Investing in gold stocks can be a strategic move for investors seeking diversification, inflation hedges, and potential capital appreciation. However, it's crucial to approach this investment avenue with a well-informed perspective, understanding both the potential benefits and inherent risks. This exploration will delve into the intricacies of gold stocks, outlining the "how" and "why" of including them in a portfolio, and providing insights to make sound investment decisions.

The fundamental allure of gold stems from its historical role as a store of value. Throughout economic cycles, gold has often maintained or even increased its value during periods of uncertainty, geopolitical instability, and inflationary pressures. Gold stocks, which represent ownership in companies involved in gold mining and exploration, offer a leveraged exposure to the price of gold. When the price of gold rises, gold mining companies generally experience increased profitability, leading to higher stock prices. This leverage effect can amplify returns compared to simply holding physical gold, but it also comes with increased volatility.

Several factors make gold stocks potentially attractive investments. Firstly, they can act as a portfolio diversifier. Gold prices often have a low or even negative correlation with other asset classes like stocks and bonds. This means that gold stocks can help to reduce overall portfolio volatility and improve risk-adjusted returns, especially during market downturns. Secondly, gold is widely regarded as an inflation hedge. When inflation erodes the purchasing power of fiat currencies, investors often turn to gold as a safe haven asset. Gold stocks can benefit from this increased demand, potentially outperforming other investments in an inflationary environment. Thirdly, the long-term outlook for gold demand remains positive, driven by factors such as increasing demand from emerging markets, central bank purchases, and the limited supply of gold.

However, investing in gold stocks is not without its challenges. Gold mining companies face operational risks related to exploration, production, and environmental regulations. Unexpected events such as mine closures, geological issues, or cost overruns can significantly impact a company's profitability and stock price. Furthermore, gold stocks are inherently volatile and can be subject to significant price swings, particularly during periods of market uncertainty. The fortunes of these companies are inextricably linked to the price of gold, and fluctuations in gold prices can have a dramatic effect on their stock performance.

Before investing in gold stocks, investors should conduct thorough research and due diligence. This includes evaluating the financial health and operational efficiency of individual mining companies, understanding their gold reserves and production costs, and assessing their management team and corporate governance practices. Examining a company's debt levels, cash flow, and hedging strategies is essential for assessing its financial stability and resilience to price fluctuations. Diversifying across multiple gold mining companies can help to mitigate company-specific risks.

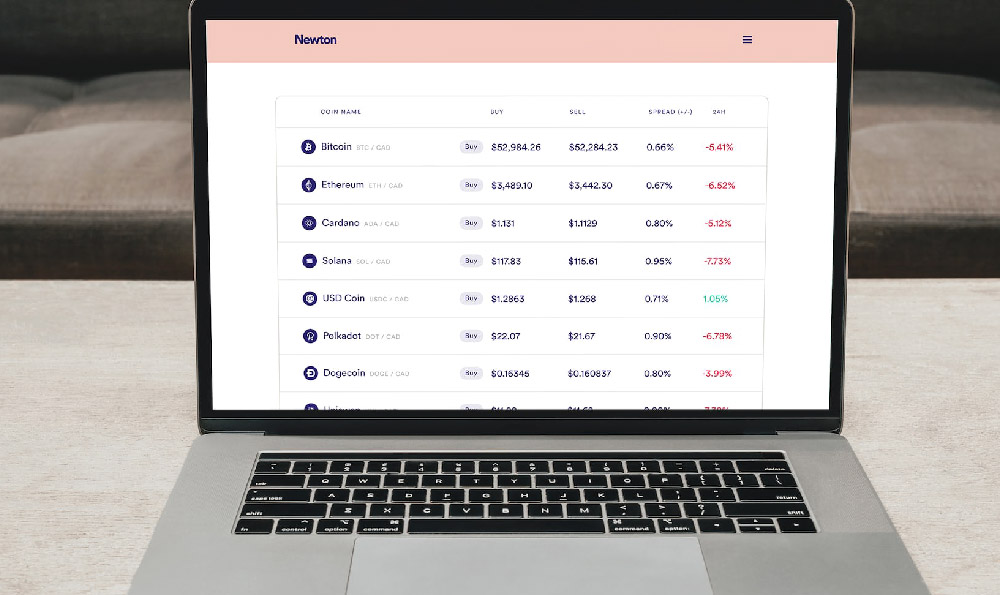

There are several ways to invest in gold stocks. Direct investment involves buying shares of individual gold mining companies listed on stock exchanges. This approach allows investors to tailor their portfolio to specific companies and investment strategies. However, it requires significant research and expertise to select the right companies and manage the associated risks. Another option is to invest in gold exchange-traded funds (ETFs) that track an index of gold mining companies. These ETFs provide instant diversification across a basket of gold stocks, simplifying the investment process and reducing the risk of selecting individual underperforming companies. Mutual funds specializing in precious metals or natural resources also offer a diversified approach to investing in gold stocks.

For novice investors, the ETF route may be more prudent, as it avoids the intricacies of directly evaluating mining companies. These ETFs are often categorized into junior gold miners, which are smaller, more speculative companies with the potential for higher growth, and senior gold miners, which are larger, more established companies with more stable operations. The choice between these depends on the investor's risk tolerance and investment goals. Junior miners are higher risk/higher reward, while senior miners are lower risk/lower reward.

Timing is crucial when investing in gold stocks. Ideally, investors should consider adding gold stocks to their portfolio during periods when gold prices are relatively low and market sentiment towards gold is negative. This contrarian approach can potentially lead to higher returns when the market eventually recognizes the value of gold. Conversely, it's generally advisable to avoid investing in gold stocks when gold prices are high and market sentiment is overly optimistic, as this may indicate a potential market top. Implementing a dollar-cost averaging strategy, which involves investing a fixed amount of money at regular intervals, can help to smooth out price fluctuations and reduce the risk of buying at a market peak.

Beyond the mechanics of buying and selling, sound risk management is paramount. Investors should determine an appropriate allocation to gold stocks based on their overall investment objectives, risk tolerance, and time horizon. A common recommendation is to allocate a small percentage of the portfolio, typically between 5% and 10%, to gold and gold-related investments. This allocation can be adjusted over time based on changes in market conditions and investment goals. Regularly rebalancing the portfolio to maintain the desired asset allocation is essential for managing risk and ensuring that the portfolio remains aligned with the investor's objectives.

In conclusion, investing in gold stocks can be a valuable strategy for diversifying a portfolio, hedging against inflation, and potentially generating capital appreciation. However, it's crucial to approach this investment with a thorough understanding of the associated risks and rewards. By conducting thorough research, diversifying across multiple companies, and implementing sound risk management strategies, investors can increase their chances of success in the gold stock market. Remember, gold stocks are not a guaranteed path to riches, and like any investment, they require careful planning and ongoing monitoring. Before making any investment decisions, consult with a qualified financial advisor to determine the best course of action based on your individual circumstances.