Navigating the intricate world of cryptocurrency investments demands a balanced perspective, combining rigorous analysis with strategic foresight. The allure of digital assets has transformed financial landscapes, offering opportunities that require careful navigation rather than reckless pursuit. As the market oscillates between periods of innovation and volatility, understanding the dynamics that shape its trajectory is essential for anyone seeking to profit from blockchain technology while safeguarding their capital. This guide explores the nuances of cryptocurrency investment through a framework that prioritizes knowledge acquisition, risk mitigation, and long-term growth, ensuring investors are equipped to make informed decisions that align with both their financial goals and ethical standards.

The cryptocurrency market is inherently influenced by a tapestry of factors, from macroeconomic trends to technological advancements. Governments and regulatory bodies play a pivotal role in shaping the environment, as policies ranging from taxation to licensing can drastically alter market sentiment. Simultaneously, advancements in blockchain technology and the emergence of new protocols can create opportunities for innovation-driven returns. However, these elements are often intertwined with speculative fervor, making it imperative to distinguish between sound investment practices and the pitfalls of short-term market manipulation. The cyclical nature of bull and bear markets further underscores the need for a long-term view, as short-term volatility can obscure the underlying value of digital assets.

A cornerstone of effective cryptocurrency investment is the ability to interpret technical indicators with precision. Charts and graphs serve as visual representations of market behavior, revealing patterns that can hint at potential price movements. Price action, for instance, often indicates the market's collective psychology, with bullish trends emerging during periods of increased demand and bearish corrections following overbought conditions. Tools such as moving averages help to smooth out short-term fluctuations, enabling investors to identify long-term trends with greater clarity. However, the reliance on technical analysis alone can be misleading, as fundamental factors such as project development, adoption rates, and regulatory clarity often dictate an asset's intrinsic value. Integrating both approaches creates a more holistic understanding of the market, allowing for decisions that consider both immediate trends and long-term potential.

Risk management in cryptocurrency investing is not merely a recommendation—it is a necessity. The decentralized nature of digital assets means that traditional safeguards such as FDIC insurance are absent, amplifying the importance of proactive strategies. A diversified portfolio is one of the most effective tools, as it spreads risk across multiple assets, sectors, and market conditions. This approach mitigates the impact of a single asset's volatility, ensuring that unexpected market shifts do not derail an investor's overall strategy. Additionally, setting clear stop-loss orders provides a mechanism to protect capital during sudden downturns, while maintaining a portion of liquid assets ensures flexibility to capitalize on emerging opportunities.

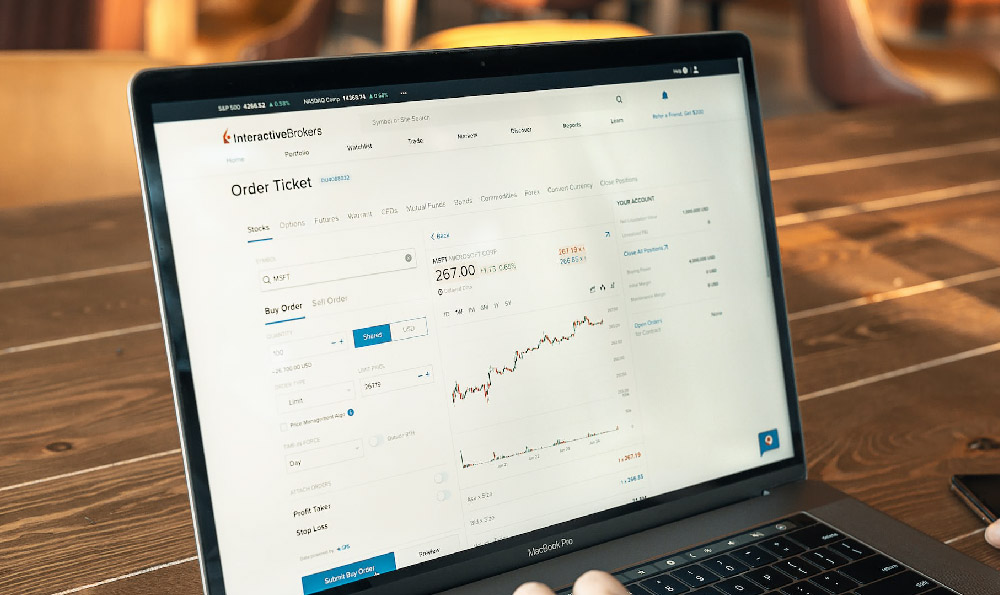

The proliferation of cryptocurrency has also brought an array of investment opportunities, but it is accompanied by significant challenges. The emergence of decentralized finance (DeFi) protocols and non-fungible tokens (NFTs) has expanded the investment landscape, offering novel avenues for profit. However, these innovations often come with heightened risks, from smart contract vulnerabilities to market saturation. Investors must exercise due diligence, examining the underlying technology, team credibility, and community support before committing capital. Furthermore, the rapid pace of innovation means that staying informed about industry developments is crucial, as outdated strategies can quickly become obsolete in a dynamic market.

For those new to cryptocurrency investing, the journey requires patience and a commitment to continuous learning. Market trends are often shaped by cycles of hype and correction, and recognizing these patterns can help investors avoid common pitfalls. Rushing into investments without thorough research is a recipe for disaster, as the market is rife with scams and misleading information. Establishing a reliable information source, such as reputable financial news outlets and industry whitepapers, ensures that investors have access to accurate insights. Moreover, the ability to discern between legitimate projects and fraudulent schemes is a skill that develops over time, requiring an understanding of blockchain fundamentals and market behavior.

In an age where financial technology is evolving at a rapid pace, the future of cryptocurrency investing holds promise but demands caution. Emerging trends such as cross-chain interoperability and the integration of artificial intelligence into blockchain systems are set to redefine the industry. However, the path to long-term growth is fraught with challenges, from regulatory uncertainty to technological risks. Investors who remain adaptable and continually refine their strategies will be best positioned to navigate these complexities. Ultimately, the key to successful cryptocurrency investing lies not in chasing quick profits, but in cultivating a deep understanding of the market, its risks, and its potential, ensuring that every decision is a step toward financial stability and growth.