Okay, here's an article exploring the potential for profitability when driving for Uber, keeping in mind the requested constraints on structure and tone.

Can driving for Uber truly translate into a worthwhile income? This question resonates with countless individuals seeking flexible employment or a supplemental revenue stream. While the allure of setting your own hours and being your own boss is undeniable, the reality of Uber earnings can be significantly more complex than initial impressions might suggest. Successfully navigating the Uber landscape and generating a genuine profit requires a strategic approach, a thorough understanding of the cost involved, and a realistic assessment of market conditions.

One of the initial factors to consider is the location. Different cities and regions offer vastly different earning potentials for Uber drivers. Areas with high population density, significant tourist activity, and a limited number of competing drivers often present the most lucrative opportunities. Conversely, smaller towns or areas saturated with drivers might yield comparatively lower earnings per hour. Thorough market research, including analyzing Uber's own demand maps and connecting with existing drivers, is crucial to understanding the potential within a specific locale.

Beyond location, the type of service offered also plays a significant role in profitability. Standard UberX rides represent the baseline, but exploring options like UberXL (for larger groups), Uber Comfort (for newer, more spacious vehicles), or Uber Black (for luxury cars) can unlock higher fares and attract a more affluent clientele. However, upgrading to a larger or more premium vehicle necessitates a substantial upfront investment and may introduce additional maintenance costs. A careful cost-benefit analysis is essential to determine if these premium services align with your financial goals and risk tolerance.

The ebb and flow of demand throughout the day and week significantly impacts earning potential. Peak hours, such as rush hour commutes, weekend evenings, and special event periods, typically offer surge pricing, which can dramatically increase fares. Strategically focusing on driving during these high-demand periods can significantly boost income. However, it's also important to acknowledge that competition among drivers tends to be fiercest during these times, potentially offsetting some of the gains from surge pricing. Learning to anticipate demand patterns and position oneself in areas likely to experience surges is a key skill for maximizing earnings.

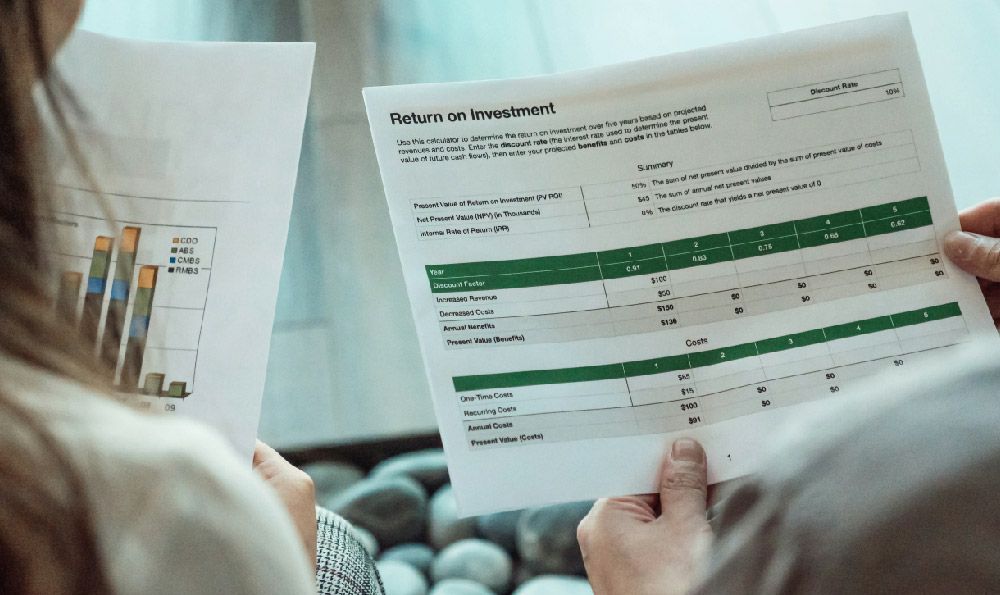

While gross earnings might seem appealing, it's crucial to meticulously track and account for all expenses associated with driving for Uber. Vehicle maintenance, including regular servicing, tire replacements, and unexpected repairs, constitutes a significant cost. Fuel consumption, which can vary depending on driving style, traffic conditions, and vehicle efficiency, is another major expense. Additionally, depreciation of the vehicle’s value is a factor often overlooked. The more miles you drive, the faster your car depreciates, impacting its resale value. Insurance is another crucial expense. Your personal auto insurance policy likely won't cover you while you're driving for Uber, so you'll need to secure rideshare insurance, which can be significantly more expensive.

Beyond these direct vehicle-related expenses, drivers must also factor in taxes. As an independent contractor, you are responsible for paying self-employment taxes, which include Social Security and Medicare taxes. Setting aside a portion of your earnings to cover these tax obligations is essential to avoid unwelcome surprises during tax season. Furthermore, consider the cost of data plans for your smartphone, which is essential for navigation and communication, and any expenses incurred for vehicle cleaning and detailing to maintain a professional appearance.

One often-overlooked aspect is the value of your time. Driving for Uber involves not just the time spent transporting passengers, but also the time spent waiting for ride requests, commuting to strategic locations, and handling administrative tasks like expense tracking. Accurately assessing the total time commitment and factoring it into your hourly earnings calculation provides a more realistic picture of profitability. Are you truly earning a wage that compensates you fairly for your time and effort, or are you simply working long hours for marginal gains?

Moreover, external factors beyond your control can significantly influence earnings. Changes in Uber's fare structure, increased competition from new drivers, and fluctuations in fuel prices can all impact profitability. Staying informed about industry trends and adapting your strategy accordingly is crucial for long-term success. Joining online driver communities and networking with other drivers can provide valuable insights and support in navigating these challenges.

In conclusion, while driving for Uber can offer a flexible income opportunity, achieving genuine profitability requires a diligent approach. It’s about meticulous expense tracking, strategic planning, a realistic assessment of time commitment, and continuous adaptation to market conditions. Potential drivers should conduct thorough research, understand their local market dynamics, and honestly evaluate whether the potential rewards outweigh the inherent risks and costs involved. Only then can one determine if driving with Uber is a financially sustainable and worthwhile endeavor. It’s not a get-rich-quick scheme, but with careful planning and execution, it can become a valuable source of income.