In the dynamic landscape of 2023, the digital realm has opened up numerous avenues for individuals to generate income with relative ease, yet the path to financial success online is rarely straightforward. The key to leveraging these opportunities lies in understanding the mechanisms that drive digital earnings, assessing personal risk tolerance, and aligning strategies with long-term financial goals. While it's tempting to chase quick returns, the most sustainable methods often require a combination of adaptability, discipline, and a nuanced understanding of market forces.

One of the most accessible digital income streams involves capitalizing on the growth of online marketplaces and platforms. For instance, dropshipping has evolved into a more sophisticated model, allowing entrepreneurs to sell products globally through marketplaces like Shopify or Etsy without maintaining inventory. This approach thrives on the demand for niche products, but requires strategic sourcing and marketing to ensure profitability. Similarly, the gig economy continues to expand, with platforms such as Upwork, Fiverr, or TaskRabbit offering opportunities for freelancing in fields ranging from content creation to graphic design. While these roles can provide flexibility, they often demand consistent skill development and a willingness to compete in crowded markets.

Another promising avenue for generating online income is the rise of affiliate marketing and digital advertising. By promoting products or services through blogs, social media, or YouTube channels, individuals can earn commissions based on sales generated through their referral links. This method relies heavily on audience engagement and content quality, but can yield substantial returns when executed with a clear value proposition. Likewise, the monetization of digital content—such as writing, photography, or video production—has expanded with the growth of platforms like Medium, Instagram, or TikTok. Success in these spaces often depends on consistency, creativity, and an ability to adapt to algorithm changes that dictate content visibility.

For those with a moderate risk tolerance, investing in online platforms that offer passive income structures presents an appealing option. Peer-to-peer lending networks, such as LendingClub, enable individuals to lend money directly to borrowers and earn interest on their investments. While these platforms can offer competitive returns, they are not without risks, including the potential for borrower default and regulatory scrutiny. Similarly, the rise of dividend-paying stocks and index funds has made it easier for novice investors to access long-term growth through automated investing apps like Robinhood or Acorns. These tools simplify the process of building a diversified portfolio, yet require a foundational understanding of market dynamics to avoid pitfalls like overexposure to volatile assets.

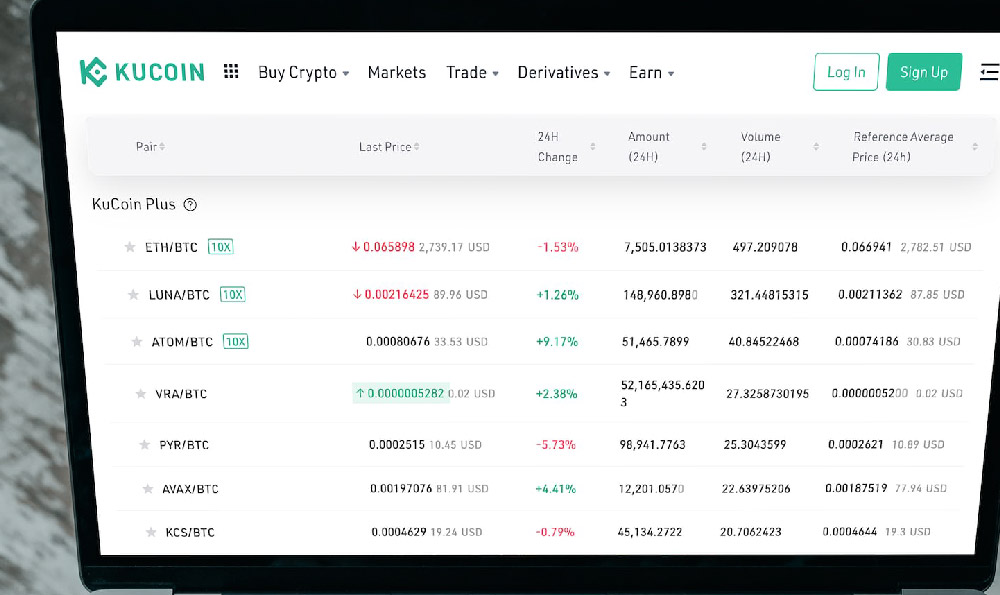

The emergence of cryptocurrency and decentralized finance (DeFi) has also created new opportunities for income generation, though the risks are significant. Staking, for example, allows individuals to earn interest on their cryptocurrency holdings by supporting the security of blockchain networks. While this approach can offer high returns, it is subject to market volatility and the inherent risks of digital asset speculation. Similarly, the rise of NFTs and digital collectibles has introduced a new layer of complexity, with platforms like OpenSea enabling creators and collectors to monetize unique digital assets. However, these markets are highly speculative, often driven by trends rather than intrinsic value, and require a deep understanding of blockchain technology and market psychology.

For those with a steady income, leveraging online tools to optimize financial resources can provide additional avenues for earnings. Robo-advisors, for example, offer automated investment management with low fees, enabling individuals to grow their assets over time without requiring active market participation. These tools rely on algorithmic analysis to suggest optimal portfolios, yet their effectiveness depends on the accuracy of underlying data and the user's ability to monitor long-term performance. Similarly, the rise of online lending and peer-to-peer investment platforms has made it possible to earn interest on savings while supporting other investors, though these systems require careful evaluation of credit risk and platform reliability.

Ultimately, the most effective strategies for generating income online involve a balance of creativity, technology, and financial acumen. While some methods may appear effortless, they often require a commitment to continuous learning and risk management. For example, the growth of online education platforms such as Udemy or Coursera has made it possible to monetize expertise through course creation, yet success depends on identifying high-demand skills and delivering quality content. Similarly, the rise of online trading and stock market analysis tools has made it easier for individuals to participate in financial markets, though the potential for loss remains high without proper education and experience.

In conclusion, while 2023 has introduced new opportunities for earning income online, the path to financial success requires careful planning, risk assessment, and adaptability. The key to sustained returns lies in aligning strategies with personal goals, leveraging technology to enhance productivity, and maintaining a long-term perspective in navigating the complexities of the digital economy. By combining a proactive approach with a commitment to financial literacy, individuals can unlock the potential of online income generation while minimizing the risks associated with these opportunities.