Okay, I'm ready. Here's an article addressing the question, "What Should I Invest In, and Why?", with a focus on providing comprehensive advice, avoiding excessive bullet points or numbered lists, and adhering to the specified length and language requirements.

Investing: A Personalized Journey to Financial Well-being

The perennial question of “What should I invest in?” echoes through the halls of financial institutions and the lively forums of online communities. There’s no universally correct answer, no magic potion guaranteed to yield boundless riches. Instead, the optimal investment strategy is a profoundly personal endeavor, intricately woven with your individual circumstances, risk tolerance, and long-term financial aspirations. Diving into investment without a clear understanding of these elements is akin to sailing uncharted waters without a compass – exciting, perhaps, but fraught with peril.

Before even considering specific investment vehicles, it's crucial to embark on a journey of self-discovery, financially speaking. Ask yourself: What are my financial goals? Are you saving for a comfortable retirement, a down payment on a house, your children's education, or simply seeking to grow your wealth over time? The timeframe for achieving these goals significantly influences the types of investments that are appropriate. A shorter timeframe typically calls for more conservative investments, while a longer timeframe allows for greater risk-taking in pursuit of potentially higher returns.

Next, honestly assess your risk tolerance. Are you the type of person who can sleep soundly at night even when your portfolio experiences a significant downturn, understanding that such fluctuations are a natural part of the investment cycle? Or does the mere thought of losing money send shivers down your spine? This emotional comfort level is a critical determinant of your investment choices. A high-risk tolerance might lead you towards stocks, emerging markets, or even alternative investments like cryptocurrencies or real estate development projects. A lower risk tolerance, on the other hand, might steer you towards bonds, certificates of deposit (CDs), or dividend-paying stocks in established, stable companies.

Furthermore, it's essential to understand your current financial situation. How much debt do you have? What is your monthly income and expenses? Do you have an emergency fund that can cover unexpected expenses? These factors will influence how much you can realistically invest and the level of risk you can afford to take. Investing while burdened with high-interest debt is generally unwise; prioritizing debt repayment should usually be the first step. Similarly, lacking an emergency fund means you might be forced to liquidate investments prematurely during unforeseen circumstances, potentially locking in losses.

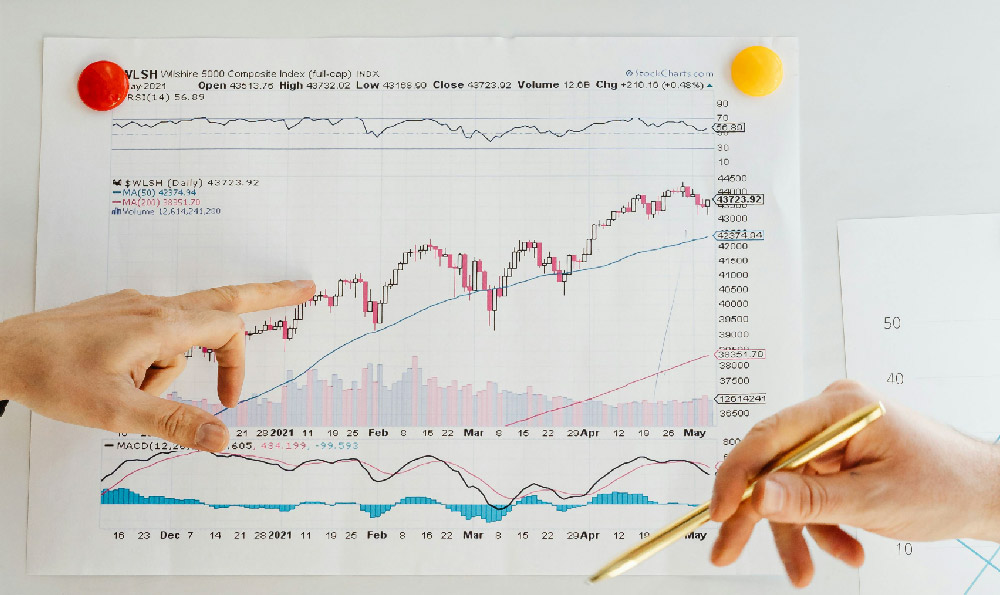

Once you have a firm grasp of your goals, risk tolerance, and financial situation, you can begin to explore the diverse landscape of investment options. Stocks, representing ownership in publicly traded companies, offer the potential for significant capital appreciation, but also carry a higher degree of risk. Bonds, representing debt issued by corporations or governments, tend to be less volatile than stocks and provide a more predictable stream of income, but their returns are typically lower. Mutual funds and exchange-traded funds (ETFs) provide diversification by pooling money from multiple investors to invest in a basket of stocks, bonds, or other assets. Real estate can be a valuable long-term investment, offering both rental income and potential appreciation, but it requires significant capital and carries its own set of risks and responsibilities.

Beyond these conventional investment vehicles, there exists a spectrum of alternative investments, ranging from precious metals like gold and silver to art, collectibles, and even peer-to-peer lending platforms. While these options can offer the potential for higher returns, they also typically come with greater risks, lower liquidity, and higher fees. Approaching these investments with caution and conducting thorough due diligence is paramount.

A crucial element often overlooked is the importance of diversification. Spreading your investments across different asset classes, industries, and geographic regions can help to mitigate risk and improve your overall portfolio performance. Diversification ensures that if one investment performs poorly, it won't have a catastrophic impact on your entire portfolio. Modern portfolio theory emphasizes the importance of asset allocation, carefully balancing risk and return based on your individual circumstances.

Moreover, it's vital to remain vigilant and continuously monitor your investments. Regularly review your portfolio's performance, rebalance your asset allocation as needed, and adjust your investment strategy as your goals, risk tolerance, or financial situation change. Market conditions are constantly evolving, and a static investment strategy can become outdated and ineffective over time.

In addition to the conventional investment options, the rise of decentralized finance (DeFi) and cryptocurrencies has introduced new avenues for potential wealth creation, albeit with significantly elevated risks. Engaging with these nascent technologies requires a profound understanding of the underlying mechanisms, the regulatory landscape, and the inherent volatility of the market. Approach such ventures with extreme caution and only invest what you can afford to lose. Remember that the regulatory environment surrounding cryptocurrencies and DeFi is still evolving, and investors should be aware of the potential for scams and fraud.

Ultimately, the best investment strategy is one that aligns with your individual circumstances and allows you to achieve your financial goals while remaining comfortable with the level of risk involved. It's a journey, not a destination, requiring continuous learning, adaptation, and a disciplined approach. Seeking professional financial advice from a qualified advisor can provide valuable guidance and help you navigate the complexities of the investment world, ensuring that you make informed decisions that are in your best interests. Remember, patience, discipline, and a long-term perspective are the cornerstones of successful investing.