In the modern era, the concept of earning income has evolved beyond the traditional constraints of time and location, offering individuals the opportunity to generate wealth from the comfort of their own homes. This shift is driven by technological advancements, digital platforms, and a growing demand for flexible solutions, making it possible to explore diverse avenues for financial gain. However, navigating these opportunities requires a blend of strategic thinking, risk management, and an understanding of market dynamics. To build a sustainable income stream at home, one must consider both active and passive methods, each with its unique advantages and considerations.

The foundation of independent income generation often lies in leveraging personal skills and passions, transforming them into monetizable assets through digital means. For example, developing niche expertise in areas such as graphic design, content creation, or virtual assistance allows individuals to offer their services globally via platforms like Upwork, Fiverr, or LinkedIn. These platforms not only provide access to a vast client base but also enable freelancers to set flexible schedules, balancing work with other responsibilities. Success in this domain hinges on quality delivery, client satisfaction, and market competitiveness. As the digital economy expands, opportunities for remote service-based work are growing, but they also demand continuous learning and adaptability to remain relevant.

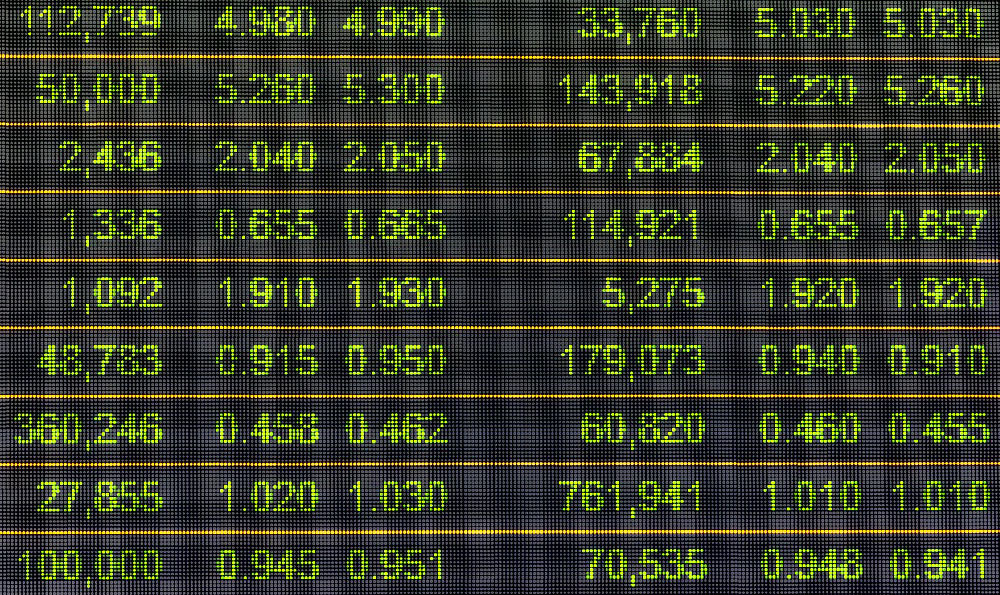

Investing in financial instruments and assets represents another promising path for generating income without active labor. By allocating resources strategically across stocks, bonds, real estate, or cryptocurrencies, individuals can benefit from the compounding effect of returns over time. However, the risks associated with market volatility necessitate a diversified portfolio and long-term perspective. For instance, investing in dividend-paying stocks or index funds can provide steady income through regular payouts and growth. Similarly, real estate investment trusts (REITs) allow individuals to participate in property markets without the burden of direct property management. The key to success here is understanding the risk-reward trade-off, conducting thorough research, and maintaining a disciplined approach to asset allocation.

In addition to active income generation, passive income streams such as rental properties, royalties, or affiliate marketing offer a way to earn money with minimal ongoing effort. Rental properties, for example, can provide a consistent cash flow through monthly lease payments, though they also entail maintenance, legal formalities, and location-specific challenges. Digital products like e-books, online courses, or software offerings can generate passive income through one-time sales or recurring subscriptions, depending on the model. Platforms like Gumroad or Udemy enable creators to reach a global audience, while affiliate marketing leverages online presence to earn commissions from product sales. The secret to sustained passive income lies in creating value that consumers are willing to pay for, and in maintaining a steady stream of content or services over time.

The rise of e-commerce and dropshipping has also transformed home-based income generation, offering low-cost entry into global markets. By establishing an online store on platforms such as Shopify or Etsy, individuals can sell handmade goods, vintage items, or digital products, bypassing the need for physical inventory. Dropshipping further reduces financial risk by allowing entrepreneurs to purchase products directly from suppliers and fulfill orders through third-party logistics. However, success in e-commerce depends on a deep understanding of market trends, effective marketing strategies, and customer service expertise. Tools like social media analytics, SEO, and targeted advertising can help businesses thrive in this competitive landscape.

Moreover, the growing attention to personal development and niche markets offers untapped potential for at-home income generation. Creating content through blogs, podcasts, or YouTube channels can attract audiences and generate income through advertising, sponsorships, or affiliate links. Ventures in areas like pet care, gardening, or wellness can also find their place in the market, particularly as demand for specialized services increases. The challenge here is to identify a unique value proposition, build a loyal audience, and consistently deliver content that meets their needs.

Ultimately, the pursuit of income at home is not a one-size-fits-all solution, but a dynamic process that requires careful planning, adaptability, and a focus on long-term goals. Whether through active efforts in service provision, strategic investments, or digital entrepreneurship, individuals can build financial independence by aligning their skills with market opportunities. However, the importance of risk assessment and financial discipline cannot be overstated, as they serve as the cornerstone of sustainable wealth creation. By cultivating a diverse income portfolio and staying attuned to evolving market trends, individuals can navigate the complexities of at-home income generation with confidence and achieve their financial aspirations.