Investing with an IRA: Wise Choice or Risky Gamble?

Unlocking the Potential of an IRA: A Path to Secure Retirement

Individual Retirement Accounts (IRAs) are often touted as cornerstones of a financially secure retirement. They offer tax advantages designed to encourage individuals to save for their golden years. However, navigating the world of IRAs requires careful consideration. Is investing with an IRA a wise choice, or does it present a risky gamble? The answer, as with most financial decisions, lies in understanding the intricacies, potential benefits, and inherent risks involved.

Understanding the Fundamentals: Traditional vs. Roth IRA

Before diving into the nuances of investment strategies, it's crucial to differentiate between the two primary types of IRAs: Traditional and Roth.

-

Traditional IRA: Contributions to a Traditional IRA may be tax-deductible, potentially lowering your taxable income in the present. However, withdrawals in retirement are taxed as ordinary income. This option is often favored by individuals who anticipate being in a lower tax bracket during retirement.

-

Roth IRA: Contributions to a Roth IRA are made with after-tax dollars. While you don't receive an immediate tax deduction, qualified withdrawals in retirement are tax-free. This makes Roth IRAs appealing to those who expect to be in a higher tax bracket in retirement.

Choosing the Right IRA: A Personalized Decision

The decision between a Traditional and Roth IRA hinges on your individual circumstances, including your current and projected income, tax bracket, and risk tolerance. Consulting with a financial advisor can provide tailored guidance based on your specific needs and financial goals.

Maximizing Growth: Investment Strategies Within an IRA

Once you've established an IRA, the next step involves choosing appropriate investment vehicles. IRAs can hold a diverse range of assets, including stocks, bonds, mutual funds, exchange-traded funds (ETFs), and even real estate (in some cases).

-

Stocks: Stocks offer the potential for high growth but also come with higher volatility. They are generally suitable for younger investors with a longer time horizon.

-

Bonds: Bonds are typically considered less risky than stocks, providing a more stable income stream. They are often favored by older investors or those with a lower risk tolerance.

-

Mutual Funds & ETFs: These investment vehicles offer diversification by pooling money from multiple investors to invest in a basket of stocks, bonds, or other assets. They can be a convenient way to achieve diversification without having to select individual securities.

-

Real Estate: While less common, some IRAs allow for investments in real estate. This can provide potential rental income and appreciation, but it also comes with complexities and potential liquidity issues.

Diversification: The Key to Mitigating Risk

Regardless of the investment vehicles you choose, diversification is paramount. Spreading your investments across different asset classes, sectors, and geographic regions can help reduce the impact of any single investment performing poorly. A well-diversified portfolio is less susceptible to market fluctuations and can provide more consistent returns over the long term.

Weighing the Risks: Understanding the Potential Downsides

While IRAs offer significant benefits, it's essential to be aware of the potential risks:

-

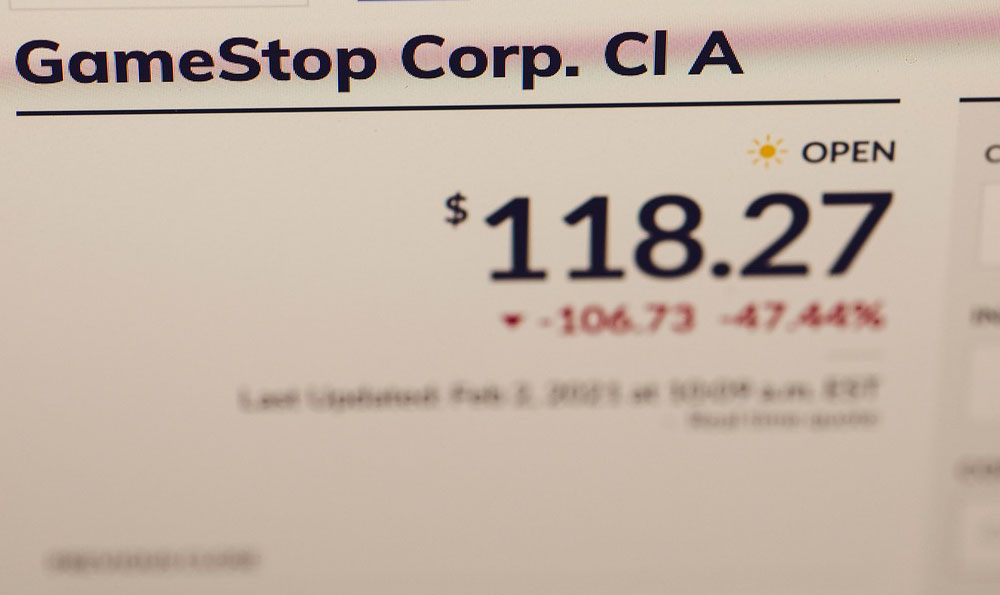

Market Volatility: The value of your IRA investments can fluctuate based on market conditions. There's no guarantee that your investments will appreciate in value, and you could even lose money.

-

Inflation Risk: Inflation can erode the purchasing power of your retirement savings. It's crucial to invest in assets that have the potential to outpace inflation.

-

Withdrawal Penalties: Withdrawing funds from an IRA before age 59 ½ typically incurs a 10% penalty, in addition to any applicable taxes. This can significantly reduce your retirement savings. (Certain exceptions apply, such as for qualified higher education expenses or first-time home purchases, depending on the IRA type).

-

Fees and Expenses: IRA providers often charge fees for account maintenance, investment management, and other services. These fees can eat into your returns, so it's important to compare fees from different providers.

Seeking Professional Advice: The Value of Financial Guidance

Navigating the complexities of IRAs and investment strategies can be challenging. Consulting with a qualified financial advisor can provide personalized guidance based on your individual circumstances, risk tolerance, and financial goals. A financial advisor can help you choose the right type of IRA, develop an appropriate investment strategy, and monitor your portfolio to ensure it remains aligned with your objectives.

Staying Informed: Continuous Learning and Adaptation

The financial landscape is constantly evolving. It's crucial to stay informed about market trends, tax law changes, and new investment opportunities. Regularly review your IRA portfolio and make adjustments as needed to ensure it continues to meet your retirement goals. Educating yourself through reputable financial resources and staying adaptable to changing circumstances are essential for long-term financial success.

Conclusion: A Strategic Tool for Retirement Planning

Investing with an IRA is not inherently a gamble. When approached with a clear understanding of the potential benefits, risks, and available investment options, it can be a wise and strategic tool for building a secure retirement. The key lies in personalized planning, diversified investments, and continuous monitoring to ensure your IRA remains aligned with your long-term financial goals. By carefully considering your individual circumstances and seeking professional advice when needed, you can harness the power of an IRA to achieve a comfortable and financially secure retirement.