Okay, here's an article exploring how to profit from options and the realities of making money with them, formatted without excessive bullet points or numbered lists, and avoiding the repetition of the title.

How to potentially profit from options and if it is realistic to make money from them is one of the most highly discussed topics in the investment world. Options, with their inherent leverage and versatility, offer a myriad of ways to generate profits. However, they also come with significant risks. Understanding the strategies, the market dynamics, and your own risk tolerance is paramount to success. The allure of quick, substantial gains often masks the complex realities of options trading.

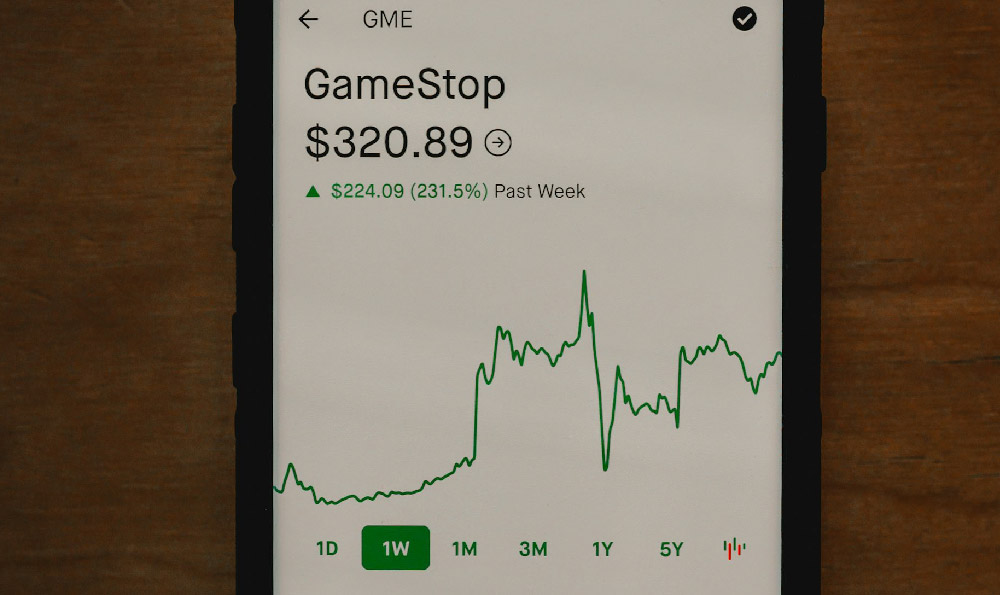

One of the primary ways individuals profit from options is through directional bets. If you believe a stock's price will increase, you can buy call options. A call option gives you the right, but not the obligation, to buy the stock at a specific price (the strike price) before a certain date (the expiration date). If the stock price rises above the strike price, the call option becomes "in the money" and its value increases. You can then sell the option for a profit. Conversely, if you expect a stock's price to decline, you can buy put options. A put option gives you the right to sell the stock at a specific price before the expiration date. If the stock price falls below the strike price, the put option becomes "in the money" and its value increases. Again, you can sell the option for a profit.

However, directional trading is not as simple as predicting which way a stock will move. The timing and the magnitude of the move are crucial. An option's value is influenced by several factors, including the underlying asset's price, time until expiration, volatility, interest rates, and dividends. Volatility, often measured by the "Greeks" (Delta, Gamma, Theta, Vega, Rho), plays a particularly important role. High volatility generally increases the value of both call and put options, while low volatility decreases their value. Theta represents the time decay of an option's value. As an option approaches its expiration date, its value erodes, especially if it is out of the money. This means that even if your directional prediction is correct, but the stock moves too slowly, or volatility decreases, you could still lose money.

Beyond simple directional bets, options offer more sophisticated strategies. Covered calls, for instance, involve selling call options on a stock you already own. This strategy generates income in the form of the premium received from selling the call option. The downside is that you limit your potential profit if the stock price rises significantly, as you might be forced to sell your stock at the strike price. Protective puts, on the other hand, involve buying put options on a stock you own as insurance against a price decline. This strategy limits your potential losses but reduces your potential profits by the cost of the put options.

Straddles and strangles are volatility strategies. A straddle involves buying both a call and a put option with the same strike price and expiration date. This strategy profits if the stock price moves significantly in either direction, regardless of whether it goes up or down. A strangle is similar to a straddle but uses different strike prices, making it cheaper to implement but requiring a larger price movement to be profitable. Iron condors and butterflies are more complex strategies that combine multiple call and put options to profit from limited price movements or specific price ranges.

Is it possible to make money with options? Absolutely. However, it's not a guaranteed path to riches. The risk of losing your entire investment is very real, especially if you're buying options and the underlying asset doesn't move as expected before the expiration date. The vast majority of options expire worthless, meaning that buyers lose the premium they paid. To succeed with options, you need a solid understanding of options pricing, risk management techniques, and a well-defined trading plan.

A comprehensive trading plan should include your investment goals, risk tolerance, capital allocation, entry and exit strategies, and position sizing rules. Risk management is crucial. Never risk more than you can afford to lose on a single trade. Use stop-loss orders to limit potential losses. Diversify your portfolio across different assets and strategies.

Furthermore, it is necessary to continuously educate yourself about the market and adapt your strategies as market conditions change. Reading books, attending seminars, and following experienced options traders can provide valuable insights. It is also wise to paper trade – simulate trading with virtual money – to test your strategies before risking real capital.

In conclusion, options can be a powerful tool for generating profits, but they are not a shortcut to wealth. Success in options trading requires knowledge, discipline, a well-defined trading plan, and a healthy dose of risk management. Treat options with respect, understand the risks involved, and never invest more than you can afford to lose. With the right approach, options can be a valuable addition to your investment portfolio. However, without proper understanding and caution, they can lead to significant financial losses.