Okay, I'm ready. Here's an article based on the title "Vanguard Roth IRA: How and Where to Invest?" aimed at providing a comprehensive guide.

Navigating the world of retirement investing can feel like traversing a complex maze. Among the various options available, the Roth IRA stands out as a powerful tool for building tax-advantaged wealth. And when it comes to Roth IRAs, Vanguard, known for its low-cost index funds and ETFs, is a popular choice for many investors. But merely opening a Roth IRA at Vanguard is only the first step. The real key lies in understanding how and where to invest your money within this account to maximize its potential.

Let's first solidify the foundational knowledge of a Roth IRA. Unlike a traditional IRA, contributions to a Roth IRA are made with after-tax dollars. This means you don’t get a tax deduction for your contributions in the present. However, the magic of a Roth IRA unfolds in retirement. Qualified withdrawals, including both contributions and earnings, are entirely tax-free. This can be a significant advantage, especially if you anticipate being in a higher tax bracket in retirement than you are currently. The annual contribution limit is subject to change, so it’s vital to be aware of the current limit. It's also important to note that Roth IRAs have income limitations. High-income earners may not be eligible to contribute directly.

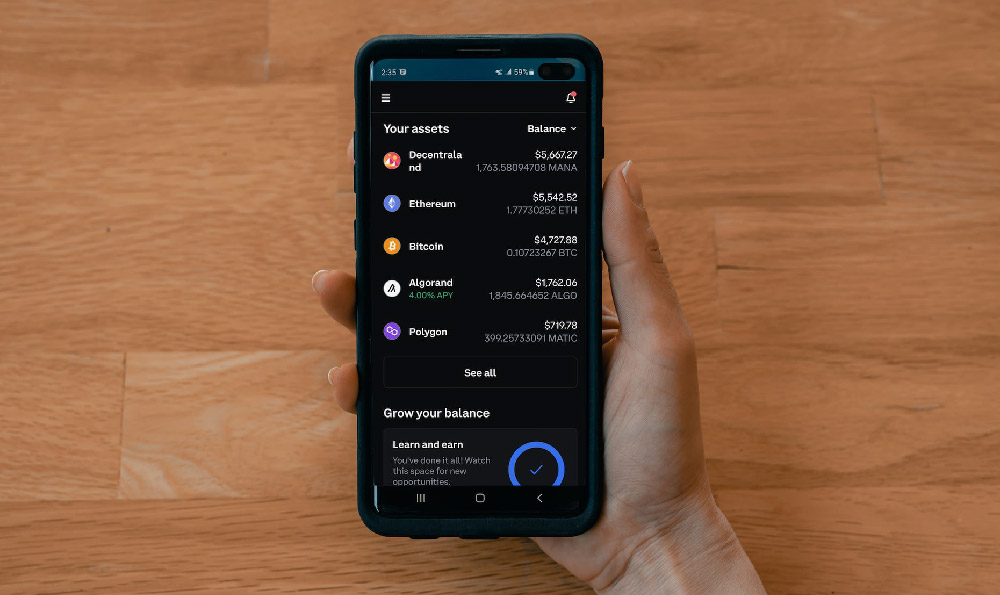

Now, let’s consider the "where" aspect of investing within your Vanguard Roth IRA. Vanguard offers a wide array of investment options, catering to different risk tolerances and investment goals. Among the most popular and generally recommended are index funds and Exchange Traded Funds (ETFs).

Index funds are mutual funds designed to track a specific market index, such as the S&P 500. This means the fund's holdings mirror the composition of the index, providing broad market exposure. Vanguard is renowned for its low-cost index funds, making them an attractive option for long-term investors. The Vanguard Total Stock Market Index Fund (VTSAX) is a cornerstone choice, offering exposure to virtually the entire U.S. stock market. Similarly, the Vanguard Total International Stock Index Fund (VTIAX) provides diversification by investing in stocks from around the world. These two funds, often paired together, form a simple yet effective core portfolio.

ETFs, or Exchange Traded Funds, are similar to index funds in that they track an index or a sector. However, ETFs trade like stocks on an exchange, offering greater flexibility in terms of buying and selling throughout the day. Vanguard offers a range of low-cost ETFs mirroring their popular index funds. For instance, VTI tracks the total U.S. stock market, while VXUS tracks the total international stock market. ETFs can be particularly appealing to investors who prefer to dollar-cost average their investments, buying smaller amounts regularly, as they can be purchased in individual shares.

Beyond broad market index funds and ETFs, Vanguard also offers sector-specific funds. These funds focus on particular industries or segments of the market, such as technology, healthcare, or real estate. While sector funds can potentially offer higher returns, they also come with increased risk, as their performance is heavily reliant on the performance of the specific sector. Investing in sector funds should be approached with caution and a thorough understanding of the sector’s dynamics.

Target Retirement Funds represent another compelling option, particularly for those seeking a hands-off investment approach. These funds are designed to become more conservative over time, gradually shifting from stocks to bonds as the target retirement date approaches. Vanguard’s Target Retirement Funds are a popular choice for Roth IRA investors, providing automatic diversification and rebalancing. You simply select the fund that corresponds to your approximate retirement year, and the fund manager handles the asset allocation adjustments.

The "how" to invest within your Vanguard Roth IRA is just as important as the "where." One of the most crucial principles is diversification. Don't put all your eggs in one basket. Spread your investments across different asset classes, sectors, and geographical regions to mitigate risk. A well-diversified portfolio can weather market volatility better than a portfolio concentrated in a single area.

Dollar-cost averaging is a strategy that involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This approach can help reduce the risk of investing a large sum of money at the wrong time. By consistently investing, you’ll buy more shares when prices are low and fewer shares when prices are high, potentially leading to a lower average cost per share over time.

Rebalancing your portfolio is an essential aspect of maintaining your desired asset allocation. Over time, some asset classes may outperform others, causing your portfolio's asset allocation to drift away from your original target. Rebalancing involves selling some of the overperforming assets and buying more of the underperforming assets to bring your portfolio back into alignment. This process helps to maintain your desired risk level and potentially enhance returns.

Consider your time horizon when making investment decisions. If you have a long time horizon (e.g., decades until retirement), you can generally afford to take on more risk, allocating a larger portion of your portfolio to stocks, which have historically provided higher returns over the long run. As you approach retirement, you may want to gradually reduce your exposure to stocks and increase your allocation to more conservative assets, such as bonds, to protect your accumulated savings.

Finally, remember that investing is a marathon, not a sprint. Don't get caught up in short-term market fluctuations or try to time the market. Focus on building a well-diversified portfolio, investing consistently, and rebalancing regularly. A disciplined, long-term approach is the key to building wealth and achieving your retirement goals within your Vanguard Roth IRA. Seek professional advice from a qualified financial advisor if you have specific questions or need personalized guidance. Investing involves risk, and past performance is not indicative of future results. Thorough research and careful consideration are essential before making any investment decisions.