In the ever-evolving landscape of personal finance, the pursuit of wealth growth often hinges on the strategic allocation of resources across diverse investment avenues. As we navigate through 2023, a year marked by shifting macroeconomic conditions and emerging market trends, understanding the comparative performance of different investment vehicles becomes crucial. While the names Tank and Martin may not immediately evoke a direct connection to financial markets, they can symbolize two distinct approaches to investing—one grounded in traditional assets and the other exploring modern instruments—each offering unique risk-reward profiles that resonate with different investor objectives. By dissecting these methods in the context of 2023, we can uncover actionable insights that help individuals tailor their financial strategies to align with their goals.

The year 2023 has presented a complex interplay of factors that influence earnings potential. Central banks around the world have maintained hawkish stances, with the Federal Reserve, European Central Bank, and others continuing to raise interest rates to combat inflation. This environment has elevated the cost of capital for businesses, thereby impacting corporate profits and, by extension, the returns on equity investments. At the same time, the global economy has shown resilience in certain sectors, such as technology and renewable energy, while facing challenges in others like consumer discretionary and real estate. These divergent performances have created opportunities for investors to capitalize on growth while strategically mitigating risks. For instance, the rise of artificial intelligence and automation has spurred innovation in the tech sector, leading to significant gains for companies at the forefront of these advancements. Conversely, the housing market has remained sluggish in many regions, prompting investors to reassess their exposure to real estate-related assets.

In this dynamic context, traditional investment approaches, akin to the metaphorical "Tank," have demonstrated steadfastness. Bonds, particularly government and high-grade corporate debt, have remained attractive for risk-averse investors due to their relative stability. In 2023, despite rising interest rates, the demand for fixed-income securities was bolstered by their role as a hedge against market volatility. Fixed-rate bonds, for example, provided predictable returns, making them a reliable component of a diversified portfolio. Moreover, the yield curve inversion in the early part of the year raised concerns about potential economic downturns, reinforcing the importance of maintaining a balance between equity and debt investments. This approach prioritizes capital preservation, ensuring that investors can weather market fluctuations while maintaining a baseline of income.

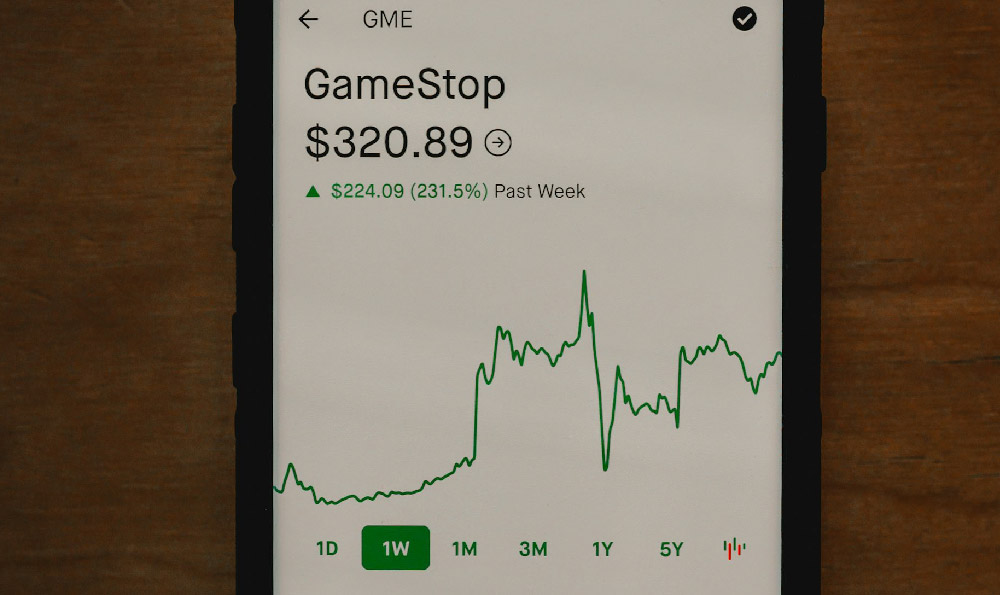

On the other hand, the more modern and aggressive strategy, represented by "Martin," has focused on capturing the upside of emerging trends. This approach often involves exposure to equities, especially those in high-growth sectors, as well as alternative assets like private equity, venture capital, and even cryptocurrencies. In 2023, the tech sector experienced a surge, driven by rapid advancements in AI, cybersecurity, and cloud computing. Companies with strong fundamentals and innovative business models saw their stock prices rise significantly, offering substantial returns to investors willing to take on higher risk. Similarly, the shift towards sustainable and green investments accelerated, with renewable energy stocks and ESG-focused funds outperforming traditional benchmarks. These opportunities highlight the importance of staying ahead of market trends and adapting investment strategies to capitalize on growing industries.

However, the effectiveness of these approaches depends on the investor's risk tolerance, time horizon, and financial goals. Traditional methods like bonds provide stability but may offer lower returns, while modern strategies involving equities and alternative assets can yield higher rewards but come with increased volatility. In 2023, the key to successful investing lay in finding the right balance between these extremes. Investors who maintained a diversified portfolio, incorporating both defensive and growth-oriented assets, were better positioned to navigate the year's uncertainties. For example, allocating a portion of the portfolio to equities while hedging with bonds allowed investors to benefit from market growth while safeguarding against potential downturns.

Furthermore, the role of asset allocation in 2023 cannot be overstated. The global market's unpredictable nature necessitated a flexible and adaptive approach. Investors who regularly rebalanced their portfolios to maintain target allocations were able to mitigate the impact of prolonged market swings. This principle is particularly relevant in a year characterized by geopolitical tensions, which introduced additional layers of uncertainty. By maintaining a balanced exposure across asset classes, investors could protect their capital from overexposure to any single market segment.

Another aspect to consider is the integration of technology into investment strategies. The proliferation of fintech tools and robo-advisors in 2023 enabled more efficient and personalized portfolio management. These platforms allowed investors to access real-time data, automate rebalancing, and optimize their asset allocation based on their risk profiles. For instance, algorithm-driven investment strategies helped capitalize on arbitrage opportunities between different markets, while data analytics provided insights into emerging trends and potential investment targets. This technological advancement underscored the importance of staying informed and leveraging innovation to enhance investment outcomes.

In conclusion, the year 2023 highlighted the significance of adopting a multifaceted approach to investing. While traditional methods offered stability, modern strategies opened avenues for higher returns, emphasizing the need for balance and adaptability. By understanding the interplay of macroeconomic conditions, market trends, and technological advancements, investors can craft strategies that align with their financial goals. The comparison between Tank and Martin serves as a metaphor for the spectrum of investment approaches, underscoring that success lies in finding the right equilibrium between risk and reward. As the financial landscape continues to evolve, the ability to adapt and refine one's investment strategy will remain essential in achieving long-term wealth growth.