Is Buying Gold Coins a Smart Investment? Or a Risky Gamble?

Gold has always held a certain mystique, a store of value that transcends borders and generations. For centuries, it has served as a hedge against inflation, economic uncertainty, and geopolitical turmoil. Gold coins, in particular, offer a tangible way to own this precious metal. But is buying gold coins a sound investment strategy, or simply a risky gamble? Let's delve into the nuances of this age-old debate.

The Allure of Gold Coins: Understanding the Appeal

Gold coins possess a multi-faceted appeal. First and foremost, they represent physical gold. Unlike stocks or bonds, you can hold them in your hand, adding a sense of security and control. This tangibility is especially attractive during times of economic instability, when faith in traditional financial instruments may waver.

Furthermore, certain gold coins, particularly those with numismatic value, can appreciate beyond the intrinsic value of their gold content. These coins, often rare or historically significant, are sought after by collectors, driving up their prices. This potential for appreciation adds another layer of potential return for investors.

Finally, gold coins offer a degree of privacy. Transactions involving physical gold are often less scrutinized than those involving digital assets or bank accounts, appealing to individuals seeking to maintain financial discretion.

The Potential Upsides: Why Invest in Gold Coins?

Investing in gold coins offers several potential benefits:

- Hedge Against Inflation: Gold has historically maintained its value, or even increased, during periods of inflation. As the purchasing power of fiat currencies erodes, gold tends to hold its ground, preserving wealth. This makes gold coins a potentially valuable asset in an inflationary environment.

- Safe Haven Asset: During economic recessions, market crashes, or geopolitical crises, investors often flock to safe-haven assets like gold. This increased demand can drive up gold prices, benefiting gold coin holders.

- Diversification: Gold coins can serve as a valuable addition to a diversified investment portfolio. Their low correlation with stocks and bonds can help reduce overall portfolio risk and improve returns during periods of market volatility.

- Numismatic Value: As mentioned earlier, some gold coins possess numismatic value beyond their gold content. This value is driven by rarity, condition, and historical significance. Savvy investors can profit by identifying and acquiring coins with significant numismatic potential.

- Tangible Asset: Unlike paper assets, gold coins are tangible and can be stored securely. This provides a sense of security and control that is appealing to some investors.

The Potential Downsides: The Risks of Investing in Gold Coins

While the allure of gold coins is undeniable, it's crucial to acknowledge the potential downsides:

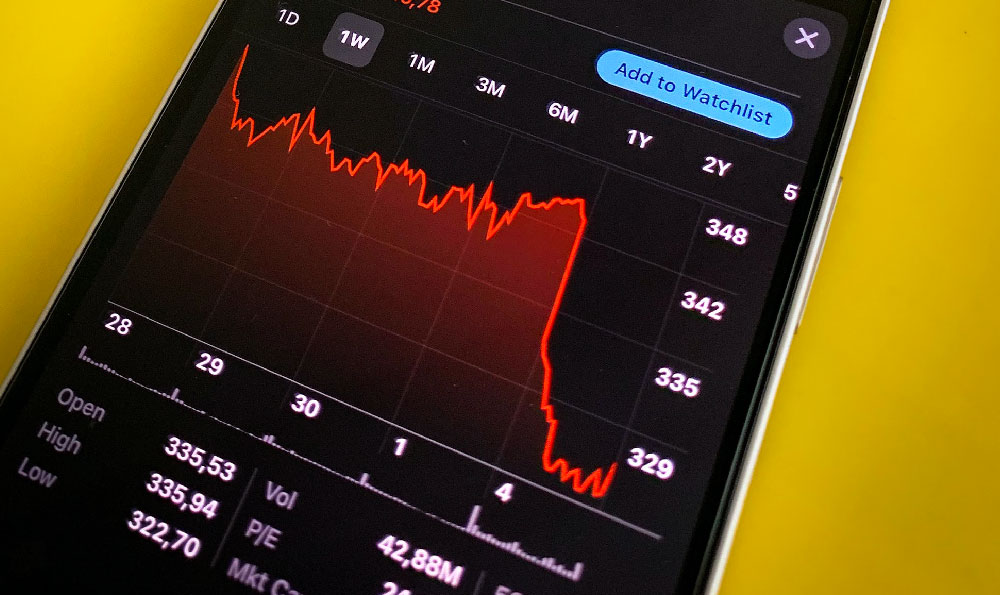

- Price Volatility: Gold prices can be volatile, fluctuating based on a variety of factors, including interest rates, inflation expectations, and geopolitical events. This volatility can lead to significant short-term losses for gold coin investors.

- Storage and Security: Storing gold coins securely can be a challenge. Home storage poses risks of theft, while professional storage facilities incur fees.

- Transaction Costs: Buying and selling gold coins often involves transaction costs, including premiums, commissions, and assaying fees. These costs can eat into potential profits, especially for small investments.

- Counterfeit Risks: The market for gold coins is rife with counterfeit products. Unwary investors can easily fall victim to scams, purchasing fake coins that are worthless. Thorough due diligence and reputable dealers are essential to mitigate this risk.

- Lack of Income: Gold coins do not generate income like stocks or bonds. Investors rely solely on price appreciation to realize a return on their investment. This can be a drawback for those seeking passive income streams.

- Market Manipulation: Like any market, the gold market is susceptible to manipulation. Large institutional investors or even governments can influence gold prices, potentially harming smaller investors.

Is Buying Gold Coins Right for You? Factors to Consider

The decision of whether to invest in gold coins depends on individual circumstances and investment goals. Consider the following factors:

- Risk Tolerance: Are you comfortable with the price volatility of gold? If you are risk-averse, gold coins may not be the best investment for you.

- Investment Horizon: Are you looking for short-term gains or long-term wealth preservation? Gold coins are generally considered a long-term investment.

- Financial Goals: Are you seeking income generation or capital appreciation? Gold coins are primarily a capital appreciation play.

- Due Diligence: Are you willing to invest the time and effort to research gold coins, identify reputable dealers, and secure proper storage?

- Percentage of Portfolio: How much of your investment portfolio are you comfortable allocating to gold coins? A common recommendation is to allocate a small percentage, such as 5-10%, to gold.

Beyond the Coin: Alternatives to Consider

If you are interested in investing in gold but hesitant to buy physical gold coins, consider these alternatives:

- Gold Exchange-Traded Funds (ETFs): Gold ETFs track the price of gold and offer a convenient and liquid way to invest in the metal.

- Gold Mining Stocks: Investing in gold mining companies can provide exposure to the gold market, but also carries the risks associated with individual companies.

- Gold Futures Contracts: Gold futures contracts are agreements to buy or sell gold at a future date. These contracts are highly leveraged and suitable only for experienced traders.

Conclusion: A Thoughtful Approach to Gold Coins

Buying gold coins can be a smart investment, but it's not a guaranteed path to riches. It's crucial to understand the potential upsides and downsides, conduct thorough due diligence, and consider your individual circumstances and investment goals. Approach gold coin investing with a thoughtful and informed perspective, and it can be a valuable addition to a well-diversified portfolio. However, viewing it as a quick path to wealth or without proper understanding can easily transform it into a risky gamble with potentially devastating consequences. Remember, informed decisions are the cornerstone of successful investing, regardless of the asset class.