In the expansive universe of BitLife, where every decision can shape the trajectory of your virtual existence, achieving financial success requires more than luck—it demands a calculated approach rooted in both strategic foresight and adaptability. The game’s sandbox environment mirrors the complexities of real-world investment, offering players the opportunity to experiment with diverse financial systems, from stock markets to cryptocurrency trading, while navigating the ever-evolving landscape of economic trends and personal goals. Whether you’re aiming to amass wealth through entrepreneurship, real estate, or digital assets, understanding the mechanics of BitLife’s economy and leveraging its unique features is essential to maximizing returns. Here’s a deeper exploration of how to strategically position yourself for financial growth within the game, while avoiding pitfalls that could derail your progress.

BitLife’s economy operates on principles that are surprisingly reflective of real-world dynamics. The game simulates global economic cycles, industry fluctuations, and the impact of personal choices on wealth accumulation, providing a realistic framework for players to explore. To thrive in this system, it’s crucial to recognize that wealth is not a static goal but a process influenced by timing, risk management, and long-term planning. For instance, the game’s stock market behaves like its real-world counterpart, with prices fluctuating based on company performance, geopolitical events, and macroeconomic indicators. Understanding these patterns allows players to make informed decisions, such as buying undervalued stocks during market downturns or selling high during periods of growth. However, the key to success lies not just in identifying opportunities but in maintaining a balanced portfolio that mitigates risk.

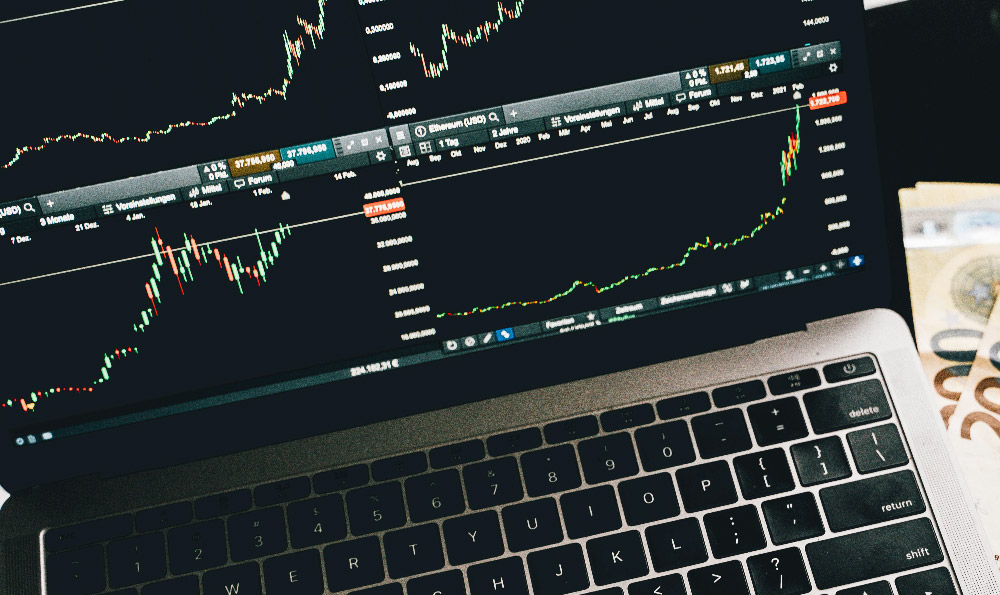

One of the most effective strategies for amassing wealth in BitLife is to diversify your investments across different sectors and asset classes. The game offers a wide range of options, including tech, real estate, commodities, and cryptocurrency, each with its own volatility and growth potential. For example, investing in tech startups during early stages may yield exponential returns, but it also carries higher risk compared to stable industries like utilities or healthcare. Diversification helps spread risk, ensuring that even if one sector suffers, others may compensate. Moreover, the game’s cryptocurrency market, though stylized, presents opportunities to explore the potential of emerging technologies and decentralized finance. Players can experiment with buying and selling cryptocurrencies during market swings, but it’s important to monitor trends and avoid speculative bets without a clear strategy.

Another critical factor in achieving financial success is the ability to recognize and adapt to market cycles. BitLife allows players to experience both bull and bear markets, where prices rise and fall based on virtual economic conditions. During periods of economic expansion, real estate investments or dividend-paying stocks tend to perform well, while in contractions, defensive assets like bonds or cash reserves may be more prudent. Understanding these phases enables players to time their entries and exits more effectively. For instance, purchasing assets at the bottom of a downturn can provide significant leverage when markets rebound, while selling during peak times locks in profits. This concept is particularly relevant in the game’s cryptocurrency market, where price cycles can be extreme and unpredictable. By studying historical data and market signals, players can anticipate trends and adjust their strategies accordingly.

However, the path to wealth in BitLife is not without its challenges. One of the most common pitfalls is over-reliance on high-risk ventures, such as speculative stocks or unproven cryptocurrencies, without adequate research or diversification. Players who neglect to balance their portfolios may face substantial losses when markets shift abruptly. For example, a sudden crash in a cryptocurrency could wipe out years of gains if not offset by other investments. Similarly, investing heavily in a single industry without considering potential downturns can leave players vulnerable to financial instability. To avoid these traps, it’s essential to adopt a disciplined approach, such as setting clear investment goals, maintaining emergency funds, and regularly reviewing portfolio performance.

Beyond market dynamics, personal development plays a pivotal role in maximizing financial success in BitLife. The game allows players to allocate time and effort to building skills, networking, and acquiring knowledge, which can significantly influence career choices and financial opportunities. For instance, investing in education or mentorship early in the game can unlock lucrative career paths, such as becoming a successful entrepreneur or a high-earning investor. Additionally, participating in community-driven events or collaborations can generate unexpected income streams, such as side hustles or business partnerships. These elements highlight the importance of long-term vision—wealth in BitLife is not merely about short-term gains but about cultivating a sustainable foundation for future growth.

Moreover, the game’s financial systems are designed to reward players who think strategically about resource allocation and time management. For example, players who prioritize saving and investing over reckless spending are more likely to accumulate wealth over time. The ability to balance immediate needs with long-term objectives is a key differentiator between those who succeed and those who struggle. Consider the game’s real estate market: buying property early in the game and holding it during periods of rising demand can yield substantial returns, but it requires careful planning and patience. Similarly, cryptocurrency trading involves buying low and selling high, a strategy that demands discipline and the ability to withstand short-term volatility.

In addition to financial strategies, leveraging technology and innovation is crucial in BitLife. The game’s economy is driven by the development of new technologies and industry advancements, which can create opportunities for players to capitalize on emerging trends. For example, investing in AI or blockchain startups during their growth phases can lead to exponential returns, while overlooking these trends may result in missed opportunities. However, staying ahead of these innovations requires continuous learning and adaptability. Players who invest in education or networking early in the game are better equipped to identify and pursue high-growth opportunities as they arise.

Ultimately, achieving financial success in BitLife is a multifaceted endeavor that requires a combination of strategic thinking, risk management, and long-term planning. The game’s sandbox environment provides a unique opportunity to experiment with different financial systems and approaches, allowing players to refine their strategies in a risk-free setting. By understanding the dynamics of the game’s economy, diversifying investments, and prioritizing personal development, players can position themselves for sustained growth and long-term wealth. However, it’s essential to remain cautious, avoid impulsive decisions, and learn from both successes and failures. The right approach not only maximizes returns but also builds a resilient financial foundation that can withstand the ups and downs of the virtual world.

In conclusion, BitLife offers an innovative platform for players to explore the intricacies of financial systems and investment strategies. By adopting a diverse approach, recognizing market cycles, and prioritizing long-term growth, players can navigate this complex environment with confidence and achieve their financial goals. The game’s unique blend of simulation and strategy makes it a valuable tool for understanding real-world economics, and those who approach it with discipline, knowledge, and adaptability are likely to reap the greatest rewards. Whether you’re a seasoned investor or a novice, the lessons learned in BitLife can translate into actionable strategies that enhance both virtual and real-world financial outcomes.