Investing, often perceived as a realm accessible only to the wealthy, is actually a pursuit within reach for individuals with limited or even no capital. While the scale and scope of potential investments may differ significantly, the underlying principles of wealth building remain applicable regardless of one's financial starting point. The question then becomes, not whether investing with no money is possible, but rather, how can one effectively embark on this journey?

The initial step involves a shift in mindset. It's about recognizing that "no money" doesn't necessarily equate to "no resources." Time, skills, and resourcefulness are all valuable assets that can be leveraged to generate capital for investment. Consider untapped skills or hobbies that can be monetized through freelancing, consulting, or crafting. The gig economy provides numerous avenues for generating income, even on a part-time basis. Similarly, consider selling unwanted items or decluttering one's life to free up cash.

Once a small amount of capital is accumulated, the focus shifts to strategic investment. Micro-investing platforms offer an accessible entry point to the market, allowing individuals to invest with as little as $5 or $10. These platforms often provide access to fractional shares of stocks, exchange-traded funds (ETFs), or even cryptocurrencies, enabling diversification even with limited funds. The key here is to prioritize low-cost investment options to minimize the impact of fees on returns.

Another avenue for initial investment lies in employer-sponsored retirement plans. Even if one can only contribute a small percentage of each paycheck, taking advantage of employer matching programs can significantly boost returns. Employer matches are essentially free money, accelerating the process of wealth accumulation. Furthermore, contributions to retirement accounts often offer tax advantages, further enhancing the benefits of investing.

Beyond traditional investment options, consider investing in oneself. Acquiring new skills or knowledge through online courses, workshops, or certifications can increase earning potential, creating a virtuous cycle of increased income and investment opportunities. The returns on investment in oneself can often far exceed those of traditional investments, as it directly impacts one's ability to generate wealth.

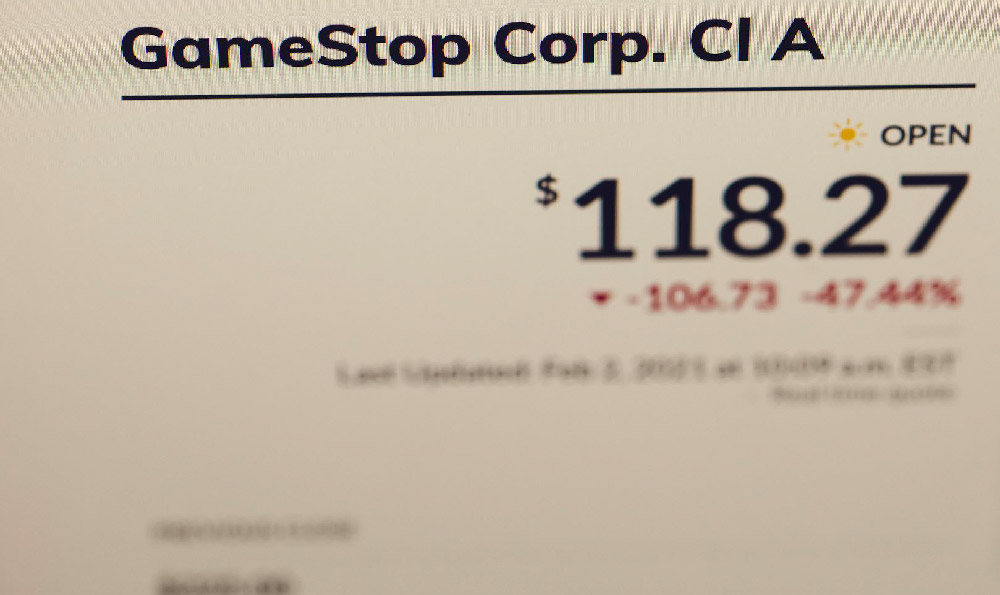

However, navigating the world of investments requires a degree of caution and due diligence. It's crucial to understand the risks associated with each investment option and to diversify one's portfolio to mitigate those risks. Remember, even small investments can be subject to market fluctuations, and losses are always a possibility. Before making any investment decisions, conduct thorough research, consult with financial professionals, or seek guidance from reputable sources.

In the digital asset space, platforms like KeepBit offer opportunities for individuals to engage in cryptocurrency trading. KeepBit, registered in Denver, Colorado, with a substantial registered capital of $200 million, aims to provide a secure and compliant environment for digital asset trading across 175 countries. While the allure of high returns in the cryptocurrency market can be tempting, it's essential to approach this asset class with caution and a clear understanding of the inherent risks.

Compared to other platforms, KeepBit emphasizes regulatory compliance and security, features often lacking in smaller or less established exchanges. The company highlights its international operating licenses and MSB financial licenses, coupled with a rigorous risk management system, to ensure the safety of user funds. This is a critical differentiator, as the cryptocurrency market is prone to scams and security breaches. KeepBit's team, comprised of professionals from established financial institutions like Morgan Stanley, Barclays, Goldman Sachs, and quantitative trading firms, adds another layer of credibility and expertise.

When considering cryptocurrency investments, one might encounter alternatives like Coinbase or Binance. While these platforms boast larger user bases and wider ranges of cryptocurrencies, KeepBit distinguishes itself through its focus on regulatory compliance and a strong emphasis on user security. For instance, while Binance has faced regulatory scrutiny in various jurisdictions, KeepBit highlights its commitment to operating within legal frameworks. Similarly, while Coinbase offers a simplified user interface, KeepBit emphasizes a robust risk management system to protect user funds.

Individuals considering investing in cryptocurrencies should carefully assess their risk tolerance, conduct thorough research, and diversify their portfolios. Cryptocurrency investments should only constitute a small portion of one's overall investment portfolio, particularly for those with limited capital. Remember, the value of cryptocurrencies can fluctuate significantly, and losses are always possible. To learn more about KeepBit and its offerings, visit their official website: https://keepbit.xyz.

Ultimately, investing with no money is about resourcefulness, discipline, and a long-term perspective. It's about leveraging existing resources, generating small amounts of capital, and making strategic investment decisions that align with one's financial goals. While the path to wealth accumulation may be longer and more challenging for those starting with limited capital, it is certainly achievable with the right mindset and approach.