Investment management is the professional asset management of funds, securities, real estate, and other investments to meet specified investment goals for investors. These investors can be individuals, families, or institutions like pension funds, corporations, or governments. The overarching goal of investment management is to grow wealth over time while managing risk. It's a comprehensive process that encompasses several key activities, including investment strategy development, asset allocation, security selection, portfolio monitoring, and performance measurement.

Think of it as having a dedicated team or individual who understands your financial situation, risk tolerance, time horizon, and specific goals. They then use this information to construct and manage a portfolio tailored to your unique needs. This isn't just about picking a few stocks and hoping for the best. It's a much more strategic and data-driven approach.

The process typically begins with a thorough assessment of your financial circumstances. This involves understanding your income, expenses, assets, and liabilities. Crucially, it also dives deep into your investment objectives. Are you saving for retirement, a down payment on a house, your children's education, or something else entirely? How long do you have to achieve these goals? And how much risk are you willing to take to get there?

Based on this information, the investment manager will develop an investment strategy. This strategy outlines the types of assets that will be included in the portfolio, such as stocks, bonds, real estate, and alternative investments. It also specifies the target allocation for each asset class. For example, a younger investor with a long time horizon might have a higher allocation to stocks, which offer the potential for higher returns but also carry more risk. Conversely, an older investor approaching retirement might have a larger allocation to bonds, which are generally less volatile and provide a more stable income stream.

Once the investment strategy is in place, the investment manager will select specific securities to include in the portfolio. This involves conducting in-depth research and analysis to identify undervalued or promising investment opportunities. They might analyze financial statements, economic trends, and industry dynamics to make informed decisions.

Portfolio monitoring is an ongoing process. The investment manager regularly reviews the portfolio's performance, rebalances the asset allocation as needed, and makes adjustments to the security selection based on market conditions and changes in your financial circumstances. This ensures that the portfolio remains aligned with your investment goals and risk tolerance.

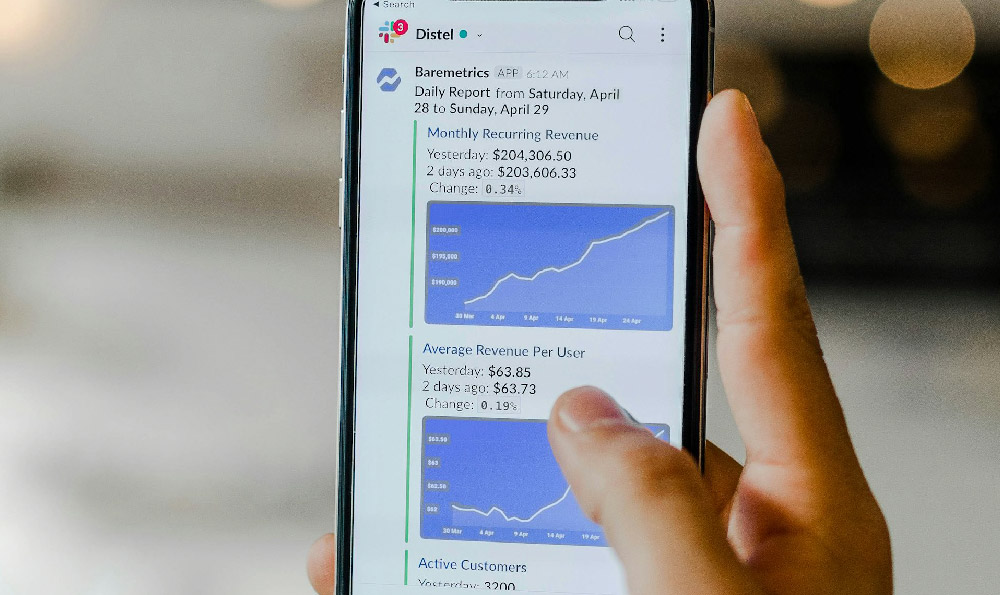

Performance measurement is also critical. The investment manager will track the portfolio's returns and compare them to relevant benchmarks. This helps to assess the effectiveness of the investment strategy and identify areas for improvement. Transparency and clear communication are key components of effective investment management. You should receive regular reports on your portfolio's performance and have the opportunity to discuss your investment strategy with your manager.

So, is investment management right for you? That depends on a number of factors.

One of the primary benefits of investment management is expertise. Professional investment managers have the knowledge, experience, and resources to navigate the complex world of investing. They can identify investment opportunities, manage risk, and make informed decisions that you might not be able to do on your own. Another advantage is time savings. Managing investments can be time-consuming, especially if you want to do it properly. Hiring a professional investment manager frees up your time to focus on other priorities. Furthermore, investment managers can provide discipline. They can help you stick to your investment strategy, even when markets are volatile. This can be especially important for investors who are prone to emotional decision-making. Access to a wider range of investment options is also a plus. Investment managers often have access to investment opportunities that are not available to individual investors. This can include private equity, hedge funds, and other alternative investments.

However, there are also potential drawbacks to consider. The most obvious is cost. Investment managers typically charge fees for their services, which can eat into your returns. These fees can vary depending on the manager, the size of your portfolio, and the complexity of the investment strategy.

You also relinquish some control. When you hire an investment manager, you are essentially giving them the authority to make investment decisions on your behalf. It's essential to choose a manager you trust and who understands your investment goals. The performance of investment managers is not guaranteed. Even the best managers can experience periods of underperformance. It's important to have realistic expectations and understand that there is always some risk involved in investing.

To determine if investment management is right for you, consider the following questions:

- Do you have the time, knowledge, and inclination to manage your investments on your own? If not, investment management may be a good option.

- Are you comfortable paying fees for professional investment management services? If not, you may want to consider alternative investment strategies, such as using a robo-advisor or investing in index funds.

- Are you willing to relinquish some control over your investment decisions? If not, you may want to maintain more direct control over your investments.

- What are your investment goals and risk tolerance? These factors will help you determine the type of investment manager that is right for you.

Ultimately, the decision of whether or not to hire an investment manager is a personal one. There's no universal answer. Carefully weigh the pros and cons before making a decision. Consider your own financial situation, investment goals, and risk tolerance. If you decide to hire an investment manager, do your research and choose someone you trust. Look for a manager with a strong track record, a clear investment philosophy, and a commitment to transparency. Talk to multiple managers before making a decision, and don't be afraid to ask questions. Choosing the right investment management strategy can significantly contribute to your financial well-being and help you achieve your long-term goals. Remember, informed decision-making is key to successful investing.