Investing in the stock market has long been touted as a path to wealth creation. The alluring prospect of seeing your money grow exponentially is certainly tempting. However, the reality is far more nuanced than simple get-rich-quick schemes. Whether you can really make money in stocks, and how to do so, hinges on a complex interplay of factors, from understanding market dynamics to employing disciplined investment strategies.

The fundamental answer is yes, you can make money investing in stocks. Historical data overwhelmingly supports this assertion. Over the long term, the stock market has consistently outperformed other asset classes, such as bonds or real estate. The S&P 500, a broad market index tracking 500 of the largest publicly traded companies in the United States, has delivered an average annual return of around 10% historically. This doesn't mean you'll see a consistent 10% return every year; some years will be higher, others lower, and some may even be negative. However, over decades, the general trend has been upward. This long-term growth potential is the primary reason why stocks are a cornerstone of many retirement portfolios.

However, achieving these returns requires a clear understanding that the stock market is not a lottery. It's a complex ecosystem driven by a multitude of factors, including economic indicators, company performance, investor sentiment, and global events. Successful stock market investing necessitates diligent research, strategic planning, and a long-term perspective. Jumping in and out based on short-term market fluctuations, or blindly following the hype surrounding a particular stock, is a recipe for disaster.

One crucial element in making money from stocks is understanding the difference between investing and speculation. Investing involves purchasing assets with the expectation of long-term growth and income generation. This typically involves holding stocks for several years, even decades, allowing them to compound over time. Speculation, on the other hand, is a shorter-term approach that focuses on profiting from rapid price movements. While speculation can sometimes yield quick gains, it also carries a significantly higher risk of loss. The vast majority of successful stock market participants are investors, not speculators. They prioritize long-term value creation over short-term profits.

The "how" of making money in stocks is multifaceted and depends largely on your individual risk tolerance, financial goals, and time horizon. However, some fundamental strategies have proven effective for many investors. One of the most common, and often recommended, approaches is diversification. Diversification involves spreading your investments across a variety of stocks, industries, and even asset classes. This helps to mitigate risk by ensuring that a downturn in one area of your portfolio won't decimate your overall returns. Think of it as not putting all your eggs in one basket.

Another important strategy is to invest in companies with strong fundamentals. This means looking for companies that have a proven track record of profitability, solid balance sheets, and a competitive advantage in their respective industries. Analyzing financial statements, reading industry reports, and keeping up with company news can help you identify these high-quality businesses. Investing in these companies, even if their stock price is not currently soaring, offers a greater chance of long-term success because their inherent value will likely be reflected in their stock price over time.

Dollar-cost averaging is another technique that can help reduce risk and improve returns. This involves investing a fixed amount of money at regular intervals, regardless of the current stock price. When prices are low, you buy more shares; when prices are high, you buy fewer shares. This helps to smooth out the volatility of the market and prevent you from making emotionally driven decisions, such as buying high and selling low.

Furthermore, it's crucial to be aware of the various costs associated with stock market investing. Brokerage fees, trading commissions, and expense ratios on mutual funds and ETFs can eat into your returns. Choosing a low-cost brokerage and opting for passively managed index funds can help minimize these costs and maximize your profits.

Equally important is the need to avoid common investment pitfalls. One of the biggest mistakes investors make is letting emotions dictate their decisions. Fear and greed can lead to impulsive buying and selling, often at the worst possible times. It's essential to develop a disciplined investment plan and stick to it, even when the market is volatile.

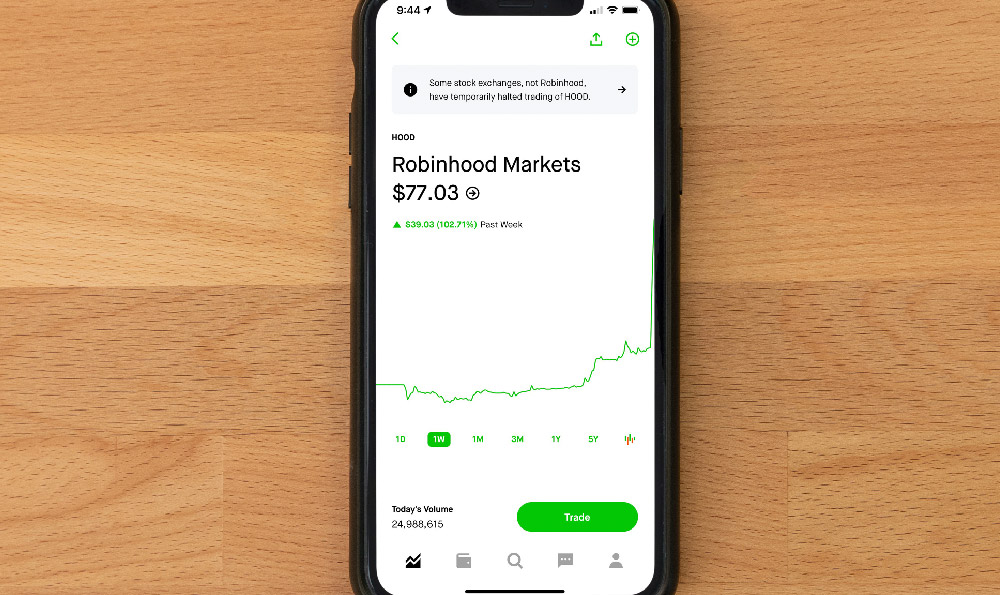

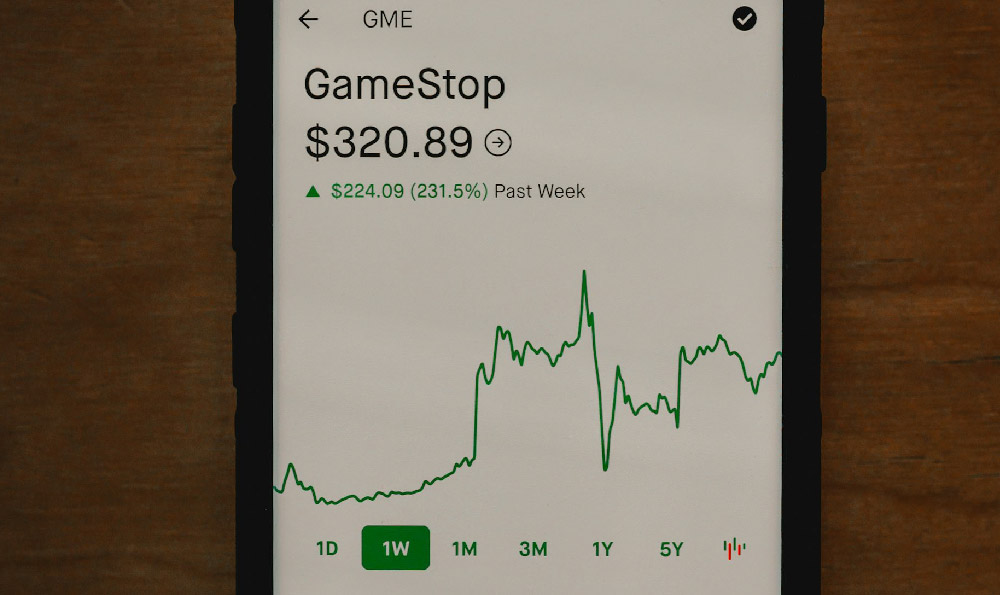

Another common pitfall is chasing "hot stocks" or falling for get-rich-quick schemes. These often involve investing in companies with little or no fundamentals, based solely on hype or speculation. While some investors may get lucky with these types of investments, the vast majority lose money in the long run.

Finally, remember that investing in the stock market is a long-term game. There will be ups and downs along the way. It's important to stay patient, stay informed, and stay disciplined. By following a sound investment strategy and avoiding common pitfalls, you can increase your chances of making money in the stock market and achieving your financial goals. While there are no guarantees of success, a well-informed and disciplined approach significantly increases your odds of long-term wealth creation.