Okay, I understand. Here's an article addressing the question of using debt to generate income, avoiding excessive bullet points, numbered lists, or phrases like "Firstly" and "Secondly," and focusing on a comprehensive and detailed explanation.

How Can Debt Make You Money? & Is Debt a Viable Investment Strategy?

Debt. The word itself often carries negative connotations, conjuring images of financial struggle and sleepless nights. Yet, in the realm of finance, debt can be a powerful tool, a double-edged sword capable of both wealth creation and financial ruin. The question isn't simply whether debt can make you money, but how, when, and under what carefully considered circumstances it becomes a viable investment strategy.

The fundamental principle behind using debt to generate income lies in the concept of leverage. Leverage, in essence, amplifies both potential gains and potential losses. When you borrow money at a certain interest rate and invest it in an asset that generates a higher return, you profit from the difference. This is the core of many successful debt-fueled investment strategies.

One of the most common and accessible examples is real estate. Imagine you purchase a rental property with a mortgage. The rental income you receive covers the mortgage payments (including interest) and ideally leaves you with a profit. In this scenario, the debt (the mortgage) is directly contributing to your income stream. Furthermore, the property itself is an asset that can appreciate in value over time, further increasing your wealth. The key here is meticulous analysis. You must accurately estimate rental income, factor in property taxes, insurance, maintenance costs, and potential vacancy periods to ensure the property generates sufficient cash flow to cover all expenses and provide a profit. Failure to do so can quickly lead to financial distress.

Another area where debt is commonly used to generate income is in business. Entrepreneurs often rely on loans to start or expand their ventures. The borrowed capital is used to purchase inventory, equipment, hire staff, and fund marketing initiatives. If the business is successful, the revenue generated will exceed the cost of the loan, resulting in a profit. However, the risks are substantial. Businesses can fail for a myriad of reasons, leaving the borrower with a significant debt burden and no income to repay it. Thorough market research, a sound business plan, and prudent financial management are crucial for success in this arena.

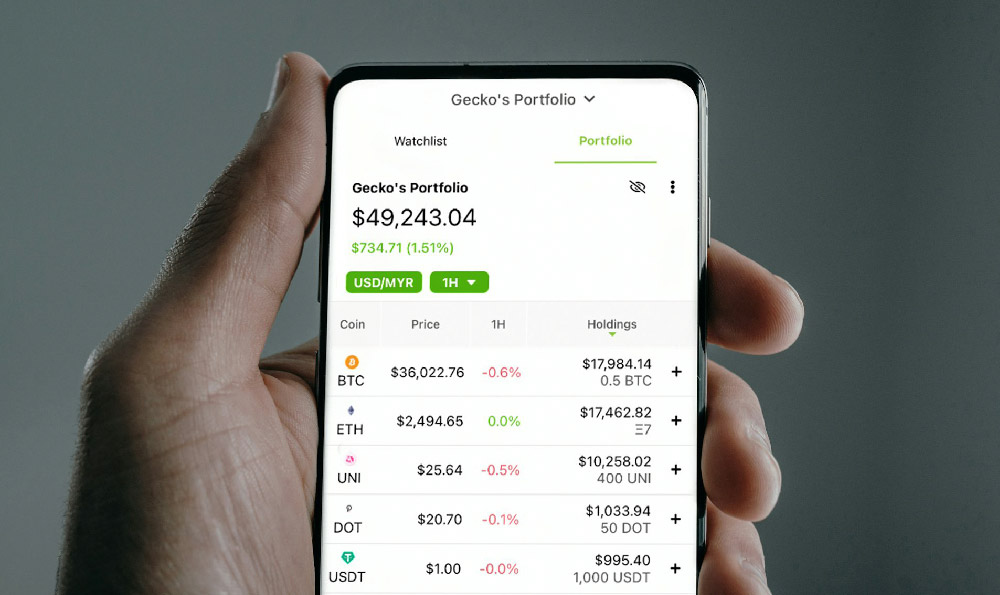

Beyond real estate and business, sophisticated investors may use debt to engage in more complex strategies, such as margin trading. Margin trading involves borrowing money from a broker to purchase securities. This allows you to control a larger position in the market with less of your own capital. If the securities appreciate in value, your profits are amplified. However, the reverse is also true. If the securities decline in value, your losses are magnified, and you may be forced to sell your holdings to repay the loan, potentially locking in significant losses. Margin trading is inherently risky and should only be undertaken by experienced investors with a deep understanding of the markets and a high tolerance for risk.

While the potential rewards of using debt to generate income can be substantial, it's essential to acknowledge the significant risks involved. The most obvious risk is the burden of repayment. If your investments fail to generate sufficient income, you will still be obligated to repay the loan, potentially jeopardizing your financial stability. Interest rates are another critical factor. Rising interest rates can increase your borrowing costs, reducing your profitability or even pushing you into a loss.

Furthermore, market volatility can significantly impact debt-fueled investments. Unexpected economic downturns, industry disruptions, or geopolitical events can cause asset values to plummet, leaving you with a substantial debt burden and diminished assets. Diversification is vital to mitigate this risk. Spreading your investments across different asset classes and sectors can help cushion the impact of market fluctuations.

Careful risk assessment is paramount before taking on debt for investment purposes. It is crucial to conduct thorough due diligence, analyze potential returns, and understand the downside risks associated with each investment. Furthermore, you should assess your own risk tolerance and financial capacity. Can you comfortably afford the loan repayments even if your investments perform poorly? Do you have sufficient emergency savings to cover unexpected expenses?

Debt can be a viable investment strategy, but it is not a strategy for the faint of heart. It requires a deep understanding of finance, meticulous planning, and a disciplined approach to risk management. It's not about recklessly borrowing money and hoping for the best. It's about strategically leveraging debt to generate income in a calculated and controlled manner. Before embarking on any debt-fueled investment strategy, it is advisable to consult with a qualified financial advisor to assess your individual circumstances and develop a personalized investment plan. Failing to do so could lead to financial ruin, underscoring the importance of responsible and informed decision-making in the realm of debt and investment.

In conclusion, using debt to make money is a strategic play with significant upside potential coupled with serious risks. Understanding the intricacies of leverage, carefully evaluating investments, and diligently managing risk are all essential to turning debt into a profit-generating engine rather than a financial liability.