Summer is a season often associated with relaxation, travel, and a break from the usual hustle. However, for those who are strategic with their time and resources, it can also be an opportune moment to explore opportunities in the world of virtual currency investment. The market dynamics of crypto can shift with the seasons, influenced by global economic trends, regulatory developments, and even social sentiment. By understanding these nuances and adapting tactics accordingly, investors can position themselves to capitalize on the summer months without compromising their financial security.

One of the most reliable approaches during this period is to focus on fundamentals. While market volatility is inevitable, certain projects may experience heightened activity or interest in the summer due to factors like increased media coverage, new partnerships, or updates that resonate with a broader audience. Pay close attention to the development of protocols that show consistent innovation, strong community engagement, and clear roadmaps. These assets often appreciate in value when institutional adoption rises, a trend that frequently gains momentum during warmer months. Assessing the underlying technology and real-world applications of a project can help identify undervalued opportunities that may be overlooked during periods of market uncertainty.

Technical analysis techniques are another critical component. Summer often sees a concentration of trading activity in specific sectors, such as DeFi or NFTs, which can create unique patterns on price charts. Students of the market should look for trending assets with bullish momentum, using indicators like moving averages and RSI to pinpoint potential entry points. However, it's vital to recognize that summer markets can also experience sharp corrections, particularly if there are macroeconomic shifts or regulatory announcements. Establishing dynamic stop-loss mechanisms, such as trailing stops or percentage-based limits, ensures that gains are protected even if prices experience short-term volatility.

Time allocation is a key differentiator between those who profit and those who lose. While the temptation to constantly monitor markets exists, research suggests that a strategic detachment can yield better long-term outcomes. Use the summer as a period for deep analysis of projects that align with your risk tolerance and financial goals. This includes studying whitepapers, evaluating team credibility, and assessing the environmental impact of blockchain protocols. Sustainable and energy-efficient projects are likely to gain favor as investors become more conscious of ESG (Environmental, Social, and Governance) factors in the coming years. Additionally, setting aside regular time for fundamental research allows for informed decision-making rather than impulsive trades.

Seasonal patterns often create windows of opportunity that are overlooked by many. For example, the end of the fiscal year can lead to increased institutional activity as companies seek to optimize their portfolios. Avoidance of common pitfalls such as "FOMO" (Fear of Missing Out) is essential during this time. Instead of chasing short-term gains, focus on building a diversified portfolio that balances high-risk and low-risk assets. A spread across different sectors, including long-term holdings in established projects and shorter-term positions in emerging protocols, can mitigate the impact of any single asset's performance.

The summer months also offer a unique chance to explore innovative investment vehicles. Projects with native governance systems or decentralized autonomous organizations (DAOs) often experience increased participation during this time. Engaging with these communities through social media or forums can provide early insights into potential developments. Additionally, the use of automated trading strategies that incorporate seasonal data can enhance returns. These systems can adjust parameters based on historical performance during specific times of the year, reducing the need for constant manual oversight.

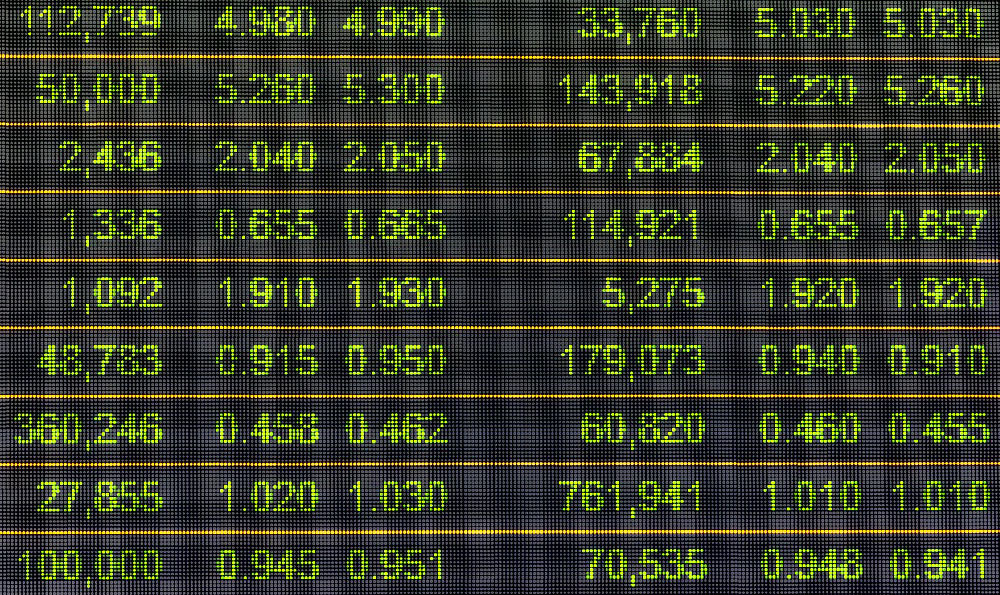

A balanced approach is crucial for long-term success. While the allure of quick profits may be tempting, sustainable growth often comes from disciplined strategies. Investors should allocate between 50-70% of their portfolio to long-term holdings and reserve the remaining for short-term trading. This balance allows for capitalizing on seasonal trends without exposing oneself to excessive risk. Moreover, maintaining a percentage of cash reserves ensures flexibility to seize new opportunities as they arise.

The summer months also present a unique opportunity for investors to seek out projects that are aligned with upcoming events. For example, the launch of new features, upgrades, or audited contracts can create short-term price surges that are worth monitoring. Education is key to understanding the implications of such developments, and staying informed about market updates can help identify unexplored niches that may benefit from early investment. This includes understanding the importance of liquidity, network effects, and market capitalization in assessing a project's long-term viability.

Finally, the summer should be used as a period for reflection and strategy refinement. Reviewing past trades and analyzing their outcomes can provide valuable lessons for the future. Adjusting position sizes based on historical performance in the summer months allows for better risk management. For example, reducing exposure in volatile assets that have shown significant fluctuations during previous summers can protect gains. This reflective approach not only improves decision-making but also ensures that the summer is not just a time for profit, but for building a more resilient and adaptive investment framework.

In conclusion, the summer months present a unique blend of challenges and opportunities in the world of virtual currency investment. By leveraging seasonal trends, focusing on fundamentals, and refining technical strategies, investors can position themselves to reap financial rewards. However, it's equally important to remain loyal to the core principles of risk management, ensuring that the pursuit of easy money does not come at the expense of long-term stability. With careful planning, this season can become an invaluable part of your investment journey.