Investing in stocks online has become increasingly accessible and appealing, offering individuals the potential for significant financial growth. However, navigating the world of online stock investing requires careful consideration, strategic planning, and a thorough understanding of the market. Before diving into the "where" and "why," it's crucial to acknowledge the inherent risks associated with stock market investing. The value of investments can fluctuate, and there's always a possibility of losing money. Therefore, this should not be considered definitive financial advice. Always do your own due diligence and consult with a financial professional before making investment decisions.

The "where" of online stock investing essentially boils down to choosing the right brokerage platform. Several factors come into play when making this decision. First, consider the commission structure. Many online brokers now offer commission-free trading, which can significantly reduce costs, especially for frequent traders or those investing smaller amounts. However, some brokers may charge fees for other services, such as account maintenance or transferring assets. It's essential to compare the overall cost structure of different brokers to find the most suitable option for your investment style and frequency.

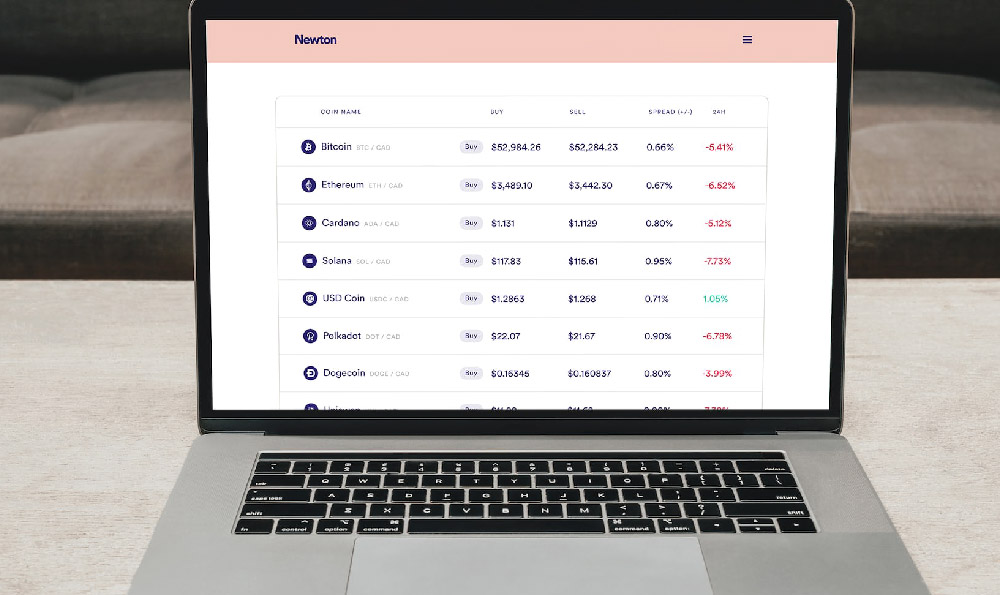

Beyond commissions, consider the platform's features and tools. Does it offer advanced charting capabilities, real-time market data, and research reports? Does it provide educational resources for beginners? A user-friendly interface is also crucial, especially for those new to online investing. You should be able to easily navigate the platform, place trades, and access your account information. Some popular online brokerage platforms include established players like Fidelity, Charles Schwab, and Vanguard, as well as newer, mobile-first platforms like Robinhood and Webull. Each platform has its own strengths and weaknesses, so it's important to research and compare them before making a decision. Consider your needs and choose the brokerage platform that best aligns with your investment goals and experience level.

Another critical aspect of "where" is the type of account you choose. Options range from taxable brokerage accounts to retirement accounts such as traditional IRAs, Roth IRAs, and 401(k)s. The optimal choice depends heavily on your individual circumstances, financial goals, and tax situation. If you're saving for retirement, utilizing tax-advantaged retirement accounts can provide significant benefits in the long run. A Roth IRA, for example, allows your investments to grow tax-free and withdrawals during retirement are also tax-free. Traditional IRAs offer tax-deductible contributions, potentially reducing your current tax burden. On the other hand, if you're investing for shorter-term goals or simply want more flexibility, a taxable brokerage account may be a better option. Keep in mind that investment gains in taxable accounts are subject to capital gains taxes.

Moving on to the "why" of online stock investing, the primary motivation is usually to grow your wealth over time. Stocks have historically provided higher returns than other asset classes, such as bonds or savings accounts, although they also come with greater volatility. Investing in stocks allows you to participate in the growth of companies and potentially benefit from their success. Over the long term, a diversified portfolio of stocks can help you achieve your financial goals, such as retirement savings, buying a home, or funding your children's education.

However, successful stock investing requires more than just picking a few stocks at random. It's crucial to develop a well-defined investment strategy based on your risk tolerance, time horizon, and financial goals. Are you a conservative investor who prefers a low-risk approach, or are you willing to take on more risk for the potential of higher returns? Are you investing for the long term, or do you have shorter-term goals? Your answers to these questions will help you determine the appropriate asset allocation for your portfolio. A diversified portfolio, consisting of stocks, bonds, and other asset classes, can help reduce risk and improve long-term returns.

Before investing in any stock, it's essential to do your research and understand the company's business model, financial performance, and competitive landscape. Analyze the company's revenue growth, profitability, debt levels, and management team. Read analyst reports and stay informed about industry trends. Investing in companies you understand and believe in can increase your chances of success.

It is important to avoid common investment pitfalls. One such pitfall is emotional investing. Fear and greed can lead to poor investment decisions, such as buying high and selling low. Avoid making impulsive decisions based on short-term market fluctuations. Stick to your long-term investment strategy and resist the temptation to chase quick profits. Another pitfall is putting all your eggs in one basket. Diversifying your portfolio across different stocks, sectors, and asset classes can help reduce risk. Don't invest more than you can afford to lose.

Finally, remember that online stock investing is a marathon, not a sprint. It takes time, patience, and discipline to achieve long-term financial success. Stay informed, continue to learn, and adjust your strategy as needed. Monitor your portfolio regularly and rebalance it periodically to maintain your desired asset allocation. By following these guidelines, you can increase your chances of achieving your financial goals through online stock investing. Remember to consult with a qualified financial advisor for personalized advice tailored to your specific circumstances.