option.

This approach, while potentially lucrative, is also considerably riskier than simply buying shares. It requires a deep understanding of options trading and a high degree of confidence in the underlying stock. Gill demonstrated both, meticulously explaining his reasoning and analysis in his online streams and posts.

His ability to clearly articulate his investment thesis and present his research in an engaging and accessible manner was crucial to his success and the subsequent GameStop phenomenon. He wasn't just telling people to buy GameStop; he was showing them the data and logic behind his investment decision. He used his online platforms, primarily YouTube and Reddit, to share his analysis, answer questions, and engage in discussions with other investors.

This transparency and willingness to share his knowledge built trust and credibility among his followers. Many retail investors, who felt excluded from the traditional financial system, were drawn to Gill's approachable style and his commitment to educating others. They saw him as a champion for the small investor, someone who was willing to challenge the established Wall Street narrative.

Gill's initial investment in GameStop was relatively modest, reportedly starting with tens of thousands of dollars. However, through his strategic use of call options and his persuasive communication, he was able to generate significant returns and attract a large following of investors who shared his conviction in GameStop's potential. As the stock price began to rise, his profits grew exponentially, turning his initial investment into millions of dollars.

It's important to note that his success wasn't solely based on luck. It was the result of diligent research, a well-defined investment strategy, and the ability to communicate his ideas effectively. He understood the risks involved and consistently emphasized the importance of doing one's own research and not investing more than one could afford to lose.

Furthermore, his timing was also a crucial factor. The confluence of factors, including the accessibility of online trading platforms, the rise of social media, and the increasing frustration with the traditional financial system, created a perfect storm that propelled GameStop's stock price to unprecedented heights.

In conclusion, Roaring Kitty's initial profit from GameStop was the culmination of a value-oriented investment strategy, a deep understanding of the options market, and an exceptional ability to communicate his analysis to a broad audience. His initial investment was based on the belief that GameStop was significantly undervalued and that it had the potential to adapt and thrive. His success serves as a reminder that thorough research, a well-defined strategy, and a willingness to challenge conventional wisdom can lead to significant returns, but it also underscores the importance of understanding and managing the inherent risks involved in investing, particularly in volatile markets.