As a teenager navigating the transition from childhood to adulthood, the opportunity to begin exploring ways to generate income can be both thrilling and instructive. While financial independence may seem distant, even young individuals can develop skills that lay the foundation for future prosperity. The key lies in identifying opportunities that align with your interests, time availability, and the practical constraints imposed by age. From small-scale side hustles to more strategic long-term planning, there are numerous avenues to explore, each offering unique insights into the nature of earning and managing money.

One of the most accessible paths for a 13-year-old is leveraging household responsibilities. Many families are willing to compensate children for tasks that extend beyond typical chores, such as organizing their closet, managing a household budget, or even preparing simple meals. Creating a structured approach to these tasks—whether through a written agreement with your parents or a verbal understanding—can help you understand responsibility and the value of labor. Over time, this practice can evolve into a more formalized earning system, where you track your tasks with a ledger or spreadsheet, negotiate fair compensation, and allocate your earnings toward savings or reinvestment. This experience not only teaches financial discipline but also cultivates a sense of ownership over your resources.

Another viable option is to explore creative industries that allow you to monetize your talents. If you enjoy drawing, crafting, or performing, you can begin selling your work online. Platforms like Etsy or local marketplaces provide opportunities to reach a broader audience, while creative projects such as designing social media content or creating short videos can be shared with friends and family first. It’s important to start small, test your ideas, and gradually refine your approach based on feedback. For instance, experimenting with different pricing models or packaging your creations to appeal to niche markets can help you develop a sense of value assessment and market demand. This process teaches you about branding, customer engagement, and the importance of persistence in creative endeavors.

Technology also presents opportunities for young earners to engage in digital work. If you have an affinity for writing, you can begin contributing to blogs or websites that pay for articles or content creation. Alternatively, you might explore platforms like YouTube or TikTok, where you can create and monetize short-form videos. While these projects may take time to generate significant revenue, they offer a way to develop skills in digital literacy, content creation, and audience building. Additionally, you can consider learning basic coding or app development, which may allow you to create simple tools or games that can be sold or licensed. These activities not only introduce you to the world of technology but also provide a glimpse into the concept of intellectual property and the potential for passive income.

Involvement in your community can also yield financial benefits. Youth can participate in local events, such as pet-sitting, tutoring younger students, or helping with community projects. These experiences allow you to practice time management, Communication, and problem-solving, while earning money through labor. It’s also beneficial to explore opportunities that provide educational value, such as taking on a part-time job that teaches you about business operations or customer service. For instance, working at a local store or café can expose you to the basics of revenue generation, expense management, and teamwork, all of which are essential for future financial success.

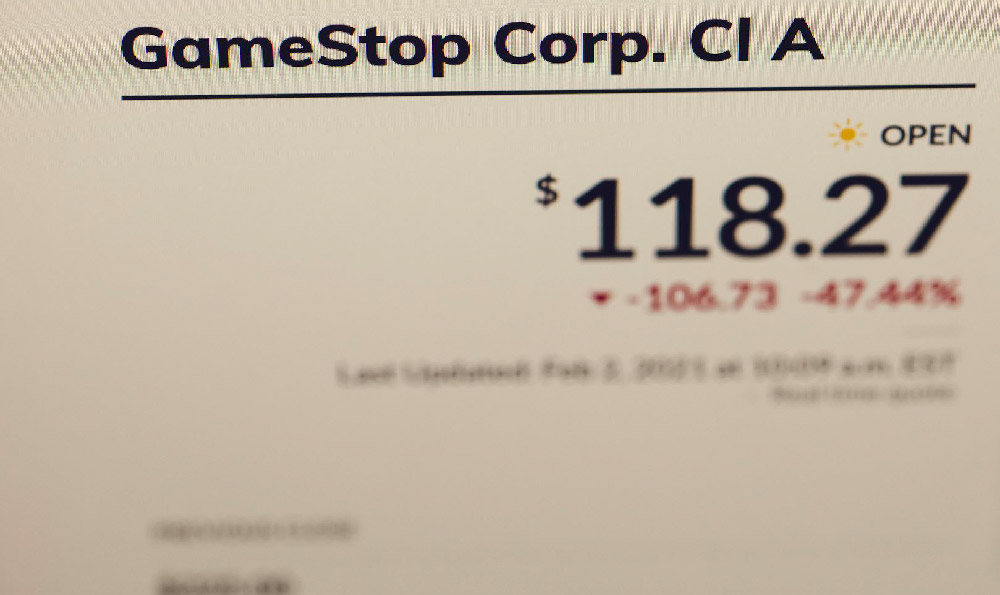

Beyond earning money, developing a habit of saving and investing is crucial for long-term financial growth. Even a small income can be redirected toward a savings account, where it can accrue interest over time. Many banks offer youth-friendly savings accounts with competitive rates, allowing you to see the power of compound interest firsthand. Additionally, you can explore educational resources about investing, such as reading books or watching videos on topics like stocks, bonds, and index funds. While investing at this age may involve more caution, learning about risk management and diversification can position you to make informed decisions when you are older.

Ultimately, the journey of earning money at 13 is as much about learning as it is about generating income. It requires a balance between experimentation, discipline, and education. By leveraging your skills, interests, and the tools available in your environment, you can begin to develop a comprehensive understanding of financial principles. This early exposure to earning, saving, and investing not only builds practical experience but also instills a mindset of financial responsibility and opportunity. As you navigate these experiences, remember that success is measured not just by the amount earned, but by the knowledge gained and the habits cultivated.