Okay, here's an article based on the title "How Much Can Day Trading Earn? Is It Really Profitable?" Written as requested, without excessive lists or numbered points, and exploring the nuances of day trading profitability. It's designed to provide a comprehensive, albeit cautionary, overview.

Day trading, the practice of buying and selling financial instruments within the same trading day, with the goal of profiting from small price movements, holds a certain allure. Images of quick profits and financial independence dance in the minds of many newcomers. But the reality is often far more complex, demanding, and, for most, ultimately less lucrative than the dream suggests. The question isn’t simply whether day trading can be profitable, but rather, for whom and under what conditions.

The potential earnings in day trading are theoretically unlimited. A trader with a substantial capital base, exceptional skills, and access to sophisticated tools could, in a particularly favorable market environment, generate significant returns. However, this scenario represents an extreme outlier, not the norm. The vast majority of day traders, particularly those just starting out, face a steep learning curve and significant initial losses.

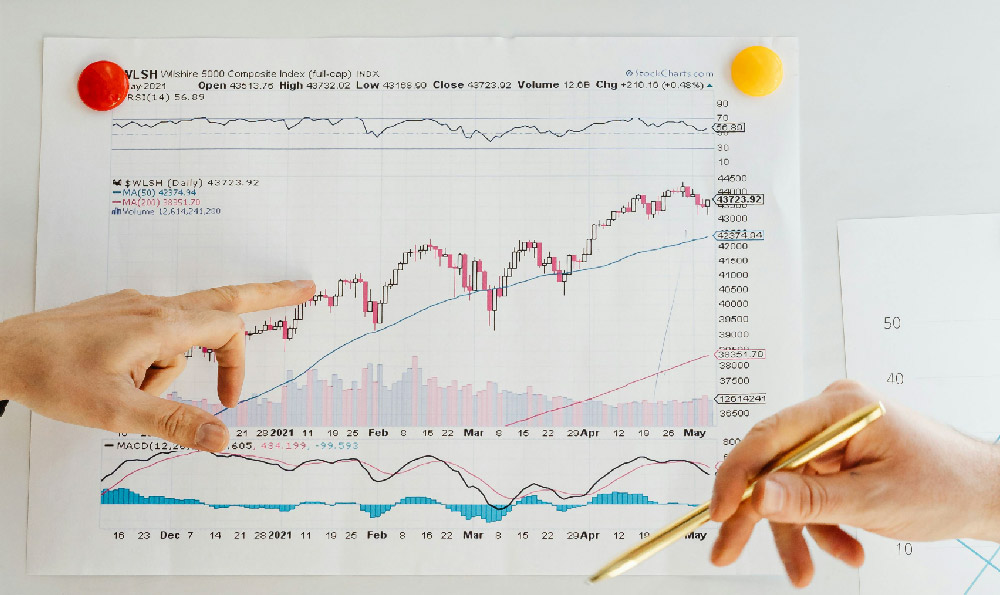

The actual amount of money a day trader can earn is heavily influenced by a multitude of factors. These include, but are not limited to: the amount of capital deployed, the trader's risk tolerance, the instruments being traded (stocks, options, futures, forex, etc.), the market volatility, and, crucially, the trader's skill and discipline. A trader with $10,000 trading capital will naturally have a vastly different earning potential compared to someone with $100,000. Similarly, a trader who consistently risks a large percentage of their capital on each trade, while potentially experiencing larger gains, also faces a correspondingly higher risk of devastating losses.

Furthermore, the market itself plays a critical role. In periods of high volatility, where prices swing dramatically, day traders have more opportunities to profit. However, volatility also amplifies the risk of losses. Conversely, in quiet, range-bound markets, opportunities are scarce, and profits are harder to come by. Success in day trading, therefore, requires not only the ability to identify and capitalize on market movements but also the ability to adapt to changing market conditions and manage risk effectively.

Beyond the technical aspects of trading, the psychological aspect is equally, if not more, important. Day trading is an intensely emotional activity. The constant pressure to make quick decisions, the fear of missing out on opportunities, and the sting of losses can all lead to impulsive and irrational behavior. Successful day traders possess exceptional emotional discipline. They are able to stick to their trading plan, even when faced with adverse market conditions, and avoid the temptation to chase losses or make reckless bets. This psychological fortitude is often the defining factor that separates successful traders from those who fail.

The profitability of day trading is further complicated by the costs involved. Day traders incur transaction fees, such as brokerage commissions and exchange fees, on every trade. These fees can quickly add up, especially for high-frequency traders, and erode profits. In addition, day traders often need to subscribe to expensive data feeds and charting software to gain a competitive edge. These costs can significantly reduce net profits, especially for smaller accounts.

So, is day trading really profitable? For a small minority of skilled and disciplined individuals, the answer is yes. These individuals typically possess years of experience, a deep understanding of market dynamics, a well-defined trading strategy, and the emotional fortitude to execute that strategy consistently. They treat day trading as a serious business, not a get-rich-quick scheme, and are willing to put in the time and effort required to succeed.

However, for the vast majority of aspiring day traders, the reality is far less rosy. Studies have consistently shown that most day traders lose money. The high degree of competition, the inherent risks involved, and the psychological pressures of day trading make it a difficult and unforgiving profession. Many individuals are drawn to day trading by the promise of easy money, but they lack the necessary skills, knowledge, and discipline to succeed. They quickly become disillusioned and lose their initial investment.

Before embarking on a day trading career, it's crucial to carefully assess your skills, knowledge, and risk tolerance. Consider the significant time commitment required to learn and master the craft. Be prepared to invest in education, training, and the necessary tools. Most importantly, be realistic about your chances of success. Day trading is not a guaranteed path to wealth, and it carries a high risk of loss.

Instead of diving headfirst into day trading, it may be wiser to explore other investment strategies that are less demanding and potentially more rewarding in the long run. Consider long-term investing in diversified portfolios of stocks and bonds, or explore alternative investment options that align with your risk tolerance and financial goals. Remember that building wealth is a marathon, not a sprint, and that patience, discipline, and a well-defined investment strategy are essential for long-term success. If you still choose to pursue day trading, approach it with caution, start small, and be prepared to learn from your mistakes. The market is a harsh teacher, but it can also be a rewarding one for those who are willing to learn and adapt.