The saga of Roaring Kitty, also known as Keith Gill, and his involvement in the GameStop (GME) short squeeze of early 2021 remains a fascinating, and somewhat controversial, chapter in financial history. Determining the exact profit Gill made and whether his actions were legal requires careful examination of available data, legal interpretations, and the nuances of market manipulation laws.

Estimating Roaring Kitty's Profit: The $50 Million Question

Precise figures are difficult to ascertain, but based on publicly available information, Roaring Kitty's profit is widely estimated to be in the tens of millions of dollars. Gill's initial investment in GameStop, disclosed through Reddit posts and YouTube videos, began well before the stock's meteoric rise. He started accumulating shares in 2019, believing the company was undervalued. Through his posts, he showed screenshots of his brokerage account.

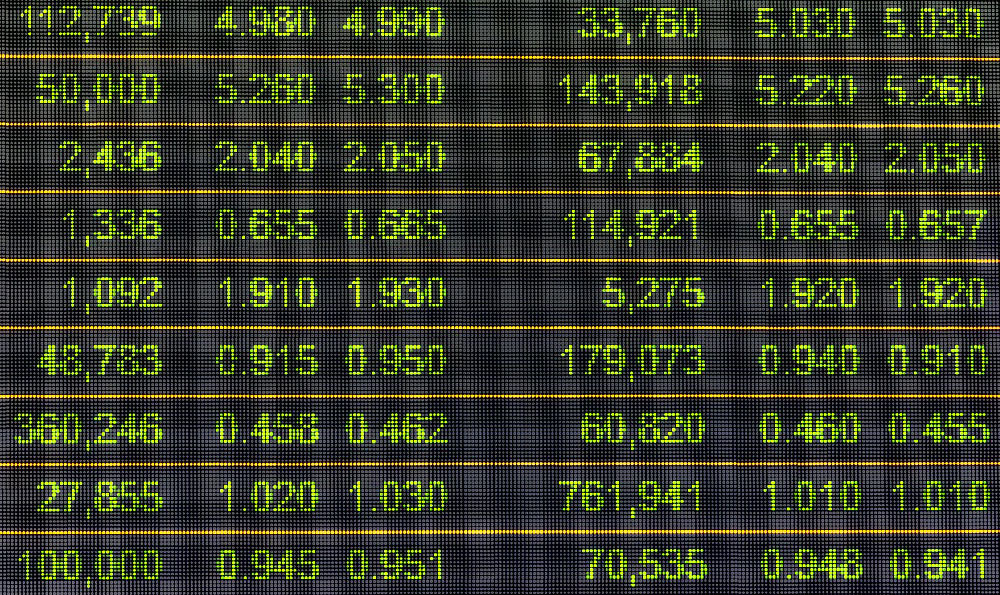

By January 2021, Gill's position had grown significantly, consisting of a substantial number of GameStop shares and call options. As the stock price soared, his gains multiplied exponentially. One screenshot, widely circulated, showed his account balance reaching nearly $50 million at one point. He also exercised many of his call options further adding to his position in GME stock.

It's crucial to remember that these figures represent unrealized gains at specific points in time. It's highly unlikely he cashed out at the very peak of the surge, and his actual profit would depend on when and at what price he sold his holdings. He publicly documented holding the stock for the “long haul” and appeared confident in the future of GameStop.

Adding complexity, Roaring Kitty also held a substantial amount of GME shares and call options following the initial surge, with some reports suggesting he may have increased his position after the prices crashed. The profits he made following the subsequent rise in price in the months and years after the initial squeeze are not publicly known. Some estimate those profits to be substantial as well.

Was Roaring Kitty's Conduct Legal? A Murky Legal Landscape

The legality of Roaring Kitty's actions has been a subject of intense scrutiny. The central question is whether his behavior constituted market manipulation. To prove market manipulation, regulators generally need to demonstrate that a person intentionally engaged in deceptive or manipulative conduct with the purpose of influencing the price of a security.

Several factors are relevant in assessing the legality of Gill's actions:

-

Intent: Did Gill intentionally mislead investors or artificially inflate the price of GameStop? He consistently presented his investment thesis, research, and rationale for believing in the company's potential. He didn’t promise guaranteed returns, but shared his journey and his belief in GameStop’s potential. While his posts were persuasive, they were largely based on publicly available information. He presented his opinion and encouraged others to do their own research, and this is key to determining that his intent was not to deceive or mislead investors.

-

Disclosure: Did Gill adequately disclose his financial interests? Gill was transparent about his positions in GameStop and his rationale for investing. He routinely shared his portfolio holdings, including the number of shares and options contracts he owned. However, there have been questions about whether he should have disclosed his previous employment at MassMutual, where he worked as a financial educator.

-

Influence: Did Gill's actions have a significant impact on the market? There is little doubt that Roaring Kitty influenced many other investors to purchase GameStop stock. The extent to which he was the sole, or even primary, driver of the surge is debatable, given the widespread attention the stock received on platforms like Reddit's WallStreetBets. The stock became a cultural phenomenon, attracting a diverse group of investors with different motivations. While he was influential, the extent of his influence and whether it rose to the level of market manipulation is still unclear.

-

The "Pump and Dump" Argument: Some critics have argued that Gill's actions resembled a "pump and dump" scheme, where someone artificially inflates the price of a stock and then sells their shares for a profit, leaving other investors with losses. However, this argument is weakened by the fact that Gill continued to hold a significant amount of GameStop stock even after the price had fallen. As previously mentioned, he even increased his position. His public statements and continued presence on social media indicated a long-term belief in the company, not a desire to quickly profit and exit.

SEC Investigations and Legal Challenges

The Securities and Exchange Commission (SEC) launched an investigation into the GameStop trading frenzy, including Roaring Kitty's role. As of now, no charges have been filed against Gill related to market manipulation. Lawsuits have been filed against him, accusing him of violating securities laws. However, these lawsuits face significant legal hurdles. Plaintiffs need to prove that Gill made false or misleading statements and that they relied on those statements to their detriment. Showing causation between Gill's posts and individual investment decisions is a difficult task.

The Importance of Context and Interpretation

The Roaring Kitty/GameStop saga highlights the challenges of applying traditional market manipulation laws to the age of social media and retail investing. Online forums and communities can amplify individual voices and create unprecedented levels of collective investment. Determining where legitimate investment analysis ends and illegal market manipulation begins is a complex question that regulators and courts will continue to grapple with.

Ultimately, whether Roaring Kitty acted illegally is a matter for legal interpretation and judgment. While he undoubtedly profited from the GameStop surge, proving that he did so through intentional deception or manipulation is a high bar to clear. The case serves as a reminder of the risks and rewards of investing and the importance of due diligence, and the potential power that a person may have in influencing a public market through social media. It also demonstrates the fine line that influencers, and people using social media in general, must walk between expressing their opinion and causing illegal market activity.

Regardless of the ultimate legal outcome, the Roaring Kitty story has left an indelible mark on the financial landscape, raising questions about the role of social media, the power of retail investors, and the future of market regulation.