In an era where digital assets are reshaping financial landscapes, the discourse around generating income through unconventional channels has gained unprecedented momentum. The intersection of collectibles and technology has birthed innovative opportunities, with niche markets like blockchain-based trading cards acting as both a testament to the evolving nature of value and a potential avenue for profit. As investors increasingly seek diversification and creative avenues to build wealth, the concept of leveraging Pokémon cards—whether as physical or digital assets—has sparked interest. However, this pursuit necessitates a nuanced understanding of market dynamics, strategic acumen, and a vigilant approach to risk management.

The allure of Pokémon cards as an investment vehicle lies in their dual identity as both a cultural phenomenon and a tradable asset. In the physical realm, they've long been coveted by collectors, with limited-edition sets and rare cards commanding prices that can defy logic. Yet, the recent integration of blockchain technology has introduced a new dimension, where Digital Pokémon Cards (DPCs) are now minted as Non-Fungible Tokens (NFTs). These NFTs leverage smart contracts for secure ownership transfers and decentralized marketplaces for trading, offering a unique blend of traditional collectible value and digital innovation. This convergence has created a microcosm of financial opportunity, where investors can capitalize on both established trends and emerging technologies.

To navigate this complex terrain effectively, it's crucial to dissect the underlying mechanisms that drive these markets. For physical cards, the value is traditionally determined by factors such as scarcity, demand, and the overall health of the Pokémon trading card ecosystem. Collectors often monitor auction prices, track the release of new sets, and study the historical performance of specific characters to identify potential investment opportunities. In contrast, DPCs introduce a new layer of volatility, as their value is influenced by blockchain-specific metrics like network congestion, token utility, and the dynamics of NFT marketplaces. This duality requires investors to adopt a multifaceted approach, balancing traditional market analysis with an understanding of digital asset pricing trends.

The potential for income generation through Pokémon cards hinges on several strategic considerations. First, the identification of high-potential investments requires a deep dive into market research. For traditional cards, this means analyzing recent sales data, understanding the collector community's preferences, and tracking the release schedules of new sets and promotions. In the digital domain, investors should scrutinize tokenomics—such as the total supply, distribution model, and utility of the DPCs—to gauge their long-term viability. Additionally, staying abreast of technological advancements, including improvements in blockchain efficiency and the integration of new features, can provide a competitive edge.

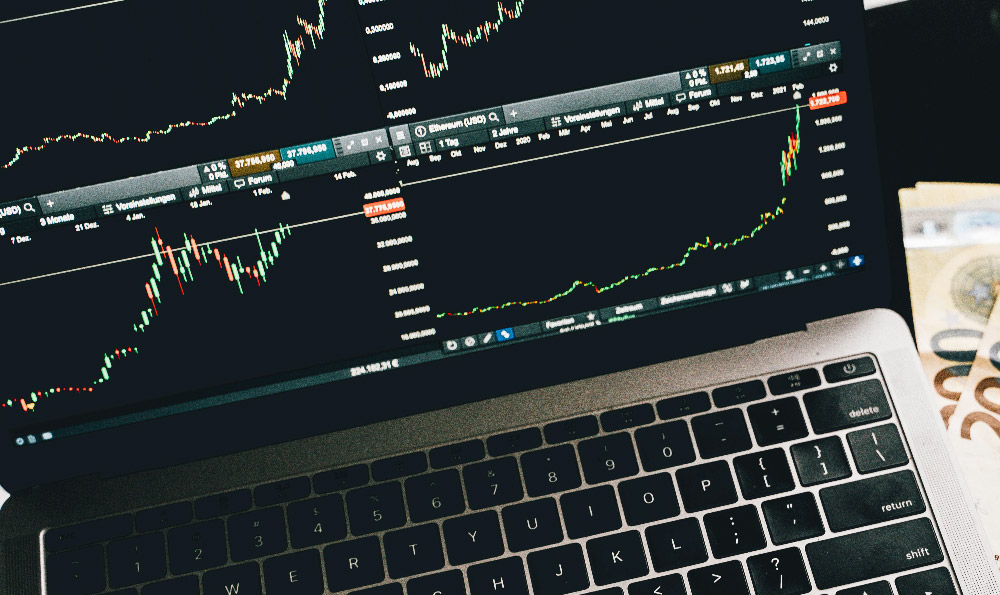

Liquidity plays a pivotal role in any investment strategy, and this is no less true for Pokémon cards. In the physical world, limited liquidity can make valuation challenging, as it may be difficult to find buyers or sellers for specific cards. This is where the emergence of online marketplaces and community-driven platforms can mitigate the risk, offering more accessible avenues for trading. For digital cards, the increased liquidity inherent in NFT marketplaces provides a unique advantage, allowing investors to buy, sell, and trade tokens with relative ease. However, this liquidity often comes with a caveat: the market can be highly speculative, requiring careful monitoring of price trends and market sentiment.

The integration of Pokémon cards with blockchain technology has also introduced novel revenue streams, such as staking or participating in decentralized autonomous organizations (DAOs). These models offer investors the opportunity to earn passive income by contributing to network security or decision-making processes within the card ecosystem. For instance, staking DPCs could reward holders with additional tokens, creating a compound growth effect. Similarly, DAOs might allow participants to vote on community initiatives that could influence the value of their holdings. These opportunities necessitate a thorough understanding of the underlying technology and its implications for wealth generation.

Yet, the pursuit of profit through Pokémon cards is not without its perils. The primary risk is market volatility, which can cause rapid fluctuations in value, often driven by speculation or unexpected events in the Pokémon franchise. For example, the release of a new game or movie can significantly impact demand, leading to unpredictable price changes. In the digital space, the inherent volatility of cryptocurrency markets exacerbates this risk, as token prices can be influenced by a myriad of factors, including regulatory changes, technological advancements, and market sentiment. Therefore, a robust risk management strategy is essential, incorporating techniques such as diversification across different card types or markets, setting stop-loss thresholds, and maintaining a long-term perspective.

The psychological aspects of investing in Pokémon cards also warrant attention. The emotional attachment to cards, particularly those linked to childhood memories or cultural significance, can cloud judgment and lead to irrational decision-making. Investors must cultivate a disciplined approach, relying on data-driven analysis rather than sentiment. Additionally, the potential for scams or fraudulent activities presents another challenge, especially in the digital arena where cybersecurity threats are prevalent. Investors should exercise caution, verifying the authenticity of cards and ensuring they are trading on reputable platforms.

As the Pokémon ecosystem continues to evolve, its potential to generate income offers a compelling narrative of both tradition and innovation. The key to success lies in balanced insights—leveraging the cultural resonance of Pokémon while embracing the analytical rigor of investment strategies. By understanding the digital and traditional mechanics, investors can navigate this complex landscape with confidence, turning their interest in Pokémon into a viable path toward financial growth. However, this journey demands not only knowledge but also vigilance, ensuring that the pursuit of profit remains grounded in prudent risk management and strategic foresight.