Navigating the world of investment taxes can feel like traversing a labyrinth. Deadlines loom, regulations shift, and the potential for costly errors hangs heavy. Understanding when investment taxes are due and how to pay them is crucial for maintaining financial health and avoiding penalties. The good news is that with a clear roadmap, this process can become manageable and even strategic.

The primary deadline to keep top of mind is April 15th. This is the standard deadline for filing your federal income tax return, which includes reporting and paying taxes on investment income and capital gains. However, if April 15th falls on a weekend or holiday, the deadline is typically shifted to the next business day. It's also important to remember that this deadline applies to the previous tax year. For example, taxes on investment income earned in 2023 are generally due by April 15, 2024.

For individuals who need more time to prepare their tax returns, an automatic extension to file until October 15th (again, adjusted for weekends and holidays) is available. This extension provides six additional months to submit your tax return, but it's crucial to understand that this is an extension to file, not an extension to pay. You are still required to estimate and pay your taxes by the original April deadline. Failure to do so can result in penalties and interest charges, even if you file your return on time in October.

Beyond the annual tax filing, estimated taxes may be necessary. If you receive a significant amount of investment income, such as dividends, interest, or capital gains, and your tax liability exceeds $1,000, you may be required to pay estimated taxes quarterly throughout the year. This prevents you from owing a large sum at the end of the tax year. The IRS provides Form 1040-ES to help calculate your estimated tax payments. These payments are typically due on April 15th, June 15th, September 15th, and January 15th of the following year (again, adjusted for weekends and holidays). The exact due dates and specific requirements for estimated taxes can be found on the IRS website.

Paying investment taxes involves several methods. The most common way is through electronic funds withdrawal (EFW) directly from your bank account when filing your tax return online. This is a convenient and secure option offered by most tax preparation software and the IRS's Free File program. Another option is to pay electronically using the Electronic Federal Tax Payment System (EFTPS), a free service provided by the U.S. Department of the Treasury. EFTPS allows you to schedule payments in advance and track your payment history. For those who prefer traditional methods, you can pay by check or money order, made payable to the U.S. Treasury. When paying by mail, it's crucial to include the correct tax year, your Social Security number, and the relevant tax form or notice number. The IRS website provides specific instructions on where to mail your payment.

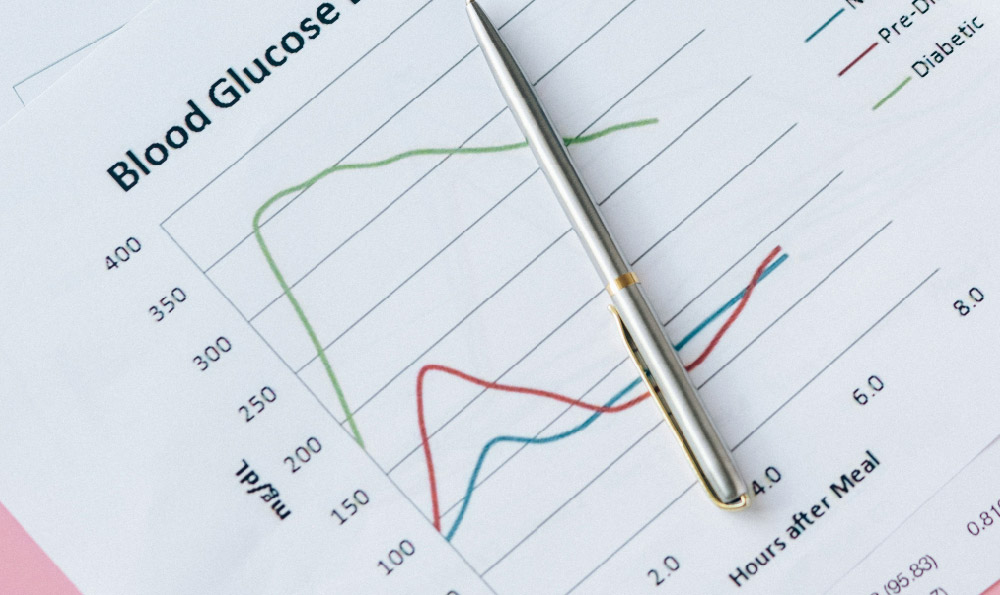

Understanding different types of investment income is essential for accurate tax reporting. Capital gains, which are profits from selling assets like stocks, bonds, or real estate, are taxed differently depending on how long you held the asset. Short-term capital gains (assets held for one year or less) are taxed at your ordinary income tax rate. Long-term capital gains (assets held for more than one year) are generally taxed at lower rates, ranging from 0% to 20%, depending on your income level. Dividends are another common form of investment income. Qualified dividends, which meet certain requirements, are taxed at the same rates as long-term capital gains. Non-qualified dividends, also known as ordinary dividends, are taxed at your ordinary income tax rate. Interest income, earned from savings accounts, bonds, or other fixed-income investments, is generally taxed at your ordinary income tax rate.

Certain tax-advantaged accounts offer ways to reduce or defer investment taxes. Traditional IRA and 401(k) contributions are typically tax-deductible, lowering your taxable income in the year you contribute. However, withdrawals in retirement are taxed as ordinary income. Roth IRA and Roth 401(k) contributions are made with after-tax dollars, but qualified withdrawals in retirement are tax-free. Health Savings Accounts (HSAs) offer a triple tax advantage: contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free. These accounts can be powerful tools for tax-efficient investing and retirement planning.

Accurate record-keeping is crucial for simplifying tax preparation and minimizing errors. Keep detailed records of all investment transactions, including purchase dates, sale dates, cost basis, and proceeds. Brokerage statements, 1099 forms (which report dividends, interest, and capital gains), and receipts for investment-related expenses are essential documents. Consider using tax preparation software or working with a qualified tax professional to ensure accuracy and take advantage of all available deductions and credits. These tools can help you navigate complex tax laws and avoid costly mistakes.

Finally, it's wise to seek professional advice. Tax laws are complex and subject to change. Consulting with a financial advisor or a qualified tax professional can help you develop a tax-efficient investment strategy and navigate the intricacies of investment taxes. They can provide personalized guidance based on your specific financial situation and goals. By staying informed, maintaining accurate records, and seeking professional assistance when needed, you can effectively manage your investment taxes and maximize your financial success.