Investing in the NASDAQ offers a gateway to participating in the growth potential of some of the world's most innovative and dynamic companies. It's a market teeming with tech giants, biotech pioneers, and disruptive startups, presenting a compelling opportunity for investors seeking long-term capital appreciation. However, navigating the NASDAQ requires understanding the different investment options available, assessing your risk tolerance, and developing a sound investment strategy.

One of the most straightforward ways to invest in the NASDAQ is through Exchange Traded Funds (ETFs). ETFs are investment funds that hold a basket of stocks, mirroring a specific index or sector. For the NASDAQ, the most popular and widely traded ETF is the Invesco QQQ Trust (QQQ). This ETF tracks the performance of the NASDAQ-100 index, which comprises the 100 largest non-financial companies listed on the NASDAQ. Investing in QQQ provides instant diversification across a broad range of technology, consumer discretionary, healthcare, and communication services companies. It's a convenient and cost-effective option for investors looking to gain exposure to the NASDAQ without having to individually select and manage a portfolio of stocks. Other NASDAQ-focused ETFs may target specific sectors within the index, such as biotechnology or cybersecurity, allowing for more targeted investments based on individual interests and market outlooks.

Beyond ETFs, investors can directly purchase shares of individual companies listed on the NASDAQ. This approach allows for greater control over investment decisions and the potential for higher returns if the chosen companies outperform the market. However, it also requires more research and due diligence. Investors need to analyze company financials, understand their business models, assess their competitive landscape, and evaluate their growth prospects. Investing in individual stocks carries a higher degree of risk, as the performance of a single company can be volatile and unpredictable. It's crucial to diversify your stock holdings across different sectors and industries to mitigate the risk of significant losses. Before investing in any individual stock, thoroughly research the company's SEC filings, analyst reports, and news articles to make informed decisions.

Another avenue for investing in the NASDAQ, albeit a more complex one, is through options trading. Options contracts give the buyer the right, but not the obligation, to buy or sell a specific stock at a predetermined price on or before a specific date. Options can be used to speculate on the future price movement of NASDAQ-listed stocks or to hedge existing stock positions. For example, an investor who owns shares of a NASDAQ company could purchase put options to protect against potential price declines. Options trading involves a high degree of risk and requires a thorough understanding of options pricing, strategies, and risk management techniques. It's generally not recommended for beginner investors without proper education and experience.

Regardless of the investment method chosen, starting to invest in the NASDAQ requires opening a brokerage account. Numerous online brokers offer access to the NASDAQ market, with varying fee structures, trading platforms, and research tools. When choosing a broker, consider factors such as commission rates, account minimums, the availability of research reports and educational resources, and the user-friendliness of the trading platform. Once the account is open, funding it is the next step. Funds can be transferred from a bank account or other investment accounts.

Before making any investment decisions, it's essential to define your investment goals, risk tolerance, and time horizon. Are you investing for long-term retirement savings, a down payment on a house, or another specific goal? How comfortable are you with the possibility of losing money? How long do you plan to hold your investments? These factors will influence your investment strategy and the types of investments that are suitable for you. If you have a long time horizon and a high-risk tolerance, you may be comfortable investing a larger portion of your portfolio in growth-oriented NASDAQ stocks. If you have a shorter time horizon or a lower risk tolerance, you may prefer to allocate a larger portion of your portfolio to more conservative investments, such as bonds or dividend-paying stocks.

Diversification is a cornerstone of sound investment management. Don't put all your eggs in one basket. Spread your investments across different asset classes, sectors, and geographic regions to reduce risk. Even within the NASDAQ, diversify your holdings across different industries and company sizes. A well-diversified portfolio is less vulnerable to the ups and downs of any single investment.

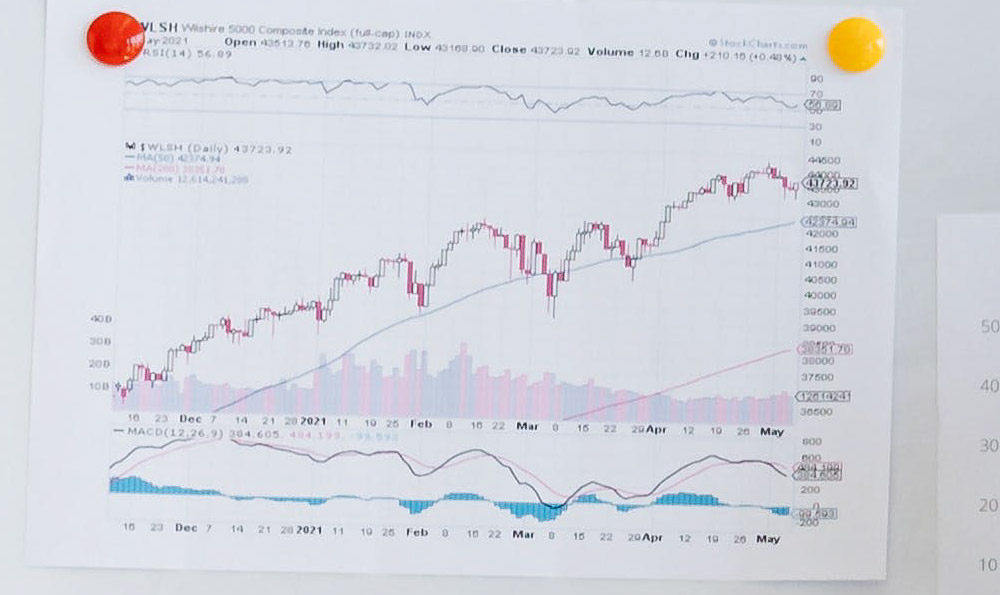

Investing in the NASDAQ is not a "set it and forget it" endeavor. It requires ongoing monitoring and adjustments. Regularly review your portfolio to ensure that it remains aligned with your investment goals, risk tolerance, and time horizon. Rebalance your portfolio periodically to maintain your desired asset allocation. This involves selling some of your winning investments and buying more of your losing investments to bring your portfolio back into balance. Market conditions change constantly, so it's important to stay informed about economic trends, company news, and industry developments.

Finally, consider seeking professional financial advice. A financial advisor can help you assess your financial situation, develop a personalized investment plan, and provide ongoing guidance and support. A qualified advisor can help you navigate the complexities of the financial markets and make informed investment decisions that align with your individual needs and goals. They can also help you avoid common investment mistakes and stay on track to achieve your financial objectives. While there are costs associated with professional advice, the benefits of having an experienced and knowledgeable advisor on your side can often outweigh the fees.