The concept of generating income without traditional employment has evolved dramatically in the digital era, offering diverse opportunities for individuals who seek financial independence through online strategies. While the idea may seem tempting, it's crucial to recognize that passive income is not a magic solution but rather a combination of skill, patience, and strategic planning. Unlike conventional work, these methods often require an initial investment of time or capital followed by relatively low maintenance, but they are not without risks. The key lies in understanding the nuances of each approach, aligning them with personal strengths and financial goals, and leveraging technology to create sustainable streams of revenue.

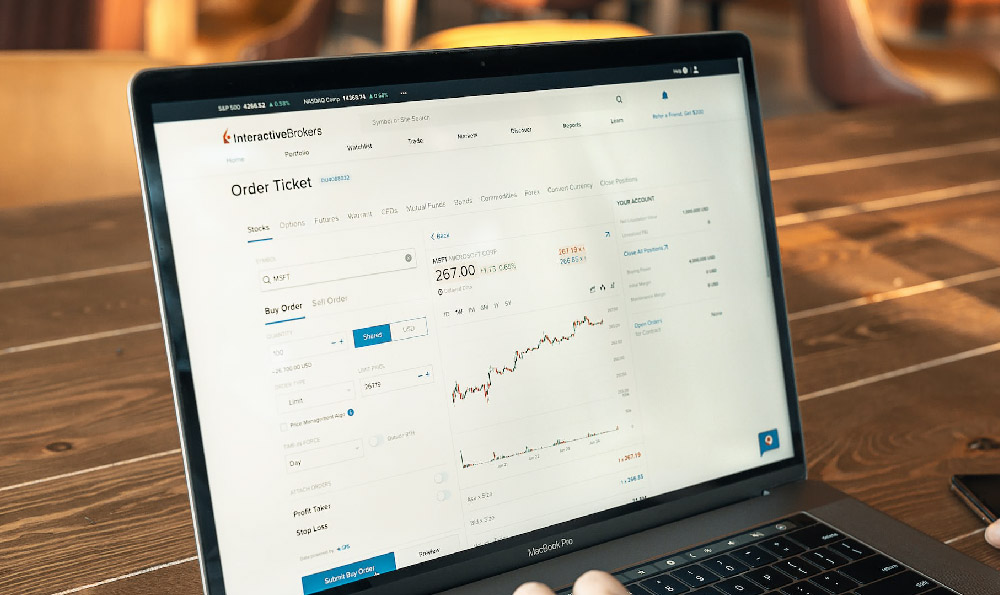

One of the most viable avenues for online passive income is capitalizing on digital markets through investments. Platforms like stock exchanges, cryptocurrency wallets, and real estate investment trusts (REITs) allow individuals to fund assets that generate returns. For instance, investing in dividend-paying stocks requires research into companies with stable earnings and a history of rewarding shareholders. Similarly, cryptocurrency trading involves navigating volatile markets, which demands a thorough understanding of blockchain technology and market trends. However, these investments carry varying levels of risk, with stocks typically offering more stability and REITs providing regular income through dividends. Long-term investment strategies, such as dollar-cost averaging, can mitigate risks by spreading out capital over time. It's also important to consider the cost of entry and the potential for compound growth, as these factors significantly impact the overall returns.

Another pathway involves monetizing digital skills and content. Platforms like YouTube, Medium, and Substack enable creators to profit through advertising, sponsorships, or subscriptions. For example, a YouTube channel with consistent viewership can generate income via ad revenue, affiliate marketing, or brand partnerships. However, success in this arena requires not only the creation of valuable content but also time to build an audience and navigate algorithm changes. Content marketing strategies, such as SEO optimization and audience engagement, play a critical role in sustaining income. Alternatively, creating and selling digital products like e-books, online courses, or templates can provide recurring revenue. This approach involves upfront effort to develop the product and digital marketing to drive sales, but the benefits can be long-lasting if the product offers unique value to its target market.

Automated online businesses represent a third category, where technology reduces the need for daily involvement. Dropshipping, for instance, allows individuals to operate an online store with minimal inventory costs, relying on suppliers to handle shipping and fulfillment. The appeal of this model lies in its low startup barriers, but it requires careful selection of niche products and effective marketing to ensure profitability. Similarly, online survey platforms and virtual assistant services provide opportunities to earn income by completing tasks or offering administrative support remotely. These options typically require less upfront capital but are limited in earning potential due to their reliance on manual work. A more scalable automation model involves developing a product or service that can be sold repeatedly with minimal customization, such as software as a service (SaaS) products or printable art. However, building such a system requires technical expertise and a deep understanding of user needs.

The digital marketplace also presents opportunities for affiliate marketing, where individuals earn commissions by promoting other people's products. This approach involves identifying high-converting products, creating content that highlights their benefits, and driving traffic to affiliate links. While it can be lucrative, it demands a strategic mindset to avoid oversaturation and ensure long-term relevance. Additionally, freelancing platforms like Upwork or Fiverr enable individuals to sell their expertise in areas like writing, design, or programming. While this isn't entirely passive, the ability to create a portfolio of work and maintain ongoing projects provides a level of income stability. The challenge here is maintaining a steady flow of clients and optimizing service offerings to remain competitive.

Monetizing online platforms through ads and data-driven strategies is another dimension of passive income. For example, owning a website or social media account with a large following can generate income through targeted advertisements, which requires maintaining audience engagement and ensuring content quality. However, ad revenue is often unpredictable, relying heavily on platform policies and audience behavior. Similarly, data monetization involves using personal data or analytics tools to create value, though ethical considerations and legal compliance are paramount in this area. The effectiveness of these methods depends on the volume of traffic and the ability to convert visitors into paying customers.

Lastly, emerging opportunities such as participation in crowdsourced funding platforms, monetizing digital assets, and leveraging smart contracts in blockchain ecosystems are gaining traction. For example, investing in crowdfunding projects allows individuals to support innovative ventures in exchange for equity or future profits, though the success of these projects is not guaranteed. Digital assets, such as NFTs or virtual real estate, offer new avenues for monetization, but their value is heavily dependent on market trends and buyer interest. Smart contracts, which automate agreements on blockchain, can reduce the need for intermediaries but require technical proficiency and a clear understanding of cryptocurrency ecosystems.

The effectiveness of these strategies varies significantly based on individual skills, resources, and market conditions. While some approaches require initial capital, others can be started with minimal financial investment. The most successful models often involve a combination of effort and strategic planning, where individuals gradually transition from active work to passive income by building systems and leveraging their expertise. It's essential to conduct thorough research, assess risk tolerance, and maintain patience, as these methods may take time to yield substantial results. Moreover, the digital landscape is constantly evolving, requiring individuals to adapt and stay informed about new opportunities and market shifts. By aligning online strategies with personal goals and continuously optimizing approaches, individuals can create sustainable income streams that reduce dependence on traditional employment.