Investing in stocks to generate profitable returns is a strategy that requires more than just putting money into the market; it demands a nuanced understanding of market dynamics, disciplined execution, and the ability to navigate uncertainty with clarity. The stock market has historically been one of the most effective channels for wealth accumulation, offering the potential for compounding growth when approached with the right mindset and tools. However, the path to success is rarely linear, and the key lies in separating genuine opportunities from the noise of short-term volatility. A successful investor recognizes that while stocks can deliver substantial gains, they also carry inherent risks, and mitigating these is as crucial as selecting the right assets.

The foundation of any profitable stock strategy begins with a clear purpose. Whether you are seeking steady income through dividends, capital appreciation via growth stocks, or a balance of both, your goals will shape the approach you take. For instance, an investor prioritizing long-term growth might allocate funds to companies with strong fundamentals and expansion potential, while a more conservative approach could focus on blue-chip stocks with stable earnings and low volatility. The critical factor is ensuring that your portfolio aligns with your risk tolerance and financial objectives. A well-defined investment thesis—rooted in research and analysis—helps avoid impulsive decisions driven by market hype or irrational fear. From this perspective, the stock market becomes not a gamble, but a sophisticated system where strategic positioning is paramount.

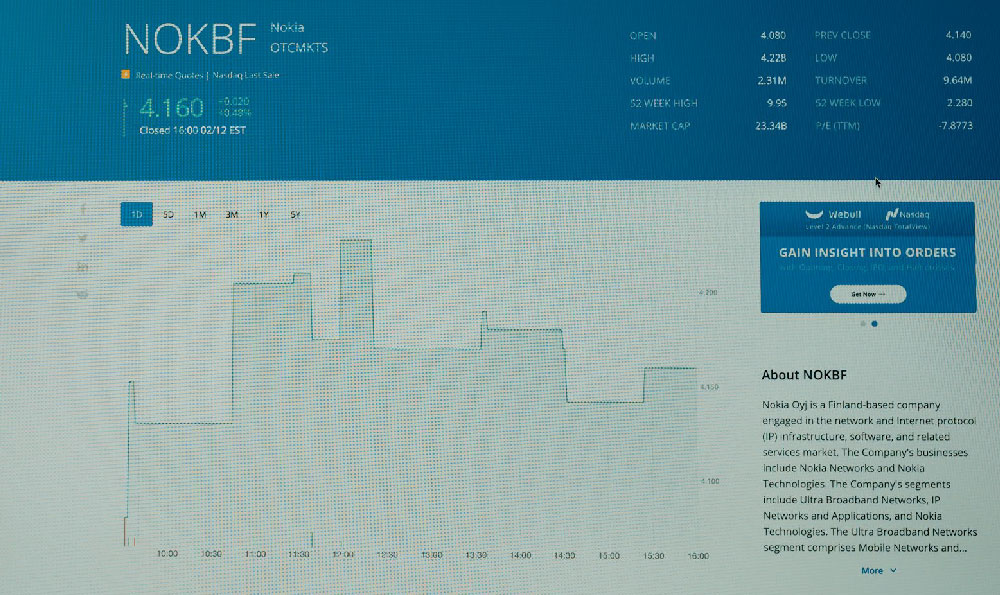

Understanding market trends is essential to identifying lucrative opportunities. Technical analysis, which examines price movements and trading volumes, can reveal patterns that suggest potential turning points. However, it is not enough to rely solely on charts; fundamental analysis offers deeper insights into a company's health. Financial metrics such as earnings reports, revenue growth, and balance sheet strength provide a clearer picture of a stock’s intrinsic value. For example, a company consistently outperforming its sector in terms of profit margins and innovation might be a compelling long-term holding. Conversely, one with deteriorating fundamentals despite short-term gains could signal an impending correction. Combining these two approaches allows investors to assess both the technical and fundamental landscapes, increasing the likelihood of informed decisions.

Risk management is another cornerstone of a sustainable stock strategy. Markets are inherently unpredictable, and even the most meticulously planned investments can face setbacks. A proactive mindset involves setting realistic expectations and preparing for volatility. Diversification across sectors, geographies, and asset classes can reduce exposure to specific risks, ensuring that a single event does not derail the entire portfolio. Additionally, maintaining a balanced approach between growth and value stocks allows for adaptability. While growth stocks may offer higher returns, they often come with greater short-term instability, whereas value stocks provide a buffer against market fluctuations. The concept of asset allocation—distributing investments based on risk profiles and time horizons—further enhances resilience. For instance, a younger investor with a higher risk tolerance might lean towards growth stocks, while a retired individual might prioritize income-generating assets that provide stability.

Avoiding common pitfalls is equally vital. Emotion-driven decisions, such as panic selling during market downturns or chasing overhyped stocks, often lead to suboptimal outcomes. A disciplined investor understands the importance of sticking to a predetermined strategy rather than reacting to market noise. Another trap to watch for is the temptation to over-leverage positions, which can amplify losses in adverse conditions. Using margin or derivatives without a proper risk assessment exposes capital to unnecessary vulnerabilities. Furthermore, the allure of quick profits can tempt investors to engage in speculative trades that lack foundational support. A measured approach, grounded in thorough research and patience, often yields more consistent results.

The role of time cannot be overstated. Compound growth is a powerful phenomenon, but it requires patience and consistency. Historically, the stock market has shown upward trends over the long term, even during periods of short-term volatility. For instance, a portfolio invested in the S&P 500 index over the past 20 years has delivered significant returns, despite multiple corrections and market recessions. This underscores the importance of holding investments for the long term rather than attempting to time the market. However, this does not mean ignoring short-term movements; rather, it involves using them as part of a larger strategy. For example, a long-term investor might use dips in market value as opportunities to buy quality stocks at discounted prices, reinforcing their position without being swayed by short-term fluctuations.

The power of compounding, when paired with strategic reinvestment, can transform modest initial investments into substantial wealth over time. This process is most effective when investors consistently add to their portfolio—whether through regular contributions, buying dips, or reallocating funds from underperforming assets. For instance, an investor who reinvests dividends can significantly enhance their returns through the snowball effect of compounding. This strategy not only increases the total value of the portfolio but also provides a steady income stream, offering a dual benefit. However, compounding requires time and discipline, and it is essential to allow investments to grow without premature intervention.

In conclusion, investing in stocks to achieve profitable returns is a multifaceted endeavor that transcends mere buying and selling. It involves a deep understanding of market trends, a balanced approach to risk management, and a commitment to long-term growth. By combining technical and fundamental analysis, diversifying investments across different sectors and time frames, and avoiding emotional pitfalls, investors can position themselves to thrive in the market. The journey is not without challenges, but with careful planning, consistent execution, and a clear vision, it becomes a pathway to financial success. In an ever-evolving market, adaptability and foresight are the ultimate tools that separate the average investor from the exceptional one.