Okay, here's an article addressing the questions of how much you need to earn and when taxes come into play, geared towards someone seeking practical financial guidance:

Navigating the world of personal finance often begins with these fundamental questions: How much should I be earning, and when do I start owing taxes? The answers, while seemingly straightforward, are nuanced and depend heavily on individual circumstances. Let's delve into these topics, providing clarity and a foundation for sound financial planning.

The question of "how much to earn" is inherently subjective, but it's crucial to approach it objectively. Start by defining your financial goals. Are you aiming for early retirement? Are you saving for a down payment on a house? Do you have significant debt to repay? Your income needs will directly correlate to the magnitude of these goals.

Begin by meticulously tracking your current expenses. Categorize them as fixed (rent/mortgage, insurance, loan payments) and variable (groceries, entertainment, transportation). Understanding where your money is currently going provides a crucial baseline. Analyze these expenses critically. Are there areas where you can cut back without significantly impacting your quality of life? Identifying and reducing unnecessary spending immediately frees up resources that can be allocated to savings or investments.

Once you have a clear picture of your current spending and a list of your financial goals, you can begin to project your future income needs. Account for inflation. The cost of goods and services generally increases over time, so the income you need today will likely be insufficient in the future. A conservative estimate of inflation, around 2-3% annually, should be factored into your calculations.

Consider your lifestyle aspirations. Do you envision traveling extensively? Do you want to provide for your children's education? These lifestyle choices have a significant impact on your required income. It's wise to research the costs associated with these aspirations and incorporate them into your financial planning.

Beyond simply covering expenses and achieving goals, consider building an emergency fund. Unexpected events, such as job loss or medical emergencies, can derail even the most well-laid financial plans. Aim to save three to six months' worth of living expenses in a readily accessible account. This provides a crucial safety net and prevents you from having to take on debt during times of crisis.

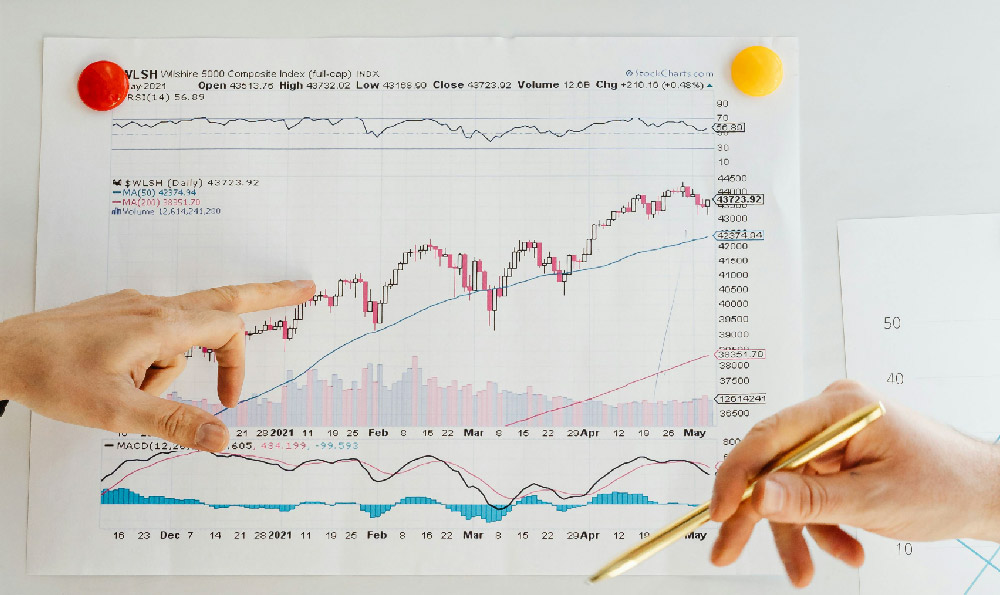

Furthermore, remember to factor in the cost of investing. While investing is essential for long-term wealth accumulation, it does come with inherent expenses, such as brokerage fees, management fees (for mutual funds or managed accounts), and potentially taxes on investment gains. Be sure to understand the fee structure of any investment products you choose and factor these costs into your income planning.

Now, let's turn to the question of when you start paying taxes. This is determined by your country's tax laws and regulations, and specific figures will vary widely across different jurisdictions. However, the underlying principles are generally consistent.

In most countries, there is a minimum income threshold below which you are not required to pay income tax. This threshold is often referred to as the standard deduction or personal allowance. The specific amount varies annually and is subject to change based on government policies. Consult your local tax authority or a qualified tax professional to determine the current threshold for your region.

Once your income exceeds the threshold, you become liable for income tax. However, not all of your income is necessarily taxed. Many deductions and credits can reduce your taxable income, ultimately lowering your tax burden.

Common deductions include contributions to retirement accounts (such as 401(k)s or IRAs), health savings account (HSA) contributions, student loan interest payments, and certain itemized deductions, such as charitable donations and medical expenses exceeding a certain percentage of your adjusted gross income (AGI).

Tax credits, on the other hand, directly reduce your tax liability, dollar for dollar. Examples include child tax credits, education credits, and energy credits. Understanding the deductions and credits available to you is crucial for minimizing your tax obligations.

The tax system is often progressive, meaning that higher income levels are taxed at higher rates. This is typically implemented through a system of tax brackets. Each bracket represents a range of income that is taxed at a specific rate. It's important to understand how tax brackets work to accurately estimate your tax liability. It’s a common misconception that if you move into a higher tax bracket, all of your income is taxed at that higher rate. Only the portion of your income that falls within that specific bracket is subject to that rate.

Beyond income tax, you may also be subject to other taxes, such as Social Security and Medicare taxes. These are typically payroll taxes that are deducted from your paycheck. In addition, you may owe state and local taxes, depending on your location.

Tax planning is an ongoing process. As your income and financial circumstances change, your tax strategies should also adapt. Regularly review your tax situation and consult with a tax professional to ensure that you are taking advantage of all available deductions and credits and minimizing your tax burden.

In conclusion, determining how much to earn and understanding your tax obligations are essential components of sound financial planning. By carefully assessing your expenses, setting realistic financial goals, and proactively managing your taxes, you can create a solid foundation for financial security and long-term wealth accumulation. Remember to seek professional advice from financial advisors and tax professionals to tailor your financial plan to your specific needs and circumstances. Financial well-being is a journey, not a destination, and requires ongoing effort and informed decision-making.