Okay, here's an article exploring the potential and options surrounding investing in Tesla, aiming to be comprehensive and avoiding excessive bullet points or numbered lists:

Investing in Tesla: A Good Idea? What are the Options?

Tesla, Inc. has become a ubiquitous name, synonymous with electric vehicles (EVs), disruptive technology, and the visionary leadership of Elon Musk. Its stock, TSLA, has been a rollercoaster, generating significant wealth for some and leaving others burned. The question of whether investing in Tesla is a good idea is far from straightforward and requires a nuanced understanding of the company, its industry, and your own investment goals and risk tolerance.

Before delving into specific investment options, it's crucial to acknowledge the multifaceted nature of Tesla. It's not solely an automaker. Its business encompasses energy generation and storage (solar panels, Powerwall, Megapack), artificial intelligence (Autopilot, Optimus robot), and even space exploration (through SpaceX, although that's a separate entity). This diversification, while potentially mitigating risk, also makes it harder to directly compare Tesla to traditional automotive companies.

One of the most compelling arguments for investing in Tesla lies in its dominant position in the rapidly growing EV market. While competition is intensifying from established automakers like Ford, GM, and Volkswagen, as well as newer entrants, Tesla maintains a significant lead in battery technology, charging infrastructure (Supercharger network), and brand recognition. Its Gigafactories are designed for massive scale and cost reduction, further solidifying its competitive advantage. The transition to electric vehicles is widely considered inevitable, driven by environmental concerns, government regulations, and decreasing battery costs. This secular trend provides a powerful tailwind for Tesla's growth potential.

However, this rosy outlook is not without its caveats. Tesla's valuation has frequently been a point of contention. The stock has often traded at a significant premium compared to its peers, reflecting high growth expectations and investor enthusiasm. Whether this premium is justified depends on Tesla's ability to continue executing its ambitious plans and maintain its market share in an increasingly competitive landscape.

Production bottlenecks, supply chain disruptions, and increased competition are all potential headwinds. Furthermore, Elon Musk's often controversial public persona and communication style can introduce volatility into the stock price. Investor sentiment can shift rapidly based on news events and social media activity, making Tesla a potentially risky investment for those with a low tolerance for fluctuations.

Beyond the fundamental analysis of the company, potential investors need to carefully consider their investment timeframe and risk profile. Is this a long-term bet on the future of electric vehicles and sustainable energy, or a shorter-term speculative play? The answer will significantly influence the suitability of Tesla stock.

Now, let's explore the various investment options available:

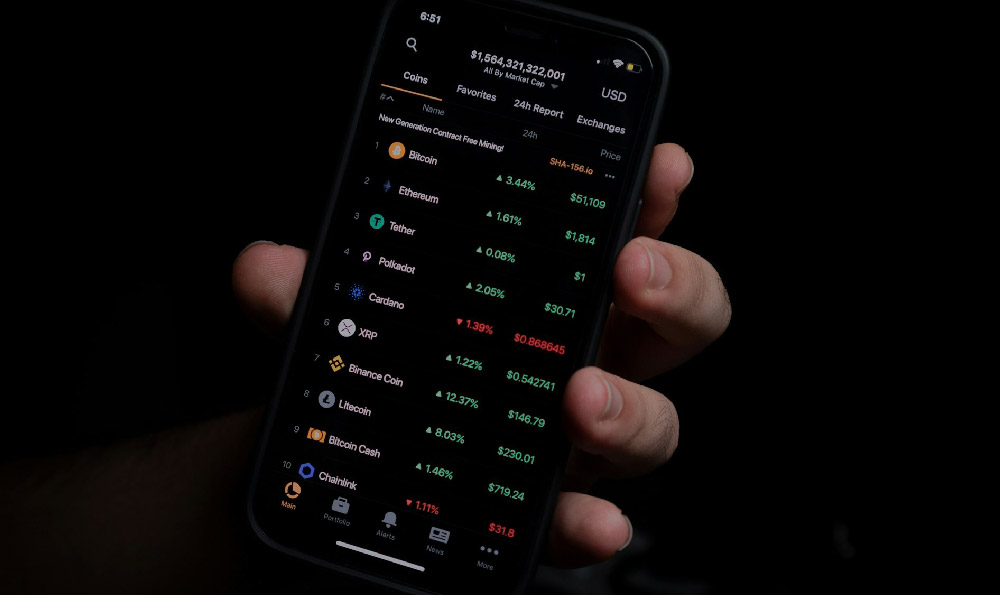

- Direct Stock Ownership (TSLA): This is the most straightforward way to invest in Tesla. You purchase shares of TSLA through a brokerage account, becoming a shareholder and entitled to a portion of the company's profits (or losses). This provides the most direct exposure to Tesla's performance, but also comes with the highest risk. The price of TSLA can be highly volatile, and you could lose a significant portion of your investment.

- Options Trading: Options contracts give you the right (but not the obligation) to buy or sell Tesla stock at a specific price within a certain timeframe. Options trading can be used to leverage your investment, potentially amplifying both gains and losses. Buying call options gives you the right to buy the stock, betting that the price will increase. Buying put options gives you the right to sell the stock, betting that the price will decrease. Options are complex financial instruments and are not suitable for all investors. A thorough understanding of options strategies and risk management is essential before engaging in options trading.

- Exchange-Traded Funds (ETFs): ETFs are investment funds that hold a basket of stocks, providing diversification. Many ETFs include Tesla as part of their holdings, particularly those focused on technology, clean energy, or disruptive innovation. Investing in an ETF allows you to gain exposure to Tesla without putting all your eggs in one basket. While you won't experience the full upside potential of Tesla's stock, you'll also be somewhat shielded from its volatility. Some ETFs with significant Tesla holdings include those tracking the NASDAQ 100, clean energy indices, or thematic investment strategies focused on future technologies.

- Mutual Funds: Similar to ETFs, mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks and bonds. Some mutual funds may include Tesla as part of their holdings. However, mutual funds typically have higher expense ratios than ETFs. Actively managed mutual funds, where a fund manager selects investments, may have a higher allocation to Tesla if the manager believes in the company's potential.

- Indirect Investment through Suppliers or Partners: While not a direct investment in Tesla, you could consider investing in companies that supply components or services to Tesla. This could include battery manufacturers, charging infrastructure providers, or autonomous driving technology companies. This approach offers a less direct exposure to Tesla, but it can still benefit from the growth of the EV market. However, it's essential to thoroughly research these companies and understand their individual business models and competitive landscapes.

Before making any investment decisions, it's crucial to conduct thorough research, understand your own risk tolerance, and consult with a qualified financial advisor. Investing in Tesla, like any investment, involves inherent risks. The company's future success is not guaranteed, and its stock price can be highly volatile. Evaluate your financial situation, investment goals, and risk appetite carefully before allocating any capital to Tesla or any other investment. Diversification is key to managing risk, and it's generally advisable to not put all your eggs in one basket. Consider the long-term outlook, the competitive landscape, and your own investment goals before making a decision about whether investing in Tesla is right for you. The dynamic nature of both the company and the market necessitate continuous monitoring and reevaluation of your investment strategy.