Here's an article based on the provided title, optimized for SEO, aiming for readability and comprehensive coverage:

Bank of America: A Deep Dive into its Investment Potential

Bank of America (BAC) is one of the world's largest financial institutions, a household name synonymous with American banking. Evaluating whether its stock represents a worthwhile investment in the current market climate requires a thorough examination of its financial health, competitive positioning, and the broader economic landscape. This article will delve into the key factors investors should consider when assessing Bank of America's investment appeal.

Understanding Bank of America's Business Model

Bank of America operates across four main business segments: Consumer Banking, Global Wealth and Investment Management (GWIM), Global Banking, and Global Markets. Consumer Banking, serving individuals and small businesses, generates revenue through deposit accounts, loans (mortgages, credit cards, personal loans), and transaction fees. GWIM caters to high-net-worth individuals and institutions, offering wealth management, investment advisory, and brokerage services. Global Banking provides corporate and commercial banking services, including loans, treasury solutions, and investment banking advisory. Finally, Global Markets encompasses trading activities in fixed income, currencies, and commodities. The diversification across these segments helps to mitigate risk, as strong performance in one area can offset weakness in another during varying economic conditions.

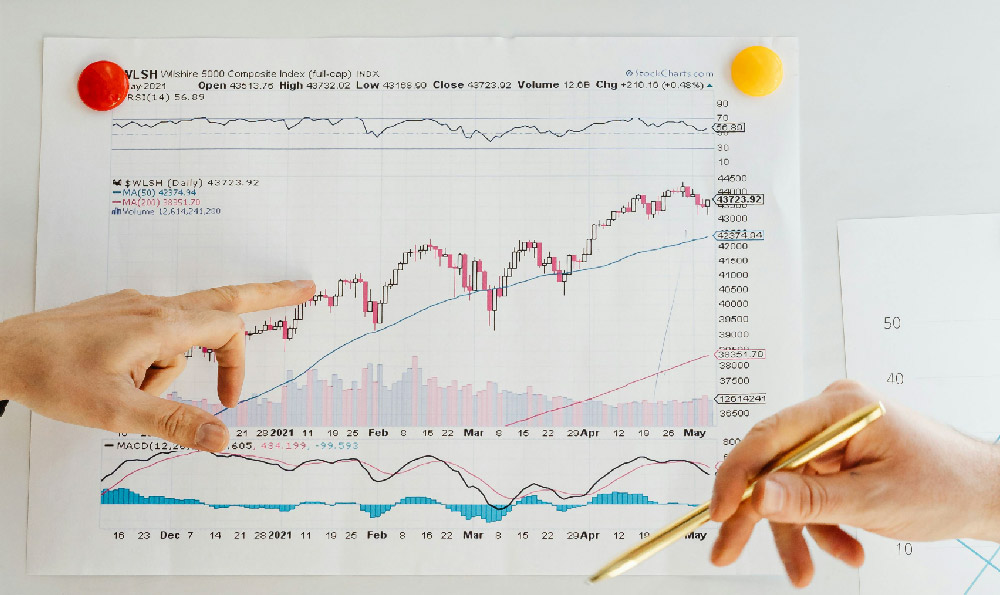

Analyzing Bank of America's Financial Performance

A crucial step in assessing any stock is to analyze its recent financial performance. Investors should focus on key metrics such as revenue growth, net income, earnings per share (EPS), and return on equity (ROE). Consistent revenue growth, driven by increased loan demand and higher interest rates, is a positive sign. EPS indicates the company's profitability on a per-share basis, while ROE measures how efficiently the company is using shareholder equity to generate profits. Tracking these metrics over several quarters and years provides insights into the company's long-term growth trajectory and profitability trends. Bank of America's efficiency ratio, which measures operating expenses as a percentage of revenue, is also a key indicator of how effectively the company is managing its costs. A lower efficiency ratio suggests better cost control.

The Impact of Interest Rates and the Economic Environment

Banks are inherently sensitive to interest rate fluctuations. When interest rates rise, banks can generally charge higher rates on loans, which boosts their net interest margin (NIM) – the difference between the interest income earned on loans and the interest paid on deposits. However, rising rates can also dampen loan demand as borrowing becomes more expensive. The overall economic environment plays a significant role as well. A strong economy typically leads to increased loan demand and fewer loan defaults, benefiting banks. Conversely, an economic slowdown or recession can lead to lower loan demand and higher default rates, negatively impacting bank profits. Investors need to consider the prevailing interest rate environment and the overall economic outlook when evaluating Bank of America. The Federal Reserve's monetary policy decisions significantly impact Bank of America’s profitability.

Competitive Landscape and Market Positioning

Bank of America operates in a highly competitive industry. It competes with other large national banks, regional banks, and fintech companies. Its large branch network, extensive product offerings, and strong brand recognition provide a competitive advantage. Furthermore, its investments in technology and digital banking are helping it to attract and retain customers in an increasingly digital world. Assessing Bank of America's competitive positioning requires understanding its market share, customer satisfaction ratings, and its ability to innovate and adapt to changing consumer preferences. Evaluating its investments in digital infrastructure and its success in attracting younger, tech-savvy customers is also important.

Risks and Challenges Facing Bank of America

Despite its strengths, Bank of America faces several risks and challenges. Regulatory compliance is a constant concern, as banks are subject to strict regulations regarding capital requirements, lending practices, and consumer protection. Cybersecurity threats pose a significant risk, as banks hold vast amounts of sensitive customer data. Economic downturns can lead to lower loan demand and higher credit losses. Additionally, increasing competition from fintech companies is disrupting the traditional banking landscape. Investors should carefully consider these risks when evaluating Bank of America's investment potential. Geopolitical risks and global economic uncertainties can also impact the bank's performance, especially its global banking and global markets divisions.

Valuation and Investment Considerations

Determining whether Bank of America stock is worth buying involves assessing its valuation relative to its peers and its historical performance. Key valuation metrics include the price-to-earnings (P/E) ratio, the price-to-book (P/B) ratio, and the dividend yield. Comparing these metrics to those of other large banks and to Bank of America's own historical averages can provide insights into whether the stock is undervalued, fairly valued, or overvalued. Additionally, consider the bank's dividend policy and its history of dividend payments. A stable and growing dividend can be an attractive feature for income-seeking investors. Ultimately, the decision of whether to invest in Bank of America should be based on your individual investment goals, risk tolerance, and time horizon. It’s crucial to conduct thorough research and consult with a financial advisor before making any investment decisions. Diversification is also key to mitigating risk, so avoid putting all your eggs in one basket. Before investing, potential investors should carefully review Bank of America's latest financial reports, investor presentations, and analyst ratings.

Conclusion: Is Bank of America a Buy?

Whether Bank of America stock is a good investment depends on a variety of factors, including your individual investment goals and risk tolerance. While the bank is a well-established financial institution with a strong brand and a diversified business model, it also faces risks and challenges related to interest rates, economic conditions, regulatory compliance, and competition. A careful analysis of its financial performance, competitive positioning, and valuation is essential before making an investment decision. Monitor economic indicators and Bank of America's performance regularly to make informed adjustments to your investment strategy. Considering both the potential rewards and the inherent risks is paramount before adding Bank of America stock to your portfolio.