Making good money from home through online opportunities has become increasingly viable in the digital age, offering a blend of flexibility and profitability that caters to a wide range of skills and interests. The key to success lies not only in identifying lucrative avenues but also in understanding the underlying principles of risk management, market trends, and personal capability. As technology continues to reshape traditional work models, individuals can now leverage internet-based platforms to generate income without the constraints of a physical workplace. However, the journey requires more than just enthusiasm—it demands a strategic approach informed by financial knowledge and a realistic assessment of one’s strengths.

One of the most accessible paths is freelancing, which allows people to monetize their expertise in fields such as writing, graphic design, programming, or digital marketing. Platforms like Upwork, Fiverr, or Guru serve as virtual marketplaces where clients from around the globe seek specialized skills. Success in this area often hinges on niche selection and consistent delivery of high-quality work. For instance, a graphic designer may focus on branding for small businesses, leveraging the growing trend of remote entrepreneurship to build a client base. However, the competitive nature of these markets necessitates a strong portfolio, active engagement with clients, and the ability to adapt to evolving project demands. While freelancing offers control over work hours and rates, it also requires an ongoing commitment to skill development and maintaining a professional online presence.

For those with a creative flair, online content creation provides an avenue to monetize their passions. Video creators on YouTube can earn through ad revenue, sponsorships, or affiliate marketing, while bloggers may generate income via SEO-friendly content and brand partnerships. The rise of social media algorithms and the demand for engaging material have made this sector highly dynamic. A consistent upload schedule, strong storytelling, and audience interaction are crucial for building a sustainable income stream. Yet, the profitability of this route depends heavily on audience size and content quality. Patience and persistence are essential, as viral success is unpredictable and requires a long-term investment in content curation and platform optimization.

The gig economy has also expanded into areas like online tutoring and virtual assistance, where individuals can earn by offering services such as language instruction, administrative support, or technical troubleshooting. These opportunities often align with the increasing reliance on remote work and digital communication. For example, a teacher may use platforms like Chegg or VIPKid to connect with students worldwide, while a virtual assistant might handle tasks for small businesses through Upwork. The scalability of these roles is a significant advantage, but their profitability depends on specialization, reliability, and the ability to meet client expectations. It is important to recognize that these jobs may involve irregular income and the need to constantly seek new clients or projects.

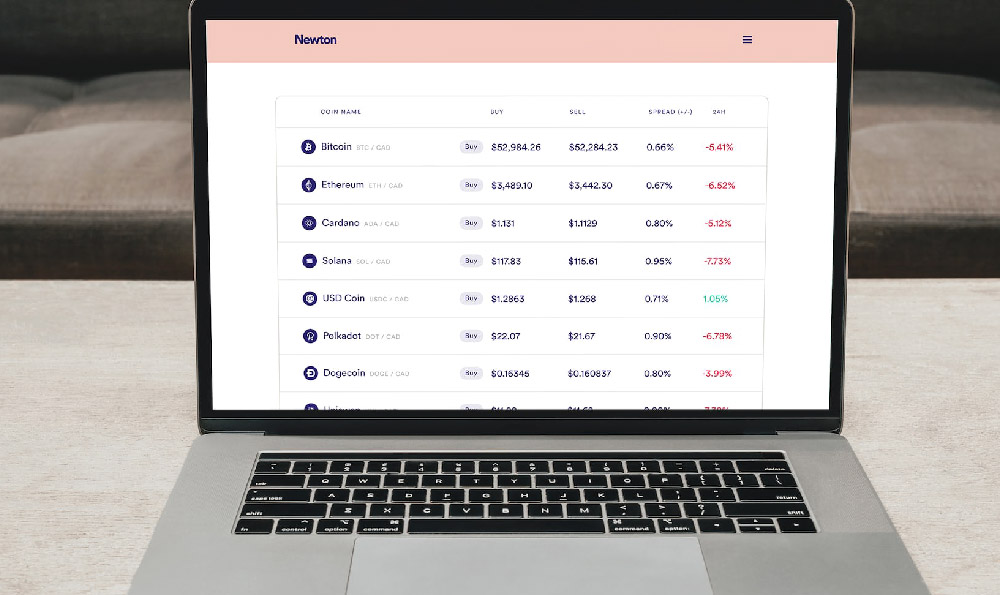

Investing in online opportunities such as stock trading, cryptocurrency, or affiliate marketing can also yield substantial returns, though these paths require a deeper understanding of financial markets and risk tolerance. Online stock brokers like Robinhood or E*TRADE provide access to global markets with minimal fees, enabling individuals to diversify their investments and potentially benefit from market appreciation. Similarly, cryptocurrency investments, though volatile, have attracted significant interest due to their decentralized nature and potential for high growth. However, these opportunities carry inherent risks, including market fluctuations, regulatory uncertainties, and cybersecurity threats. Diversification, continuous education on market fundamentals, and disciplined risk management are critical to navigating these volatile landscapes effectively.

The rise of e-commerce has further democratized online income generation, allowing individuals to sell products or services through platforms like Etsy, Amazon, or Shopify. Dropshipping, for instance, enables entrepreneurs to operate without managing inventory, leveraging the demand for customizable goods. However, the success of such ventures depends on product research, marketing acumen, and customer service excellence. While e-commerce offers the potential for passive income, it requires significant initial effort and strategic planning to build a profitable business. Additionally, the competition in this space is fierce, necessitating a unique value proposition and effective branding.

Ultimately, the most sustainable online income strategies often combine multiple approaches, such as monetizing skills through freelancing while investing in financial markets or e-commerce. This diversified model mitigates risk and leverages compounding growth across different sectors. However, it is imperative to approach these opportunities with a clear financial plan, setting realistic goals and prioritizing long-term wealth building over short-term gains. The digital landscape is constantly evolving, and staying adaptable, informed, and disciplined will be the cornerstone of achieving financial success from home. While the prospect of earning money online can be enticing, it is crucial to recognize that no method is foolproof, and mastery requires time, effort, and a willingness to learn from both failures and successes. By aligning online opportunities with personal strengths and financial objectives, individuals can unlock new avenues for income generation and build a resilient financial foundation.