Okay, I understand. Here's an article responding to the title "Investing: What's Fact, What's Fiction?", aiming for comprehensive coverage and avoiding overly structured lists and direct repetitions of the title.

Investing, a cornerstone of wealth building and financial security, is often shrouded in myths and misconceptions, making it difficult for individuals to navigate the complexities of the financial world. Separating the realities of investing from the widespread falsehoods is crucial for making informed decisions and achieving long-term financial goals. The blurring of lines between legitimate strategies and speculative fads can lead to costly mistakes and disillusionment. Let’s dissect some common beliefs and unveil the truth behind them.

One pervasive notion is that investing is only for the wealthy. This simply isn't true. Thanks to the proliferation of online brokerage platforms, fractional shares, and low-cost index funds, investing is now more accessible than ever before. You don't need a fortune to begin. Even small, consistent contributions over time can compound significantly and generate substantial returns. The power of compounding, often described as earning interest on your interest, works best over longer periods, emphasizing the importance of starting early, regardless of the amount you can initially invest. Delaying investment due to the perceived need for a large initial sum is a missed opportunity to harness the power of time and compounding.

Another misconception is that you need to be an expert to succeed. While financial knowledge is undoubtedly beneficial, you don’t need to be a Wall Street analyst to build a successful investment portfolio. A basic understanding of diversification, risk tolerance, and different asset classes is sufficient to get started. Moreover, countless resources are available, from online tutorials and educational articles to financial advisors who can provide personalized guidance. The key is to commit to continuous learning and adapt your strategy as your understanding of the market evolves. Overcomplicating the process often leads to paralysis and inaction, while simplicity and consistency can be surprisingly effective. Passive investing, through index funds and ETFs, offers a straightforward way to participate in market growth without requiring constant monitoring or active trading.

The allure of "get-rich-quick" schemes is a siren song that has lured many investors to financial ruin. The truth is that sustainable wealth building is a marathon, not a sprint. Investments that promise unusually high returns often come with equally high risks. These schemes frequently involve unregulated markets, complex instruments, or outright fraud. A healthy dose of skepticism is crucial when evaluating investment opportunities. If something sounds too good to be true, it probably is. Focus instead on building a diversified portfolio of well-established assets with a proven track record of long-term growth. Patience and discipline are essential virtues in the world of investing.

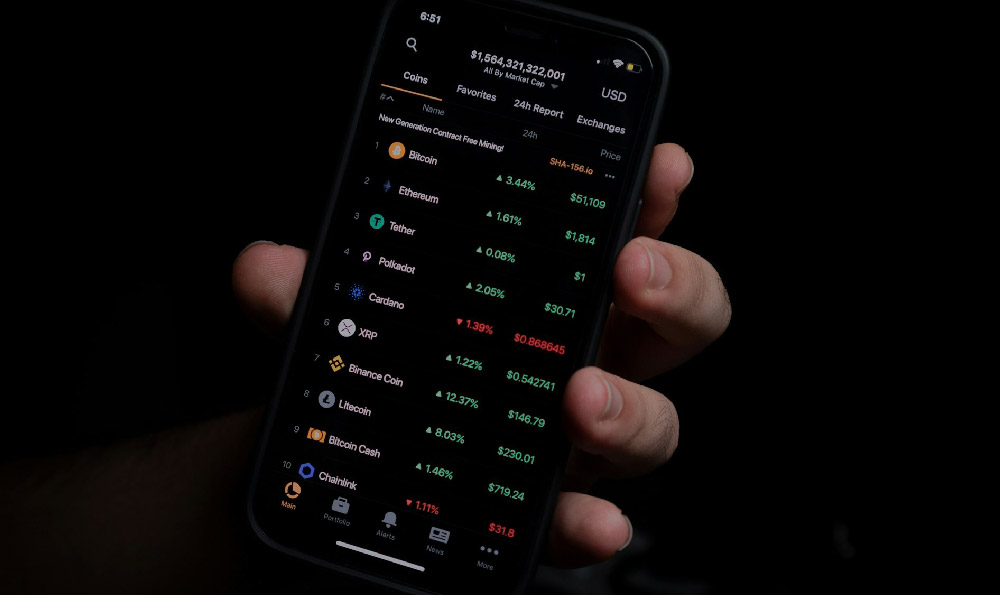

A common error is confusing speculation with investment. Speculation involves taking on significant risk in the hopes of achieving short-term gains. While speculation can occasionally yield lucrative returns, it is more akin to gambling than investing. Investing, on the other hand, is a long-term strategy focused on building wealth through the ownership of productive assets. It emphasizes careful research, diversification, and a commitment to holding investments through market fluctuations. The difference lies in the mindset and the time horizon. Speculators are primarily concerned with price movements, while investors are focused on the underlying value of the assets they own.

Many believe that timing the market is a viable strategy. Attempting to predict market highs and lows is a notoriously difficult, and often futile, endeavor. Even seasoned professionals struggle to consistently time the market successfully. Instead of trying to time the market, focus on time in the market. Dollar-cost averaging, a strategy of investing a fixed amount of money at regular intervals, can help mitigate the risk of buying at a market peak and take advantage of price dips. This approach eliminates the emotional component of timing the market and allows you to steadily build your portfolio over time.

The myth of "this time it's different" is a recurring trap that investors often fall into. Every market cycle is unique, but the underlying principles of investing remain constant. History provides valuable lessons about market behavior and risk management. Dismissing past patterns and believing that a new paradigm has emerged can lead to reckless decision-making. A healthy respect for historical data and a willingness to learn from past mistakes are crucial for avoiding costly errors. Understanding the cyclical nature of markets can help you stay grounded during periods of euphoria and navigate downturns with greater confidence.

Ignoring the impact of inflation is another common mistake. Inflation erodes the purchasing power of money over time. Investments that do not outpace inflation will effectively lose value. It’s crucial to consider the real rate of return, which is the return after accounting for inflation. Investments in assets that have the potential to generate returns above the inflation rate, such as stocks and real estate, are essential for preserving and growing wealth. Failing to factor in inflation can lead to a false sense of security and undermine long-term financial goals.

Finally, many believe that seeking professional advice is unnecessary. While it’s possible to manage your own investments, a qualified financial advisor can provide valuable guidance, particularly for those with complex financial situations or limited investment knowledge. A financial advisor can help you develop a personalized investment plan, manage risk, and stay on track towards your financial goals. The cost of professional advice can often be offset by the benefits of improved investment performance and reduced stress.

In conclusion, navigating the world of investing requires a critical eye and a healthy dose of skepticism. By separating fact from fiction, investors can make informed decisions, avoid costly mistakes, and build a solid foundation for long-term financial success. Remember that investing is a journey, not a destination, and continuous learning and adaptation are essential for navigating the ever-changing landscape of the financial markets. The key is to focus on building a diversified portfolio, staying disciplined, and remaining patient through market ups and downs. The truth about investing lies not in secret formulas or get-rich-quick schemes, but in sound principles, consistent effort, and a long-term perspective.