It's crucial to understand that attributing specific financial success solely to cryptocurrency investments, especially for public figures like Marjorie Taylor Greene, often requires speculation and publicly available information rather than definitive, inside knowledge. Without access to her detailed financial records, any analysis relies on documented transactions, media reports, and deductions based on her public statements and activities.

Greene's financial disclosure forms, required for members of Congress, provide some insights, although they often present asset ranges rather than precise figures. These forms typically reveal holdings in stocks, mutual funds, real estate, and potentially, cryptocurrency assets. The ranges reported can make it difficult to ascertain the precise composition and growth of her wealth. Public sentiment towards cryptocurrency, especially among certain political demographics, might influence investment strategies; however, it's essential to separate political views from purely financial motivations.

One potential avenue for wealth accumulation, particularly in the early days of cryptocurrency, lies in identifying promising projects with significant growth potential before they become mainstream. Early investors in Bitcoin and Ethereum, for example, experienced exponential returns as adoption increased. While there is no concrete evidence to suggest that Greene was among these very early adopters, her investments, if present in the cryptocurrency market early on, could have contributed to her overall financial portfolio.

Furthermore, her platform as a public figure could potentially open doors to exclusive investment opportunities not available to the average investor. Venture capitalists and private equity firms sometimes offer preferential deals to individuals with substantial influence, though again, no specific evidence connects this to Greene. Networking within political and business circles can also provide access to valuable information about emerging market trends and investment possibilities.

Another contributing factor to wealth accumulation can be astute business acumen and entrepreneurial ventures. Before entering politics, Greene was involved in her family's construction business, Taylor Commercial. Managing and expanding this business, or subsequently selling it, could have provided a significant capital base for further investments. The construction industry itself can generate substantial wealth through property development, land acquisition, and strategic partnerships.

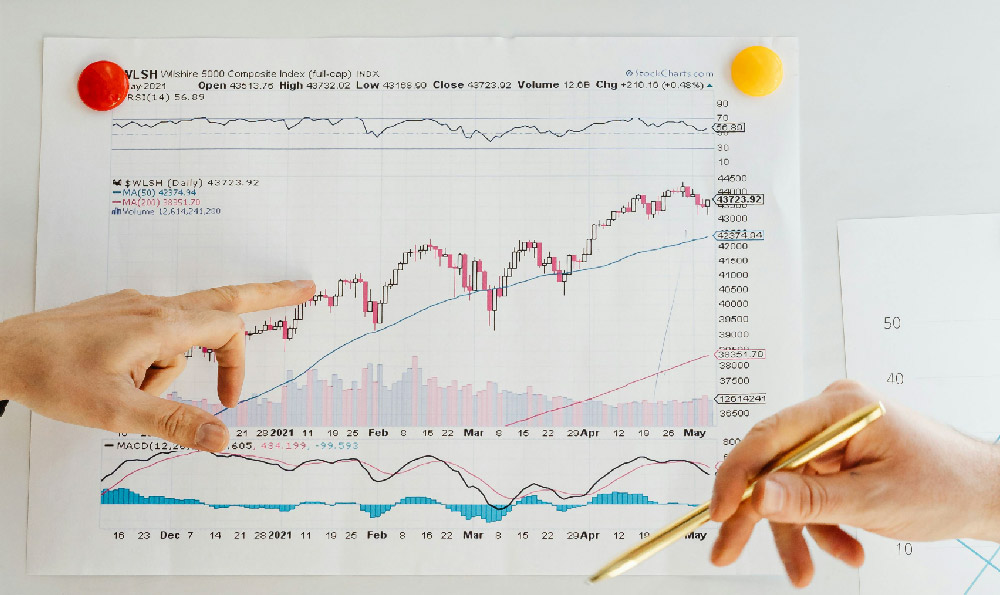

The stock market, even without direct involvement in cryptocurrency, remains a primary wealth-building tool for many individuals. Investing in a diversified portfolio of stocks, bonds, and other securities can yield steady returns over time. If Greene held a substantial portfolio of traditional assets prior to venturing into cryptocurrency, the returns from those investments could have significantly boosted her net worth.

Real estate holdings can also play a significant role in wealth accumulation. Owning and managing properties, whether residential or commercial, can generate rental income and appreciate in value over time. If Greene has a portfolio of real estate investments, this could contribute to her overall financial success, independent of cryptocurrency.

Beyond specific investments, financial literacy and disciplined money management are crucial for building wealth. Understanding how to budget, save, and invest wisely can make a significant difference in the long run. It's possible that Greene has a strong grasp of financial principles and consistently makes sound financial decisions, regardless of the specific assets she holds.

Moreover, it is important to acknowledge the potential for inheritance or family wealth to contribute to someone's financial standing. If Greene inherited assets from her family, this could be a significant factor in her overall net worth. While this isn't necessarily related to her investment acumen, it's an important consideration when assessing someone's financial success.

It is also critical to consider the limitations of publicly available information. Financial disclosure forms provide only a snapshot of a person's assets at a particular point in time. They may not reflect the full extent of their holdings or the strategies they use to manage their wealth. Furthermore, these forms often allow for significant ranges in reporting asset values, making it difficult to determine the precise composition of someone's portfolio.

Finally, it is vital to approach any analysis of someone's wealth with a critical and unbiased perspective. Sensationalist headlines and speculation can often distort the truth. It's important to rely on verifiable information and avoid making assumptions based on incomplete data. While cryptocurrency investments may play a role in Marjorie Taylor Greene's financial picture, the precise extent and impact are difficult to determine without access to more comprehensive financial records. A confluence of factors, including business ventures, traditional investments, real estate holdings, and potentially, cryptocurrency investments, likely contribute to her overall wealth. Moreover, her acumen in managing and growing those resources plays a critical role in her overall success.