State representatives, the individuals elected to represent their constituents in state legislatures, derive their income from a variety of sources. Understanding these income streams is crucial for evaluating their financial independence, potential conflicts of interest, and the overall accountability of state government. While salaries and benefits form the core of their compensation, a closer look reveals a more complex financial landscape.

The primary source of income for state representatives is their salary. State legislatures, unlike the federal government, operate with varying degrees of professionalization. This directly impacts the compensation offered to lawmakers. Some states, like California and Pennsylvania, have full-time legislatures, meaning representatives are expected to devote their primary efforts to legislative duties. In these states, salaries are comparatively higher, reflecting the demand for a full-time commitment. These salaries can range from approximately $80,000 to over $100,000 per year. This full-time nature often limits outside employment opportunities.

Conversely, many states have part-time or "citizen" legislatures. In these instances, lawmakers are expected to maintain other employment or professional activities alongside their legislative service. Salaries in these states are significantly lower, sometimes only a few thousand dollars annually. The expectation is that these representatives will derive the bulk of their income from other sources. This model relies on the idea that citizen legislators bring diverse perspectives and experiences from their respective professions to the legislative process. States with this model include New Hampshire, Wyoming, and Vermont.

In addition to salaries, state representatives typically receive benefits packages. These benefits can include health insurance, dental insurance, vision insurance, and life insurance. The value of these benefits can be substantial, particularly in states with robust public employee benefits systems. Furthermore, many states offer retirement plans or pension programs for their legislators. The specifics of these retirement benefits vary widely across states, with some offering defined-benefit plans and others opting for defined-contribution plans. The availability and generosity of these benefits can be a significant factor in attracting and retaining qualified individuals to public service.

Another important component of a state representative's compensation package is per diem and expense reimbursements. Per diem, a daily allowance, is intended to cover the costs of meals, lodging, and incidental expenses incurred while attending legislative sessions or official meetings. Expense reimbursements cover specific costs such as travel expenses, office supplies, and constituent outreach activities. The rules governing per diem and expense reimbursements vary considerably between states, with some states having strict documentation requirements and others operating under more flexible guidelines. Public scrutiny of these reimbursements is common, particularly when perceived as excessive or mismanaged.

Beyond direct compensation, state representatives may also have income from outside employment or business activities. This is particularly relevant in states with part-time legislatures. Representatives may be attorneys, business owners, consultants, farmers, or hold other professional positions. The potential for conflicts of interest arising from these outside activities is a constant concern. To mitigate this risk, many states have ethics laws and disclosure requirements in place, requiring representatives to disclose their financial interests and recuse themselves from votes that could directly benefit them financially. The effectiveness of these laws and the level of enforcement varies from state to state.

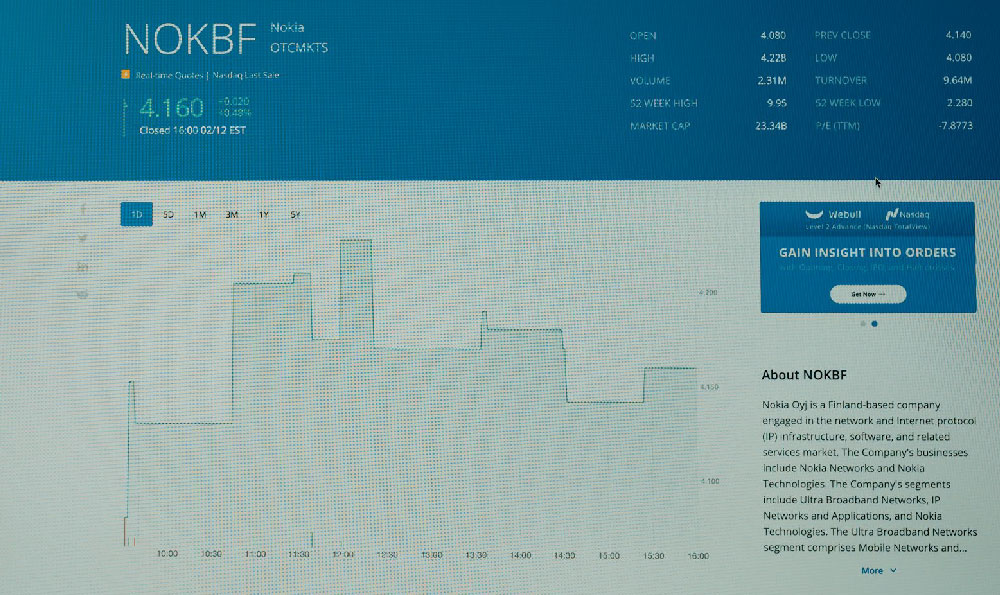

Furthermore, state representatives may receive income from investments, such as stocks, bonds, real estate, or business ownership. Again, transparency and disclosure are crucial to prevent conflicts of interest. Representatives are typically required to disclose these investments on financial disclosure forms, which are often accessible to the public. The extent to which these investments influence legislative decisions is a matter of ongoing debate and ethical consideration.

Finally, some state representatives may receive income from speaking engagements, honorariums, or book royalties. While these sources of income may be less common than salaries or outside employment, they can still contribute to a representative's overall financial picture. Regulations regarding these types of income vary, with some states placing limits on the amount a representative can receive or requiring disclosure of the source and amount of the income.

In summary, state representatives earn money from a variety of sources, including salaries, benefits, per diem and expense reimbursements, outside employment, investments, and other income-generating activities. The relative importance of each source varies depending on the degree of professionalization of the state legislature and the individual circumstances of the representative. Transparency, disclosure, and ethical oversight are essential to ensure that representatives act in the best interests of their constituents and that potential conflicts of interest are appropriately managed. The complexities of these income streams underscore the importance of a well-informed public and a vigilant press in holding state representatives accountable and promoting good governance. Understanding these details is paramount for fostering trust and ensuring the integrity of the legislative process at the state level.