Navigating the complexities of the stock market requires a nuanced understanding of various factors influencing a particular company's performance. Evaluating whether now is the optimal time to invest in a stock, let's hypothetically call it "S," necessitates a thorough analysis encompassing the company's financials, industry trends, macroeconomic conditions, and individual investor risk tolerance. Jumping into a position without considering these elements is akin to navigating a ship without a compass – you might eventually reach land, but the journey will be fraught with unnecessary risks and uncertainties.

Before making any investment decision, a deep dive into the company's financial health is paramount. Scrutinize S's recent earnings reports, paying close attention to revenue growth, profitability margins, and debt levels. Consistently increasing revenue signifies growing market demand for its products or services. A robust profit margin demonstrates efficient management of expenses and the ability to generate substantial profits from sales. A manageable debt level indicates financial stability and the capacity to withstand economic downturns. However, simply glancing at the numbers isn't enough. One needs to understand the context behind these figures. Are the revenue increases sustainable, or are they a one-time anomaly? Are the profit margins industry-leading, or merely average? Is the debt level decreasing or increasing over time? Analyzing these trends provides a more comprehensive picture of the company's financial trajectory.

Beyond the company's financials, it's crucial to understand the industry in which S operates. Is the industry experiencing rapid growth, consolidation, or disruption? Emerging technologies, changing consumer preferences, and evolving regulatory landscapes can significantly impact a company's prospects. For example, if S operates in the electric vehicle (EV) industry, understanding the growth projections for EVs, the competition from other EV manufacturers, and the government incentives supporting EV adoption is vital. Conversely, if S operates in a declining industry, even a well-managed company may struggle to achieve significant growth. A thorough understanding of the industry allows investors to assess the potential upside and downside risks associated with investing in S.

Macroeconomic conditions also play a significant role in determining the attractiveness of an investment. Factors such as interest rates, inflation, and economic growth can significantly impact investor sentiment and corporate profitability. Rising interest rates, for instance, can make it more expensive for companies to borrow money, potentially hindering their growth. High inflation can erode consumer purchasing power, leading to decreased demand for products and services. A slowing economy can reduce corporate earnings and lead to stock market volatility. Conversely, low interest rates, low inflation, and a growing economy can create a favorable environment for businesses to thrive and for stock prices to appreciate. Therefore, understanding the prevailing macroeconomic conditions and their potential impact on S is crucial.

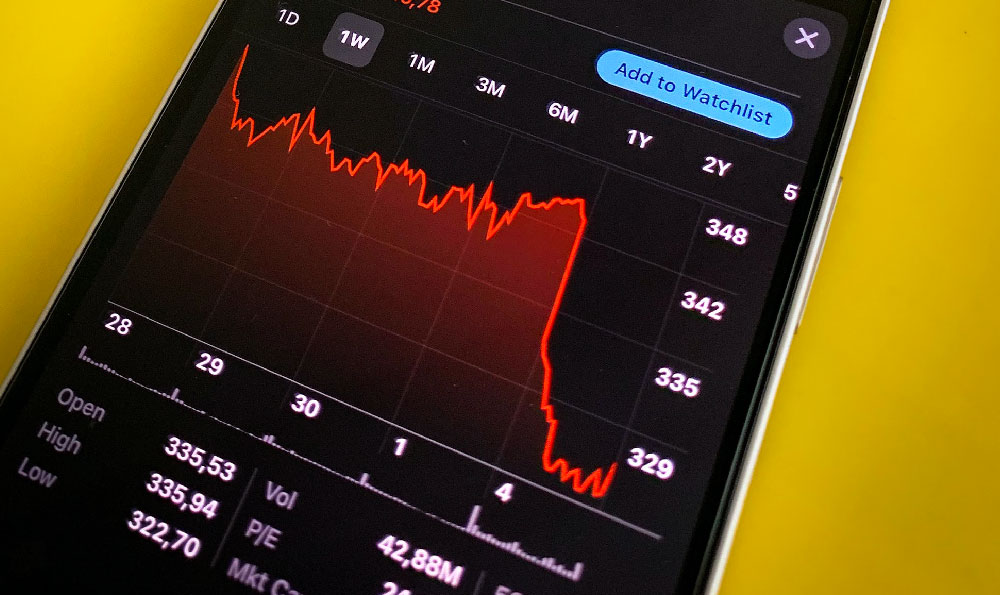

Furthermore, the current valuation of S is a key consideration. Is the stock trading at a premium or a discount compared to its peers and its historical averages? Metrics like the price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio, and price-to-book (P/B) ratio can provide insights into the stock's valuation. A high P/E ratio, for example, might suggest that the stock is overvalued, while a low P/E ratio might indicate that it's undervalued. However, these ratios should be used in conjunction with other factors, as they don't tell the whole story. A high P/E ratio might be justified if the company is experiencing rapid growth and is expected to generate significant future earnings. Conversely, a low P/E ratio might be a red flag if the company is facing significant challenges. Comparing S's valuation metrics to those of its competitors and its own historical averages can help investors determine whether the stock is fairly priced.

Finally, individual investor risk tolerance is a critical factor. Investing in the stock market inherently involves risk, and investors should only invest money that they can afford to lose. Younger investors with a longer time horizon may be able to tolerate more risk than older investors who are closer to retirement. Diversification is a key strategy for managing risk. Instead of putting all your eggs in one basket, spreading your investments across different asset classes, industries, and geographies can help mitigate potential losses. Understanding your own risk tolerance and developing a well-diversified investment portfolio is crucial for achieving long-term financial success.

Ultimately, the decision of whether to invest in S now or wait depends on a comprehensive assessment of all these factors. There's no one-size-fits-all answer, and what's right for one investor may not be right for another. By carefully analyzing the company's financials, industry trends, macroeconomic conditions, and valuation, and by considering your own risk tolerance, you can make a more informed investment decision and increase your chances of achieving your financial goals. It's crucial to remember that investing is a marathon, not a sprint. Patience, discipline, and a long-term perspective are essential for success. Consult with a qualified financial advisor if you need personalized guidance.