Shorting stocks, or short selling, is an investment strategy that allows you to profit from the decline in a stock's price. It's a sophisticated technique that can offer significant returns, but it also comes with considerable risk. Understanding the strategy, its mechanics, and the risk management involved is crucial before engaging in short selling. This discussion will delve into the intricacies of shorting stocks, providing a comprehensive overview of the strategy and how to approach it responsibly.

The basic premise of shorting a stock involves borrowing shares of that stock from a broker and immediately selling them in the open market. The hope is that the stock's price will decrease, allowing you to buy back the same number of shares at a lower price. You then return the borrowed shares to the broker, pocketing the difference between the selling price and the repurchase price as your profit. This profit is, of course, reduced by any borrowing fees or interest charged by the broker for lending you the shares.

To illustrate, imagine you believe that XYZ Company's stock, currently trading at $50 per share, is overvalued and likely to decline. You borrow 100 shares of XYZ from your broker and sell them in the market, receiving $5,000. Over the next few weeks, as you predicted, XYZ's stock price drops to $40 per share. You then buy back 100 shares at $40 each, spending $4,000. You return the 100 shares to your broker, effectively closing out your short position. Your profit is $1,000 ($5,000 - $4,000), minus any borrowing fees or commissions.

Identifying potential shorting opportunities requires a keen understanding of market dynamics and company fundamentals. Look for companies with weak financials, declining sales, negative industry trends, or questionable management practices. Overvalued stocks, those trading at high price-to-earnings ratios relative to their peers, can also be prime candidates for short selling.

Technical analysis can also play a role. Identifying downtrends, bearish chart patterns (such as head and shoulders or double tops), and negative momentum indicators can provide confirmation of a potential shorting opportunity. Combining fundamental and technical analysis can increase the probability of success.

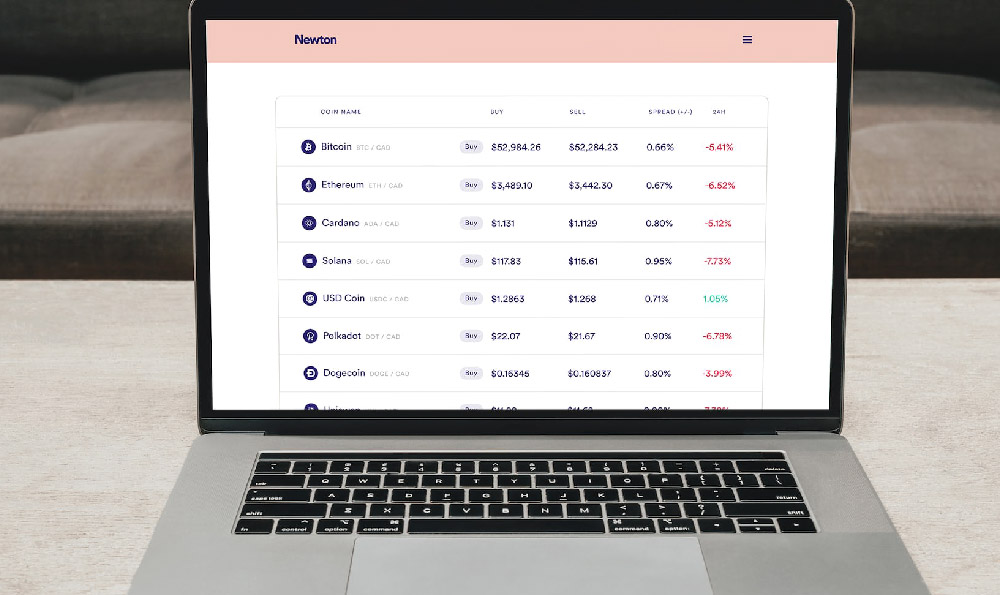

Selecting the right broker is essential. Not all brokers offer short selling capabilities, and the fees and margin requirements can vary significantly. Look for a broker with a robust stock loan program, competitive interest rates on margin accounts, and access to a wide range of shortable stocks. Also, ensure the broker provides real-time quotes and advanced charting tools to aid in your analysis.

Risk management is paramount when shorting stocks. Unlike buying stocks, where your potential loss is limited to the amount you invested, the potential loss when shorting is theoretically unlimited. This is because a stock's price can rise indefinitely.

To mitigate this risk, implementing stop-loss orders is crucial. A stop-loss order automatically buys back the borrowed shares if the stock price rises to a predetermined level, limiting your potential losses. For example, if you short XYZ Company at $50 per share, you might set a stop-loss order at $55 per share. If the stock price reaches $55, your broker will automatically buy back the shares, limiting your loss to $5 per share (plus commissions).

Position sizing is another critical aspect of risk management. Avoid allocating a large portion of your capital to a single short position. Diversifying your portfolio across multiple short positions can help reduce the impact of any single stock's unexpected price movements.

Monitoring your short positions closely is also essential. Stay informed about company news, earnings announcements, and industry trends that could affect the stock price. Be prepared to adjust your stop-loss orders or close out your position if the situation changes.

Furthermore, be aware of the potential for short squeezes. A short squeeze occurs when a heavily shorted stock experiences a sudden surge in price, forcing short sellers to cover their positions (buy back the shares) to limit their losses. This buying pressure further drives up the stock price, exacerbating the squeeze. Identify stocks with high short interest ratios (the percentage of outstanding shares that are shorted) and be wary of shorting them, as they are more susceptible to short squeezes.

Understanding margin requirements is also critical. Short selling requires a margin account, which means you need to deposit a certain amount of cash or securities as collateral. The margin requirement is typically a percentage of the value of the shorted shares. If the stock price rises against your position, your broker may issue a margin call, requiring you to deposit additional funds to maintain the required margin level. Failing to meet a margin call can result in your broker liquidating your position at a loss.

Finally, consider the tax implications of short selling. Profits from short selling are typically taxed as short-term capital gains, which are taxed at your ordinary income tax rate. It's crucial to consult with a tax professional to understand the specific tax rules and regulations that apply to your situation.

In conclusion, shorting stocks can be a profitable strategy for investors who are comfortable with risk and have a thorough understanding of market dynamics. However, it's not a strategy to be taken lightly. Careful research, prudent risk management, and a disciplined approach are essential for success. Before engaging in short selling, it's advisable to seek advice from a qualified financial advisor to ensure it aligns with your investment objectives and risk tolerance.