Investing in Stocks: Books? Do I Need Them?

The allure of the stock market is undeniable. Fortunes are made (and lost) daily, fueled by the ebb and flow of company performance, global events, and the ever-present specter of investor sentiment. For those new to the game, or even seasoned players looking to refine their strategies, the question arises: are books about stock investing truly necessary? The short answer is a resounding yes, with a significant caveat: choosing the right books is paramount.

The Importance of Foundational Knowledge

Imagine attempting to build a house without understanding blueprints or the properties of different materials. Similarly, venturing into the stock market without a solid understanding of its fundamentals is a recipe for potential disaster. Books provide this crucial foundation. They demystify complex concepts like:

-

Financial Statements: Understanding balance sheets, income statements, and cash flow statements is vital for assessing a company's financial health and potential for growth. Books dissect these reports, explaining key ratios and metrics that reveal hidden strengths and weaknesses.

-

Valuation Techniques: Determining the intrinsic value of a stock is essential for making informed investment decisions. Books introduce various valuation methods, such as discounted cash flow analysis, price-to-earnings ratio analysis, and relative valuation, empowering investors to identify undervalued or overvalued assets.

-

Risk Management: Investing inherently involves risk. Books equip investors with the knowledge to identify, assess, and mitigate these risks. They delve into topics like diversification, asset allocation, and stop-loss orders, helping investors protect their capital and manage potential losses.

-

Market Dynamics: Comprehending how the market operates, including the roles of different participants, the impact of economic indicators, and the influence of psychological factors, is crucial for navigating market volatility and making strategic decisions. Books provide insights into these complex dynamics, helping investors understand the forces that drive market movements.

Selecting the Right Books: A Curation Guide

Not all investing books are created equal. Some offer timeless wisdom, while others are filled with outdated information or biased perspectives. Here's a guide to selecting books that will truly enhance your investment knowledge:

-

Focus on Fundamentals: Prioritize books that emphasize fundamental analysis, valuation techniques, and risk management principles. These concepts are timeless and applicable across various market conditions.

-

Seek Reputable Authors: Look for authors with established expertise in the field of investing, such as renowned investors, financial analysts, or academics. Their experience and insights will provide valuable guidance.

-

Read Reviews and Recommendations: Before purchasing a book, read reviews from other investors and financial professionals. Their feedback can help you assess the book's quality and relevance to your investment goals.

-

Consider Your Experience Level: Choose books that align with your current knowledge and experience. Beginners should start with introductory texts that explain basic concepts, while experienced investors can delve into more advanced topics.

-

Look for Practical Examples and Case Studies: The best investing books illustrate concepts with real-world examples and case studies. These practical applications help you understand how to apply the knowledge in actual investment scenarios.

Beyond the Basics: Exploring Advanced Topics

Once you have a solid grasp of the fundamentals, you can explore more advanced topics to further refine your investment skills. Some areas to consider include:

-

Behavioral Finance: This field explores the psychological factors that influence investor behavior, such as biases, emotions, and cognitive errors. Understanding these biases can help you make more rational investment decisions.

-

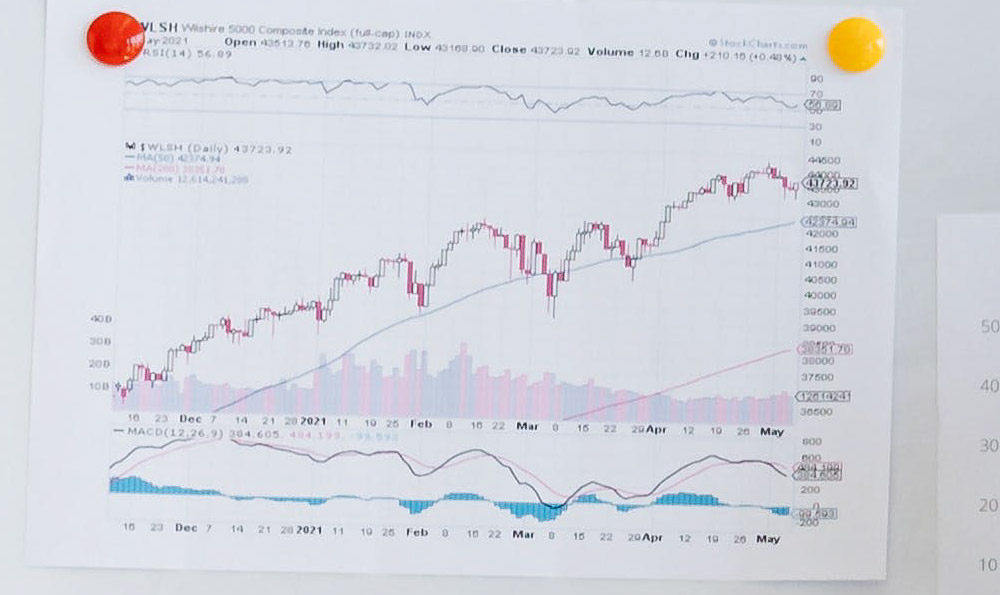

Technical Analysis: This approach involves analyzing price charts and trading patterns to identify potential buying and selling opportunities. While not universally accepted, technical analysis can provide valuable insights into market sentiment and trends.

-

Specific Investment Strategies: Explore different investment strategies, such as value investing, growth investing, dividend investing, and index investing. Choose strategies that align with your risk tolerance and investment goals.

-

Options and Derivatives: Understanding options and other derivatives can provide opportunities for hedging risk and generating income. However, these instruments are complex and require a thorough understanding before use.

The Digital Age: E-books, Audiobooks, and Online Resources

While traditional print books remain a valuable resource, the digital age offers a wealth of alternative learning options. E-books provide convenient access to information on your computer or mobile device, while audiobooks allow you to learn while commuting or exercising. Online resources, such as financial websites, blogs, and forums, can provide up-to-date news, analysis, and insights.

However, be discerning when using online resources. Not all information is accurate or unbiased. Stick to reputable sources and critically evaluate the information you encounter.

Continuous Learning: A Lifelong Journey

Investing is a lifelong journey of continuous learning and adaptation. The market is constantly evolving, and new challenges and opportunities arise. By committing to ongoing education through books, articles, seminars, and other resources, you can stay ahead of the curve and improve your investment outcomes. Don't be afraid to revisit fundamental concepts and explore new strategies as your experience grows. Remember, the more you learn, the better equipped you'll be to navigate the complexities of the stock market and achieve your financial goals. Therefore, investing in books is an investment in yourself and your financial future.